The IndeX Files 20-08-19

Trade Optimism & Recession Reassurances

Its been a solid start to the week for indices as markets continue to recover from losses suffered midway through last week. The driver behind the reversal in sentiment this week has renewed optimism around US-China trade negotiations as well as rising expectations of further central bank easing.

Last week, markets were buoyed by news that a portion of the $300 billion of Chinese goods due to be hit with a new 10% trade tariff as of September, will now be exempt until December 15th. Trump described the move as a gift to US shoppers over the holiday seasons. However, it is clearly tactical given the ongoing trade negotiations with China, which markets are hoping can finally be resolved.

Commenting on the situation on Twitter on Sunday, Trump said “We are doing very well with China, and talking!”. Indeed, this view was echoed by White House adviser Larry Kudlow who told reporters that recent phone conversations between the two countries’ negotiators had produced more “positive news”.

Furthermore, in response to the emergence of recession fears which capped the rally in equities last week, Kudlow said “I don’t see a recession at all…Consumers are working. At higher wages. They are spending at a rapid pace. They’re actually saving also while they’re spending – that’s an ideal situation”.

Another White House adviser, Pete Navarro, supported this statement telling reporters "We have the strongest economy in the world and money is coming here for our stock market. It's also coming here to chase yield in our bond markets".

European indices have been supported by expectations that the ECB will cut rates when it meets in September. In line with guidance given at the bank’s last meeting and in light of continued data weakness, the bank is widely expected to announce fresh measures.

Technical Perspective for Indices

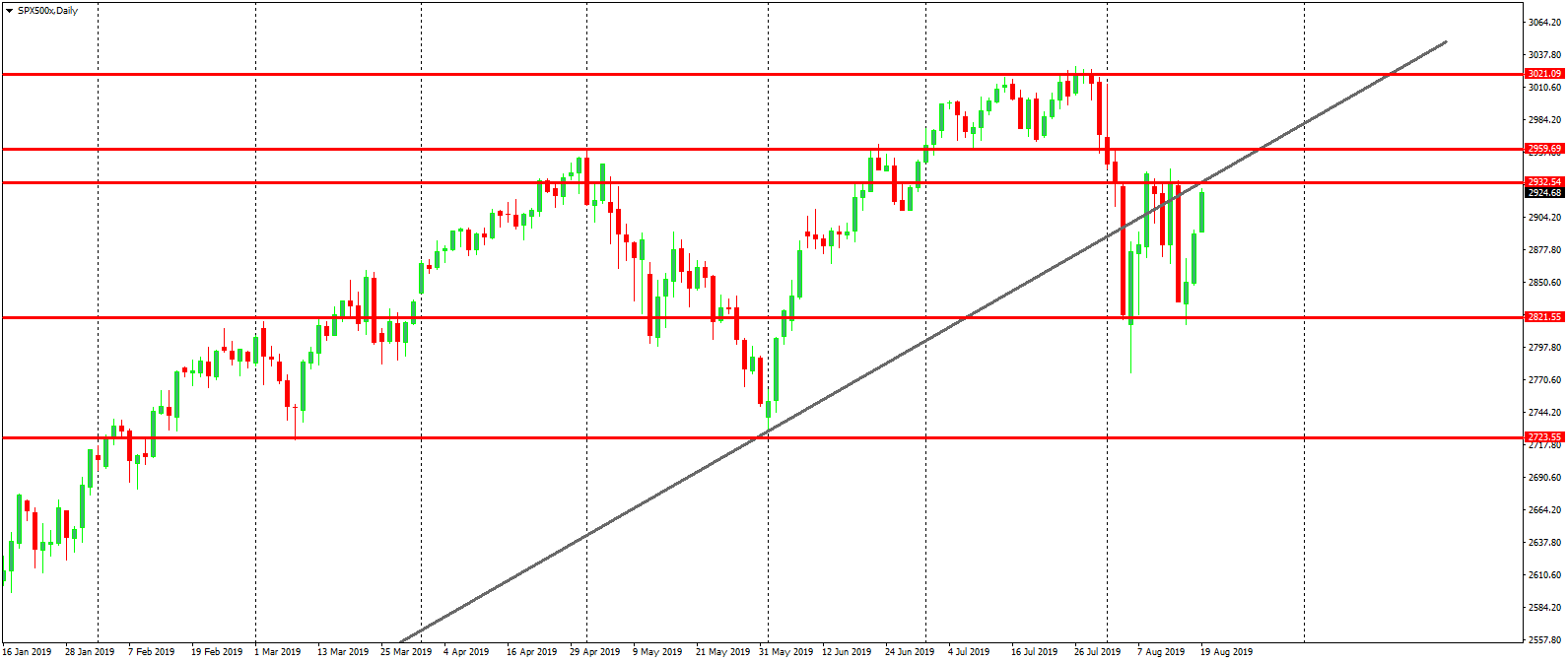

S&P 500

The ongoing recovery rally in the S&P is potentially creating a double bottom with a higher low against the 2821.55 level, pointing to further upside. However, bulls have plenty of work ahead of them with the 2932.54 and 2959.69 levels sitting just above market, as well as the retest of the broken bullish trend line.

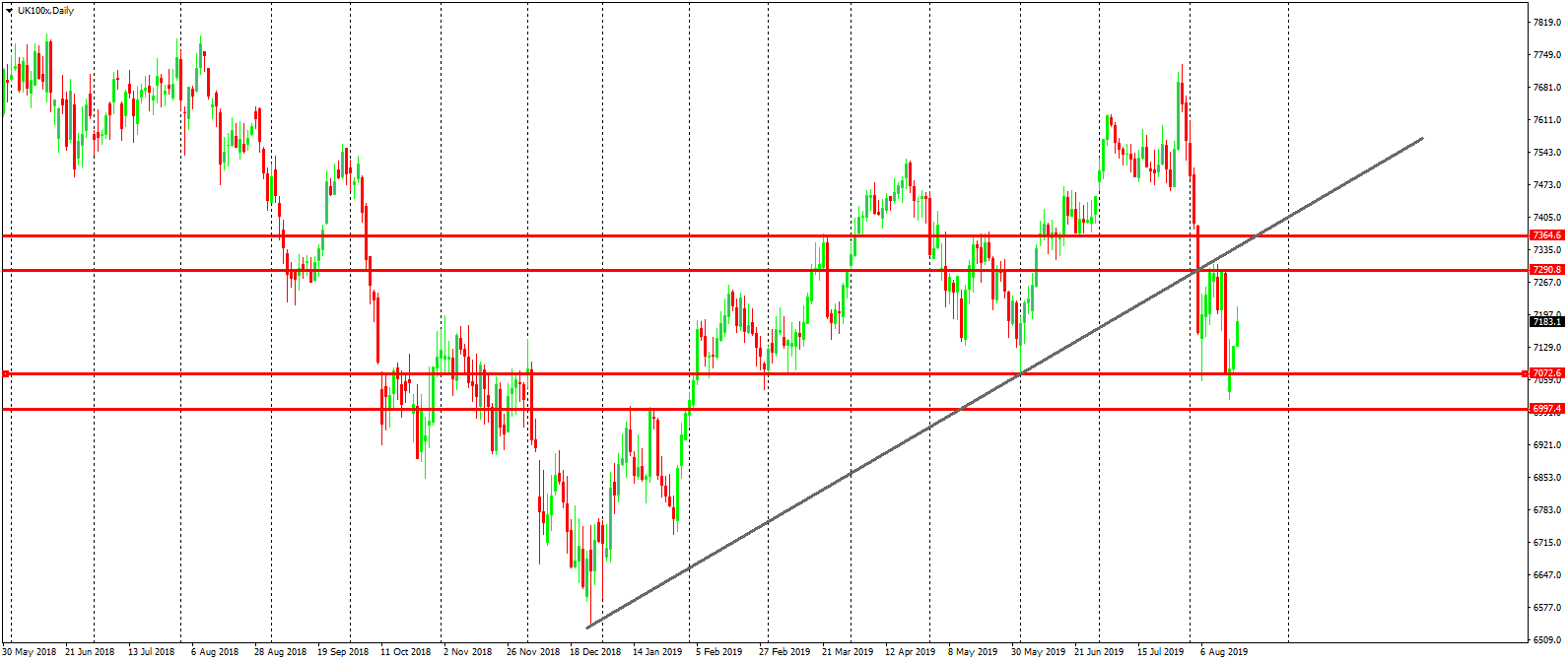

FTSE 100

The FTSE remains range bound between support at the 7072.6 level and resistance at 7364.6. The recovery last week was capped by the latter level and for now, further ranging action looks likely. If we break to the downside, the next level to watch will be the 6997.4 level while 7364.6 is the next topside level to watch.

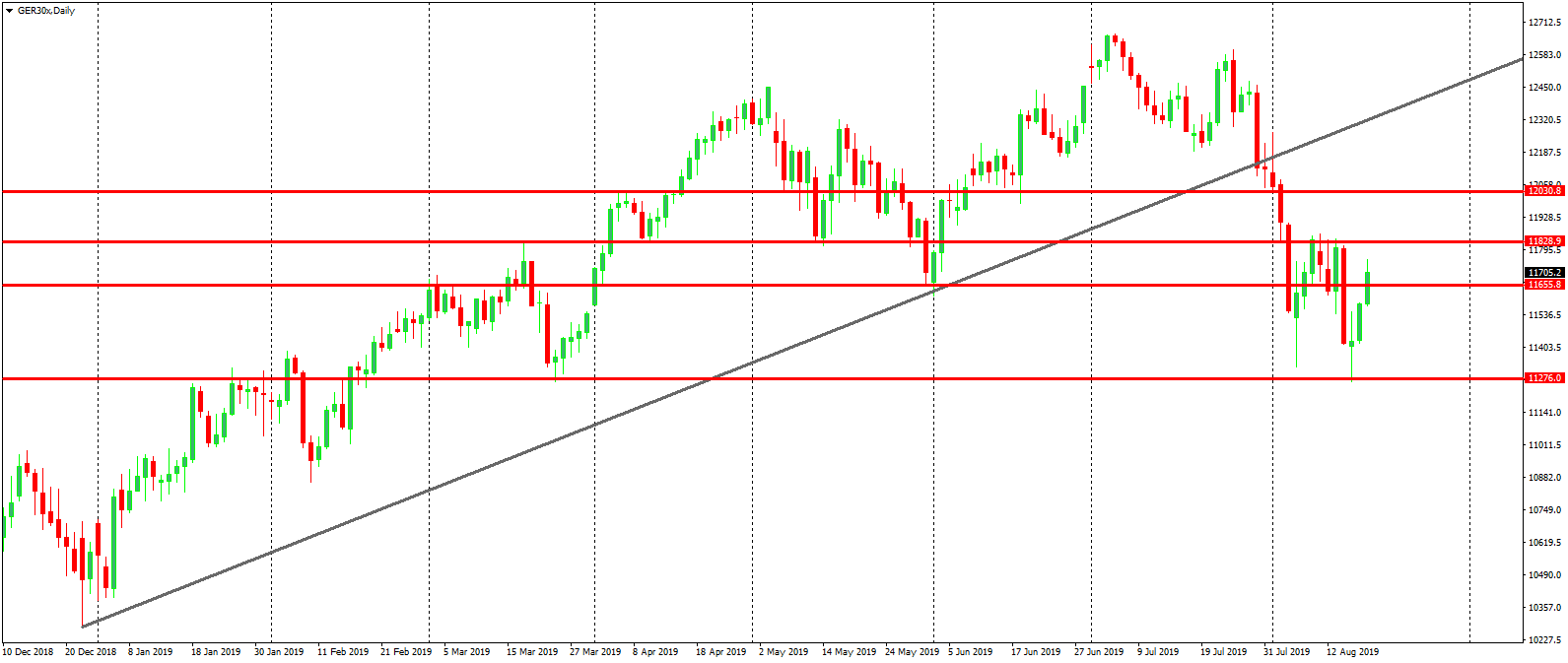

DAX

The rally in the DAX has seen price reversing firmly higher off the recent 11276 lows to trade back above the 11655.8 level. The 11828.9 level sits just above market now and is the next topside hurdle for bulls. Above there and focus will turn to the 12030.8 level. For now, the 11276 remain the key downside level, keeping focus on a further grind higher for now.

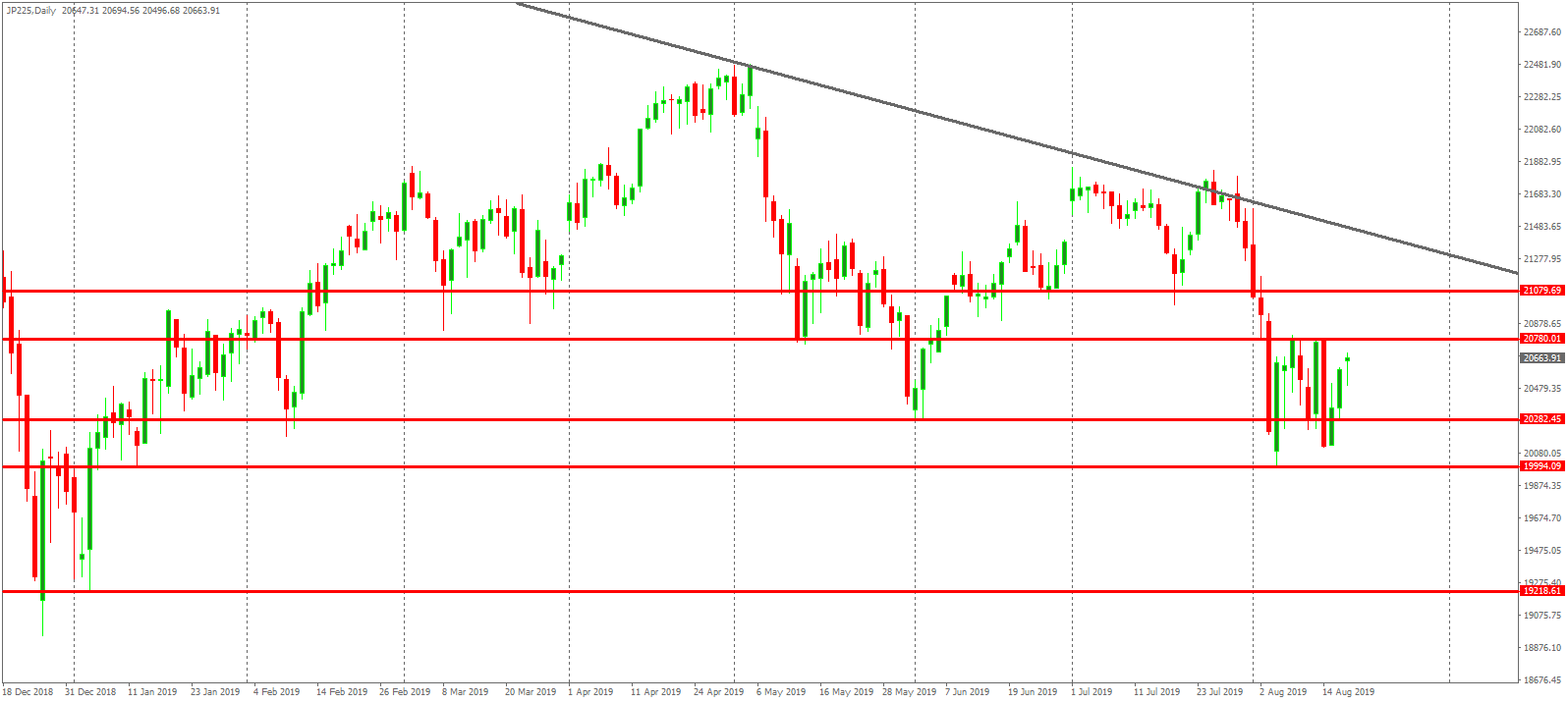

Nikkei 225

The Nikkei recovery continues this week also with price moving higher off the recent 20282.45 lows. For now, price remains below the 20780.01 resistance level which capped the rally last week. If we break back above here, focus will turn to the 21079.69 level next with the bearish trend line from year to date highs coming in above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.