USD/RUB Jumps: What’s Next?

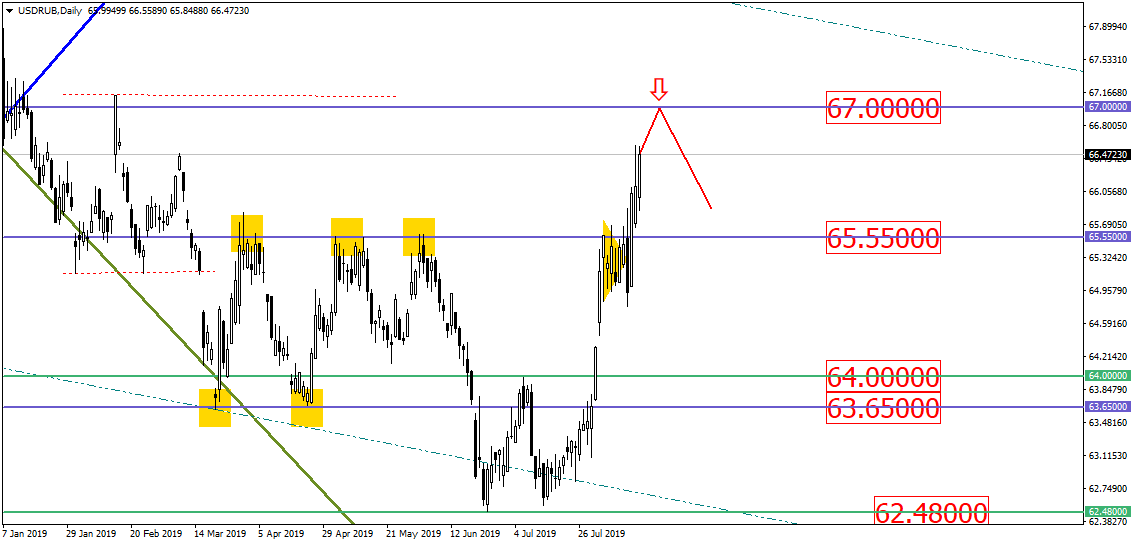

The currency pair USD/RUB jumped, currently targeting horizontal psychological resistance level of 67.00 away from which it can potentially pull back:

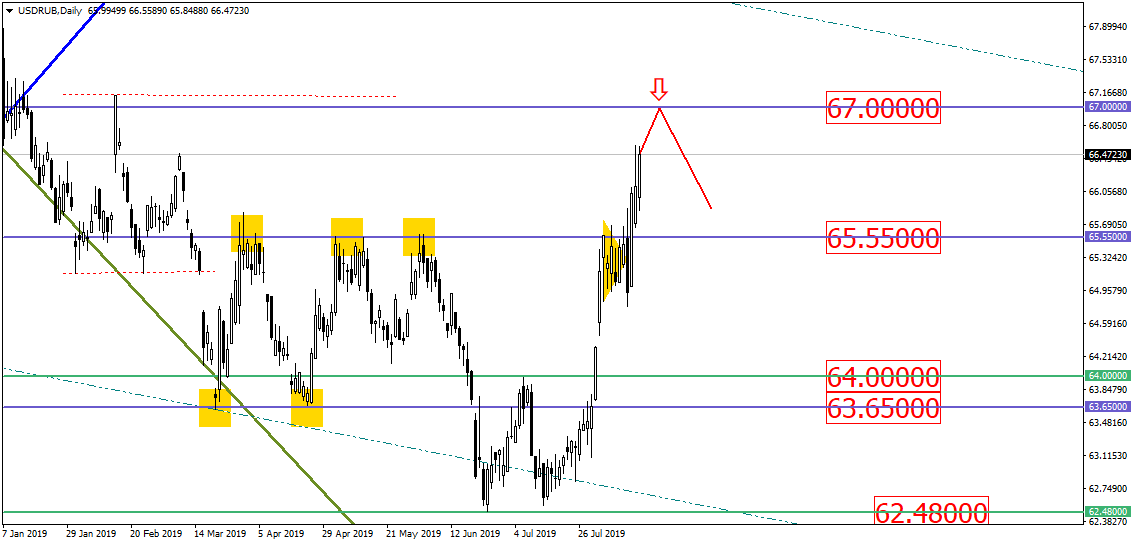

Recent reports by the COT CFTC show that large operators are slowly shortening their long positions on Russian ruble against new sanctions towards Russia and the Fed’s decision regarding the monetary policy. A trade war between USA and China is getting wild, and a new crisis might already be on its way (inverted yield curve for U.S. debt). All in all, this shortening of the long positions might turn into a mass exit from Russian ruble. The following week what will happen with all of that:

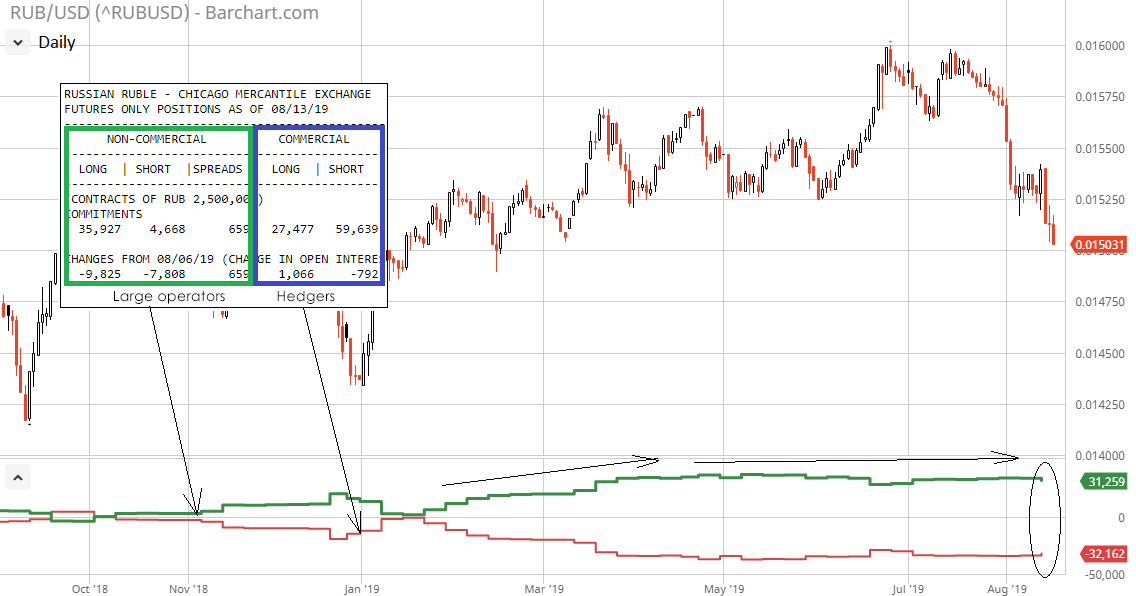

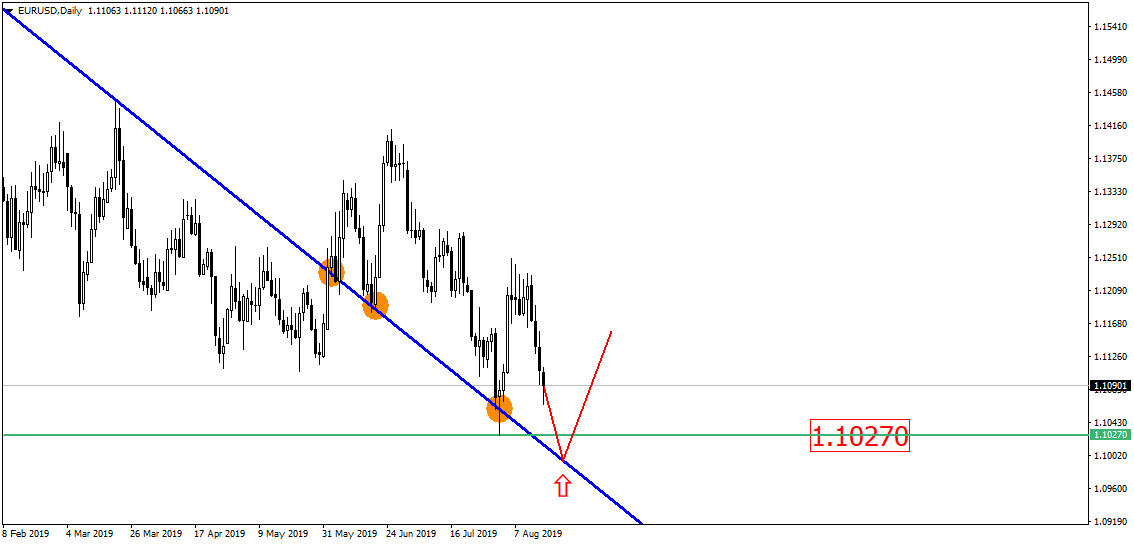

The broken downtrend has formed in the weekly chart of European currency, and the currency pair has closely approached it right now:

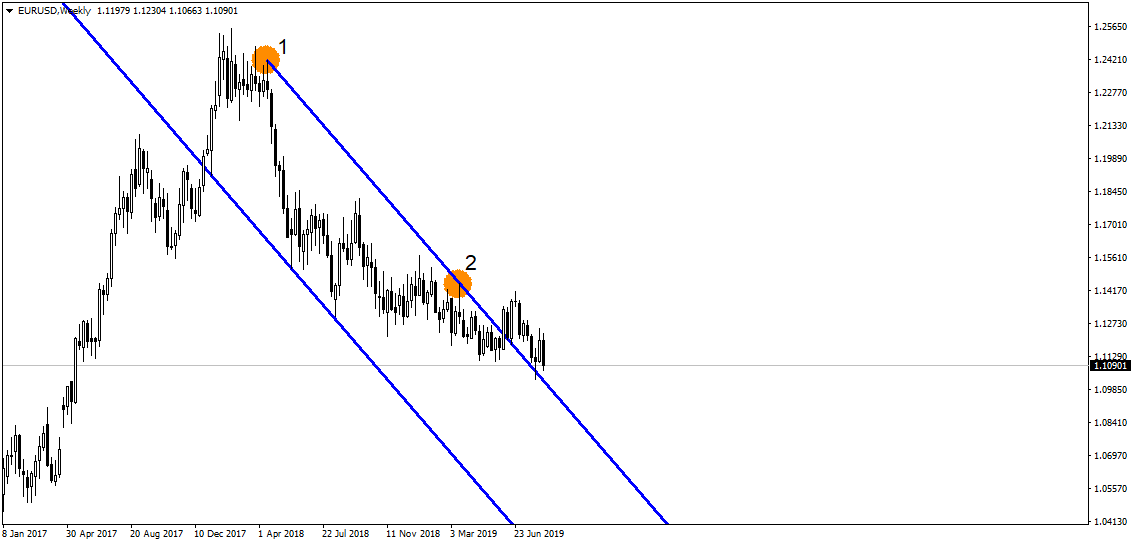

The daily chart shows that the asset’s price has already pulled from the broken downtrend for many times in a row. So far, we assume that the asset will pull back from the broken downtrend. The local horizontal support level of 1.1027 is located there as well:

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.