USDJPY Rallying on Muted BOJ Meeting

Softer Tone from BOJ

USDJPY is seeing strong gains today on the back of the BOJ meeting overnight. The BOJ was seen keeping rates on hold, as expected, with traders caught a little offside by the more hawkish tone hear from Governor Ueda. While Ueda noted that the economy was enjoying a moderate recovery he acknowledge that there was still some weakness to be monitored.

Further Hikes Still Expected

Despite this, Ueda signalled that the bank will continue to raise rates as needed if the economy and inflation develop as expected. The market is still pricing in a further BOJ rate hike this year. Near-term, however, JPY is softening with traders perhaps sensing more two-way risk than they previously anticipated on the back of the double measures taken by the bank in July.

Mixed Japanese Data

The weakness in JPY comes despite the latest Japanese inflation data providing further evidence to support the hawkish BOJ case. National core CPI was seen rising to 2.8% from the prior and expected 2.7% last month. This marks the fourth consecutive increase in the reading. With inflation continuing to rise above the bank’s target, the market is widely expecting the BOJ to press ahead with further tightening next month. In terms of downside risks, a lower revision to Q2 GDP to 2.9% from 3.2% echoes the BOJ’s comments on weakness in the economy to be monitored.

Technical Views

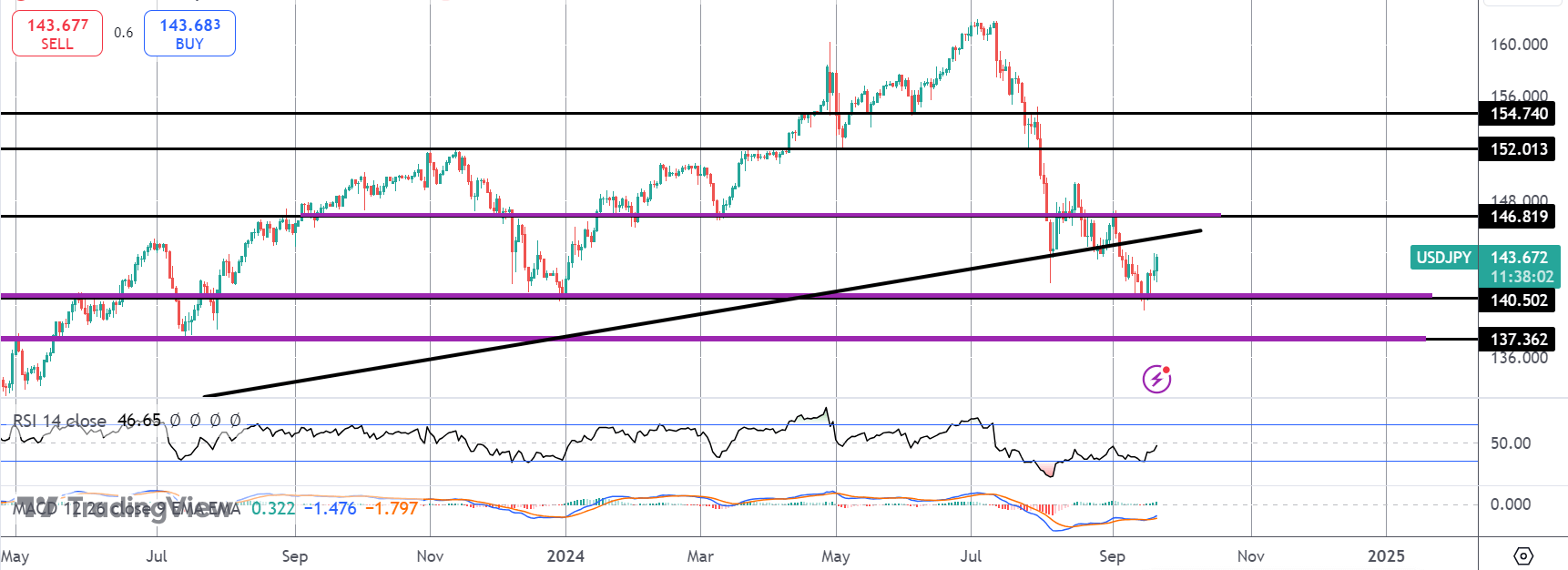

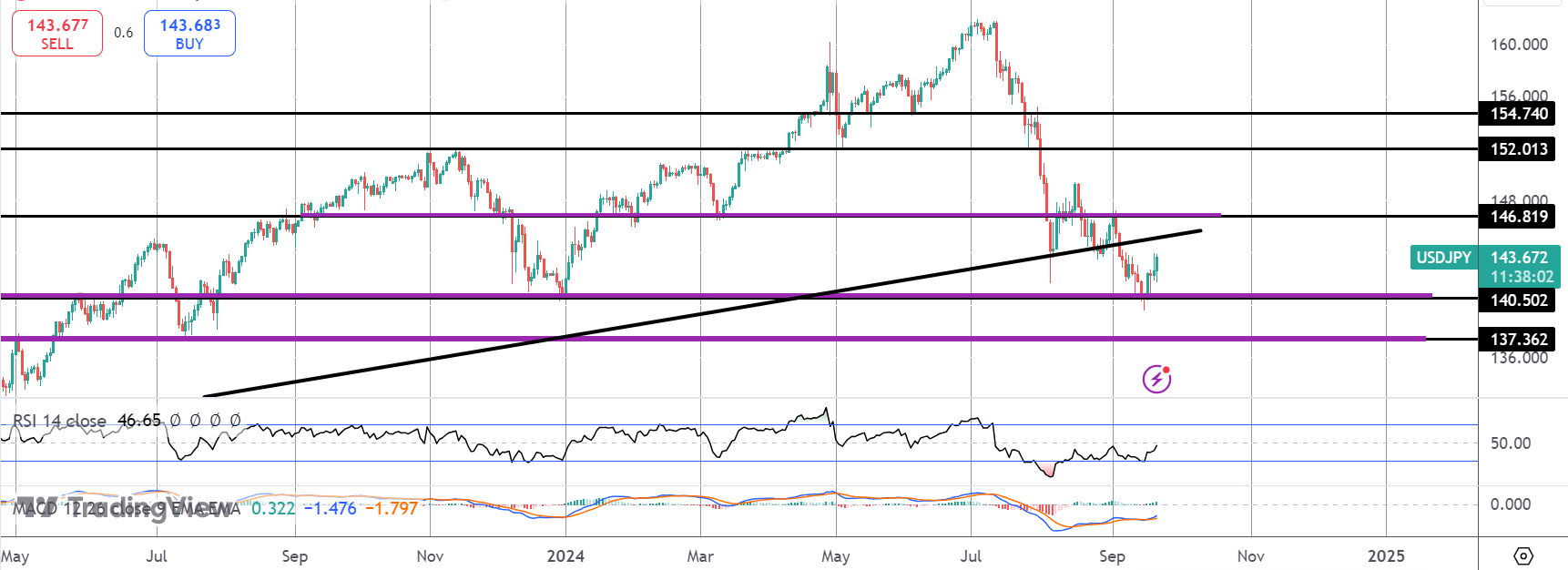

USDJPY

The sell off in USDJPY has stalled for now into a test of the 140.50 level with price now bouncing firmly off the level. The big test for bulls will be the retest of the broken bull trend line along with the 146.81 level. Above here, 152 will be the next bull objective. Should we fail and turn lower again, 137.36 is the next bear target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.