The FTSE Finish Line - July 10 - 2024

The FTSE Finish Line - July 10 - 2024

FTSE Rebounds After Tuesday Marked Worst Day In Month

On Wednesday, London stocks saw a widespread increase following various corporate updates, as investors anticipated Federal Reserve Chair Jerome Powell's testimony to assess the U.S. central bank's monetary policy direction. The FTSE 100 index, which experienced its worst day in almost a month on Tuesday, rose by 0.3%, while the FTSE 250 index also saw an increase.

The travel and leisure sector saw a 0.9% increase in stocks, with SSPGroup experiencing an 8.7% surge as it maintained its fiscal year forecasts. Precious metal miners also rose by 1.2% as gold prices stabilised in anticipation of an important U.S. inflation report. On the other hand, homebuilders were the main underperformers, dropping by 1% on the index. Barratt Developments, in particular, fell by 3%, projecting a potential up to 7% decrease in its home build targets for fiscal year 2025. Meanwhile, energy and industrial metal miners both experienced slight declines of 0.2% and 0.4% respectively, in line with the movements of oil and copper prices. Investor attention is currently focused on the second day of Powell's Congressional testimony, where he mentioned that a rate cut would not be appropriate until the Fed is more certain about curbing inflation. These statements precede the release of crucial U.S. consumer price index figures and Britain's GDP numbers, both scheduled for Thursday.

Barratt Developments, the UK homebuilder, experienced a 3% drop in its shares to 499.4p, making it the top loser on London's FTSE 100 index. The company revised its homebuilding targets for FY25, anticipating a potential 7% decline due to increased mortgage rates and broader economic concerns impacting the housing sector's recovery. Barratt now forecasts building 13,000-13,500 homes, compared to the previous fiscal year's 14,004 homes. The stock has decreased by 4% year-to-date as of the last close.

Travis Perkins, sees a 2.4% rise in its stock price to 820p following the appointment of Pete Redfern as the new CEO of the British construction materials firm. Redfern will take over from Nick Roberts, who is set to step down on September 16. The company's shares have fallen approximately 3% year-to-date.

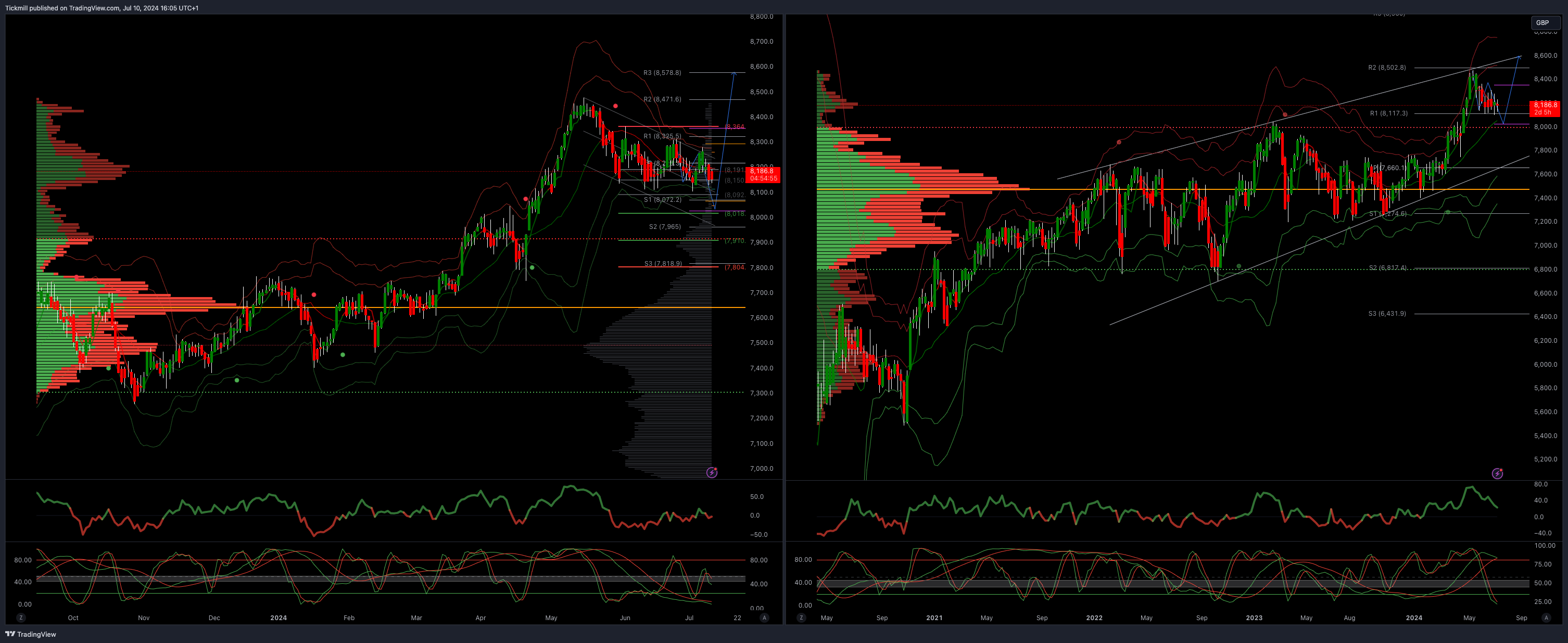

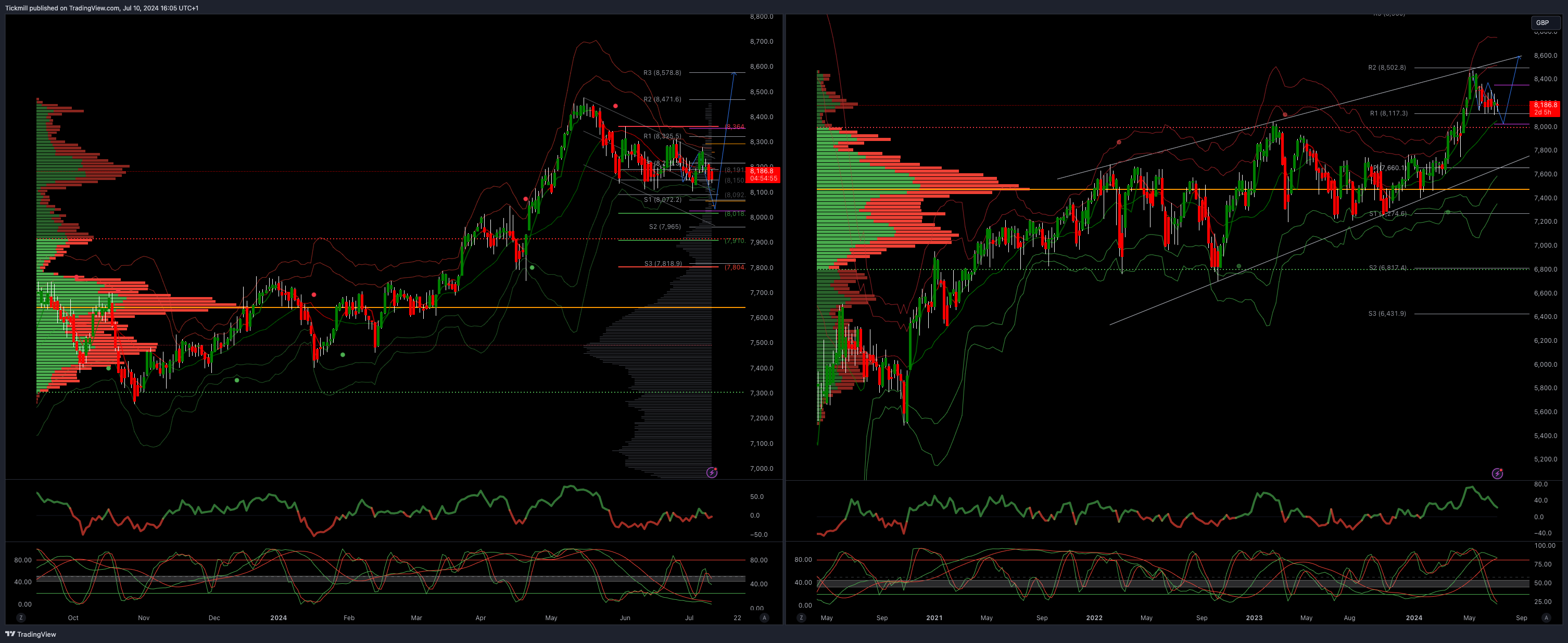

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bullish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!