US Bond Yields Rise Despite Dovish Retail Sales Figures

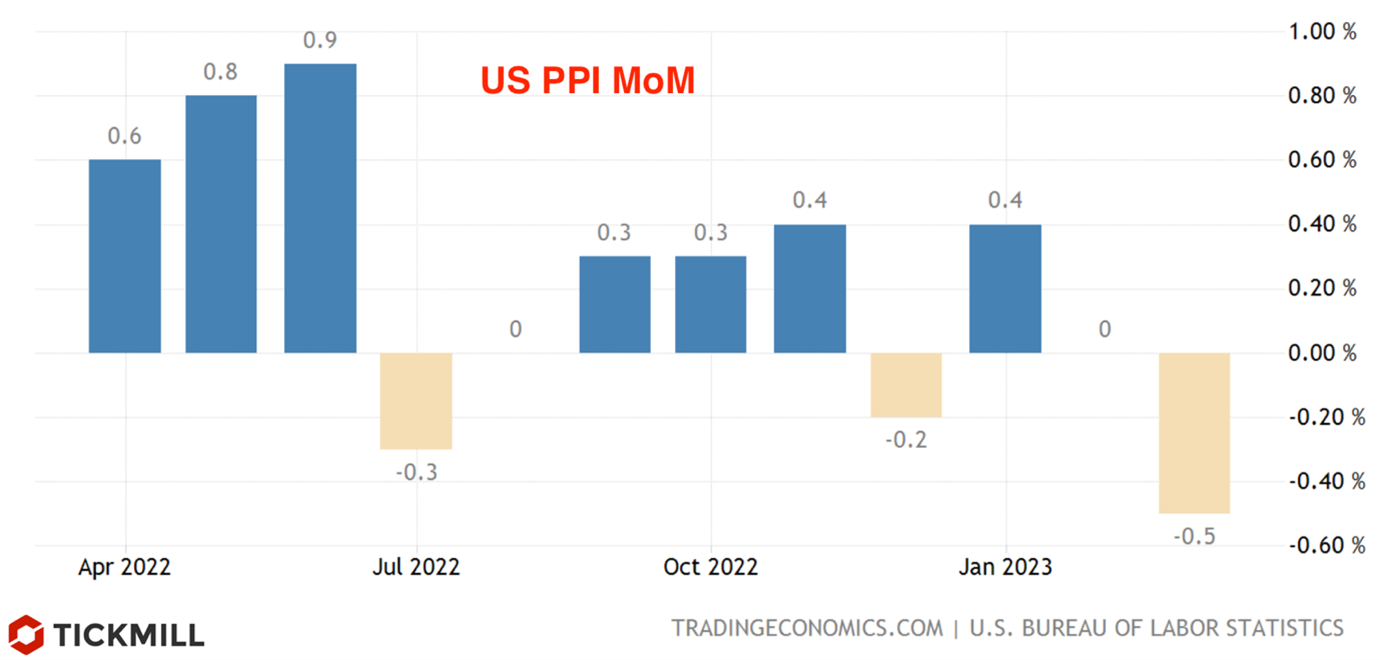

The chances of the Federal Reserve keeping its policy unchanged in May have increased after the release of US production inflation data for March. Overall production inflation unexpectedly turned negative in March: prices fell by 0.5% in a month, although it was forecasted that they would remain at the same level:

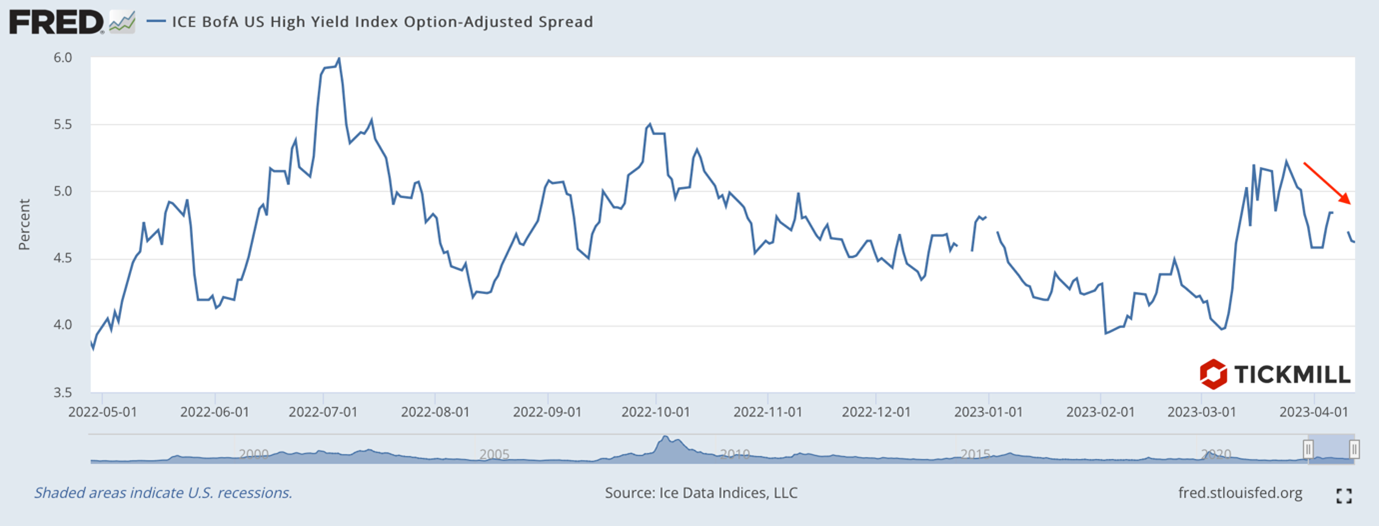

The market enthusiastically received another signal that price pressure in the US economy is abating, and as a result, the probability that the Fed will abandon the idea of raising rates in May has increased. Key US stock indices gained more than 1% on Thursday, but Nasdaq stood out, closing the session with a 2% increase. Since growth stocks, which dominate the technology sector, have a longer duration, they should be more sensitive to changes in expected inflation. Therefore, the greater rise of the index yesterday suggests that investors are betting on further inflation reduction. Meanwhile, the bond market suggests that investors are not yet overly concerned about a recession in the economy: demand for bonds has not only not increased recently, but has even slightly decreased, as can be seen from the rise in Treasury yields. Even a 1% monthly decline in retail sales, as shown in the report on Friday, turned out to be unconvincing: bond yields rose, and the 10-year Treasury yield crossed the 3.5% mark. Apparently, the market does not fully share the Fed's concerns about an impending recession. Credit spreads, which reflect investors' preference for high-yielding bonds over protective bonds, although still higher than the March lows, continue to decline after the US banking sector shock:

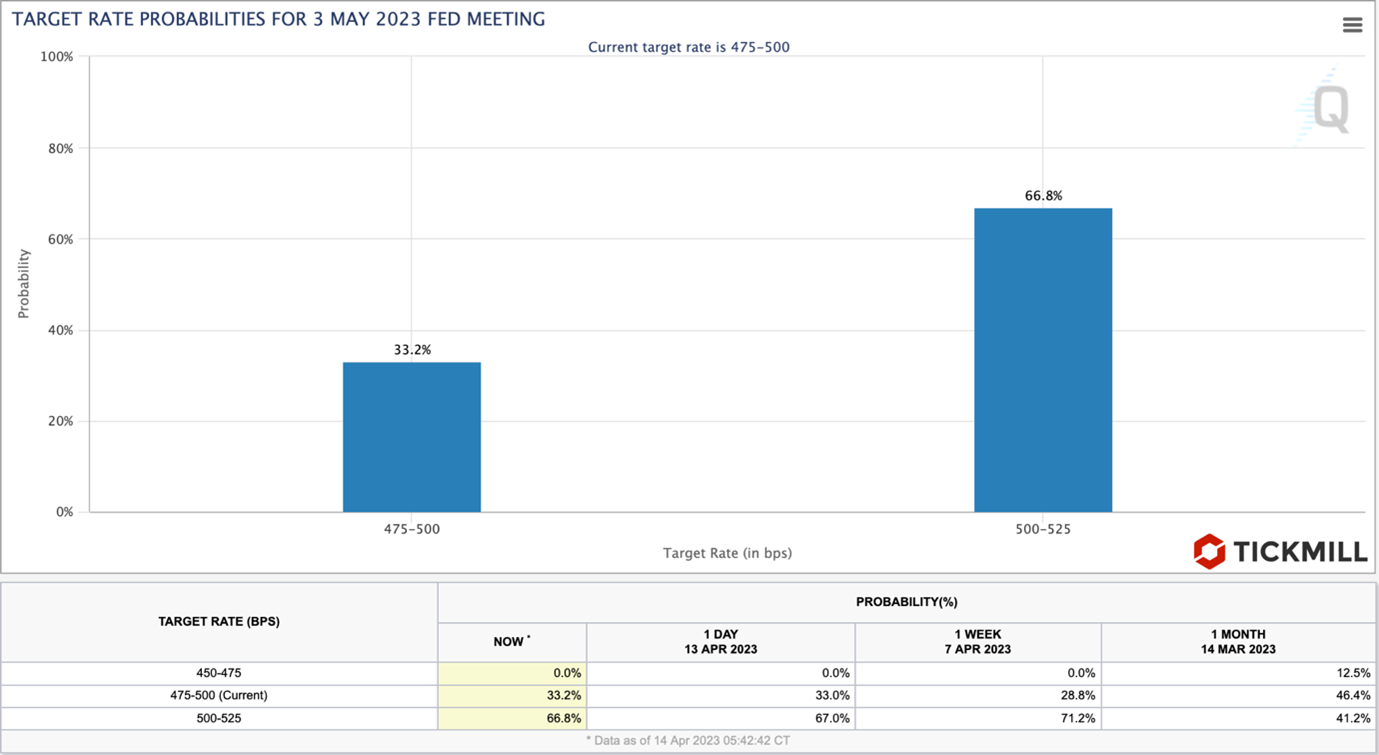

There are still almost three weeks left before the Fed meeting, and futures on interest rates show that risk appetite may still increase: the chances that the Fed will still raise rates in May are almost 67%, but slightly decreased after yesterday's PPI report (from 71%):

However, there is still a growing weakness in the US labour market: initial jobless claims are consistently increasing, with yesterday's data showing an increase of 239K (forecast 232K). The situation with long-term claims has improved slightly, with the number falling to 1.81 million (forecast 1.814 million).

The inflation report in France pleased euro buyers as it contained another hawkish surprise: year-on-year inflation slowed in March, but not as quickly as the ECB would like - 5.7% versus a forecast of 5.6%.

In the near future, the market is likely to continue to expect no changes in the Fed's policy in May, which will provide additional support to the market, especially to the assets which offer higher yields. Dollar should remain under pressure, despite uptick after retail sales data.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.