User Activity Sinks As Bitcoin Range Persists

Crypto Disinterest Growing

The range-bound action seen in BTC over recent months is taking its toll on market interest. According to crypto data analytics from CryptoQuant, the number of BTC transactions taking place daily has hit three-year lows. Following the price surge earlier in the year which saw daily active users rising to highs of just below 1.2 million, this number has since fallen back to just above 800,000. Given that user activity typically tends to track price moves (higher activity during rallies, lower activity during selloffs and range-bound periods), the data does little to inspire confidence for bulls near-term. Indeed, Bitcoin ETF’s this week saw their heaviest net-outflows in four months.

US Elections Uncertainty

The malaise in Bitcoin has been seen despite the broad trend higher in risk assets over summer in response to a weaker US Dollar. Earlier in the year, expectations of Fed easing were helping drive BTC higher, but those same expectations now, confirmed by the Fed, are having little upside impact. One likely reason for this is the uncertainty around the US elections. The heightened expectations of Trump winning were a strong bullish driver for BTC over early summer, given Trump’s pro-crypto stance. However, with those expectations having now been scaled back sharply, the prospect of an easier regulatory environment for the crypto sector looks less likely.

Bullish Opportunities?

Looking ahead, the current BTC range looks likely to persist until we start to see some action from the Fed and get a better read on the US elections. The current drop-in market activity and institutional demand might well prove to be a bonus longer-term creating plenty of support for any fresh rally as capital returns to the market.

Technical Views

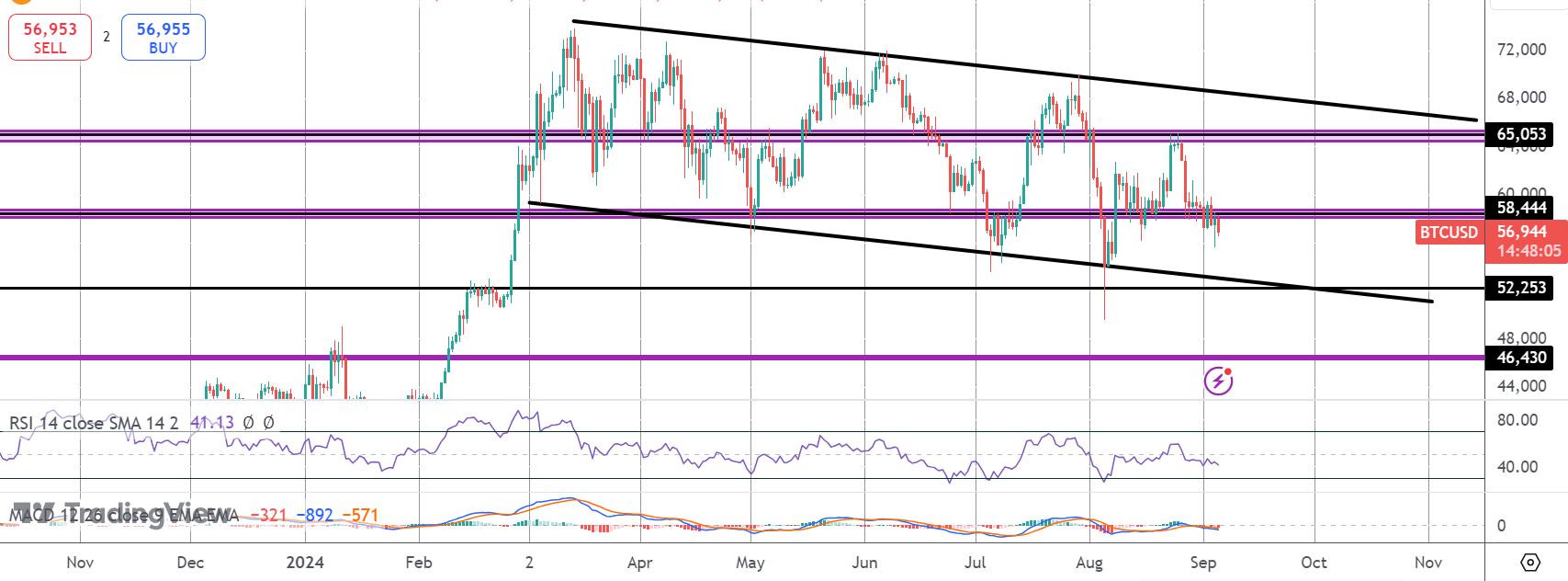

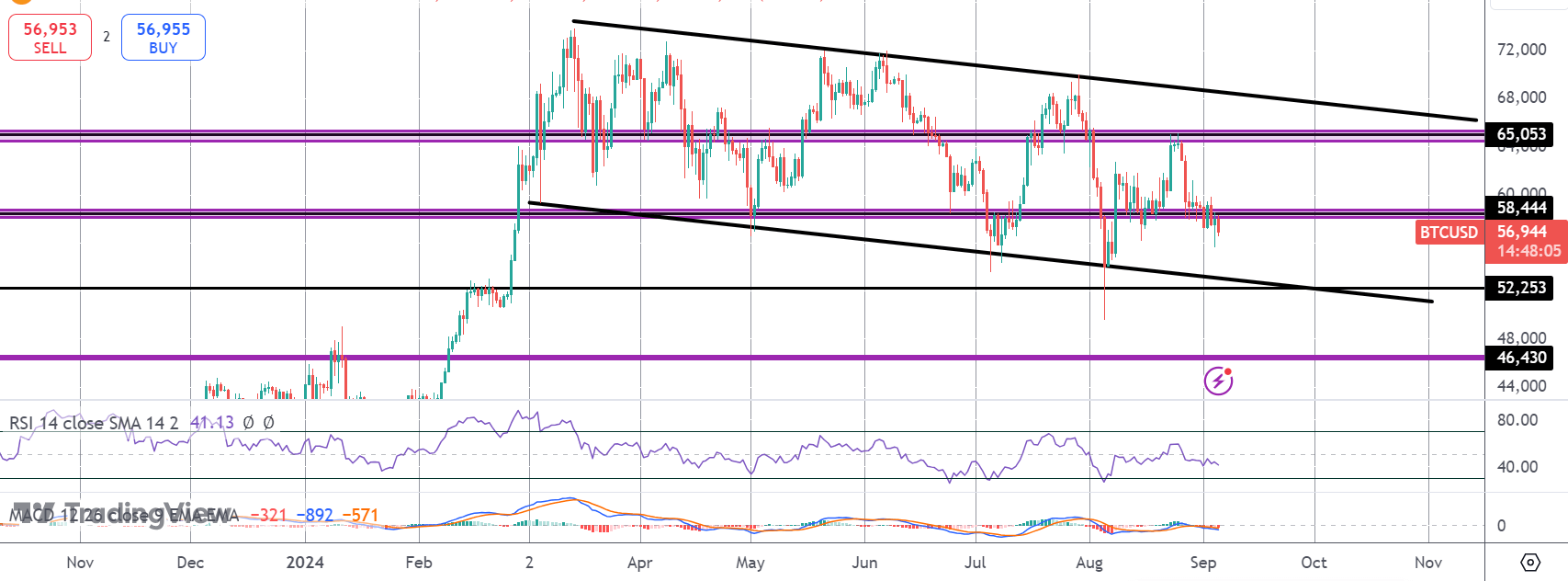

BTC

The failure at 65,053 looks pretty damning for BTC near-term with the market since slipping back below 58,444. While below here and with momentum studies bearish, focus is on a continued push lower and a test of the 52,253 support and bear channel lows next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.