Tech Meltdown as Trump Sparks US Economic Fears

Tech Stocks Plunge

Risk assets have come under heavy selling pressure this week as trade war risks balloon. Aggressive rhetoric from Trump, his warnings over the US economy and fears over his geopolitical meddling, have sparked a heavy turn in sentiment in stock prices. Tech stocks suffered their largest one-day loss yesterday since 2022 with the Nasdaq now down more than 12% from YTD highs as the correction lower deepens. Bearish sentiment among tech stocks has been amplified recently by fears over Chinese AI competition and the future of western dominance in the sector. Slowing growth margins in sector-leader Nvidia have added to these concerns. With Trump now cracking down on US chip supply to China, there are additional headwinds for AI companies to navigate near-term.

US Economic Concerns & Fed Expectations

Trump’s warnings over the US economy have come at a time when recent US data has started to show weakness, creating a stronger sense of uncertainty among investors. A weaker set of US labour market data last week has underscored these concerns with wages cooling, the unemployment rate rising and the headline NFP undershooting forecasts. While near-term Fed easing expectations have risen accordingly and the US Dollar has been heavily sold, stock prices are finding no relief so far, suggesting that the current push lower has further to run near-term. Traders will now be looking to tomorrow’s US inflation readings as the next input which could help steady stocks if focus swings back to Fed easing expectations.

Technical Views

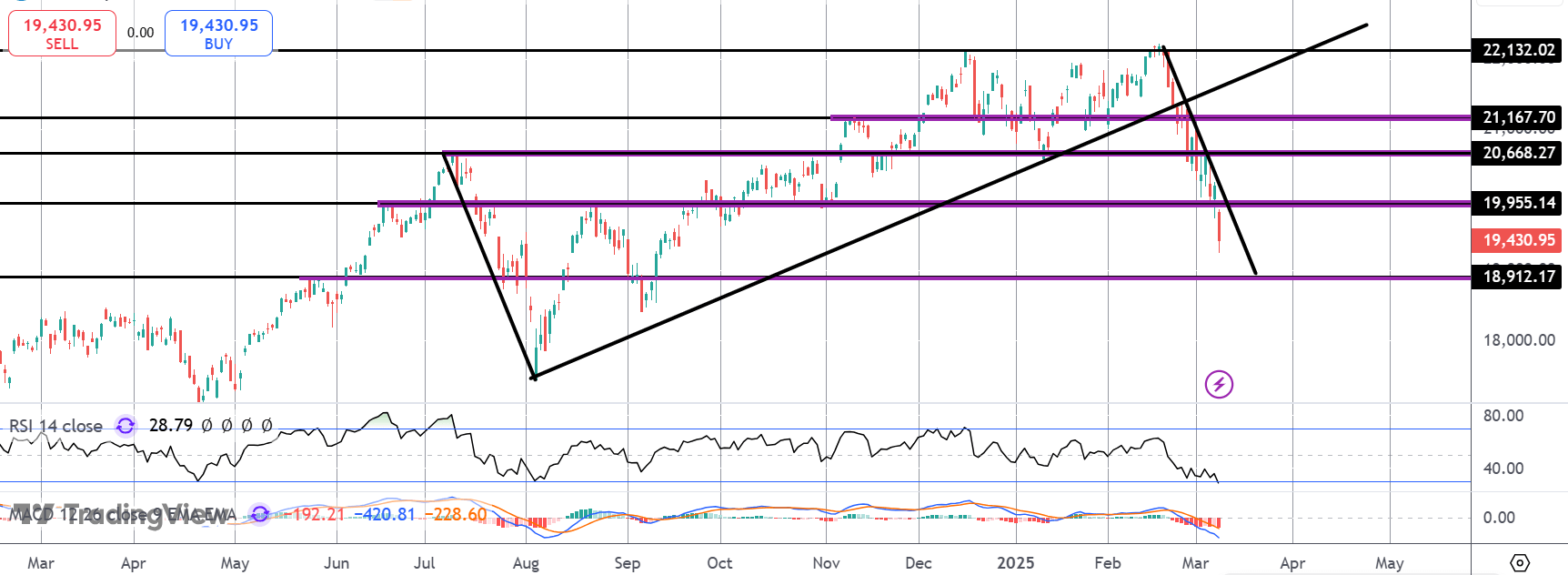

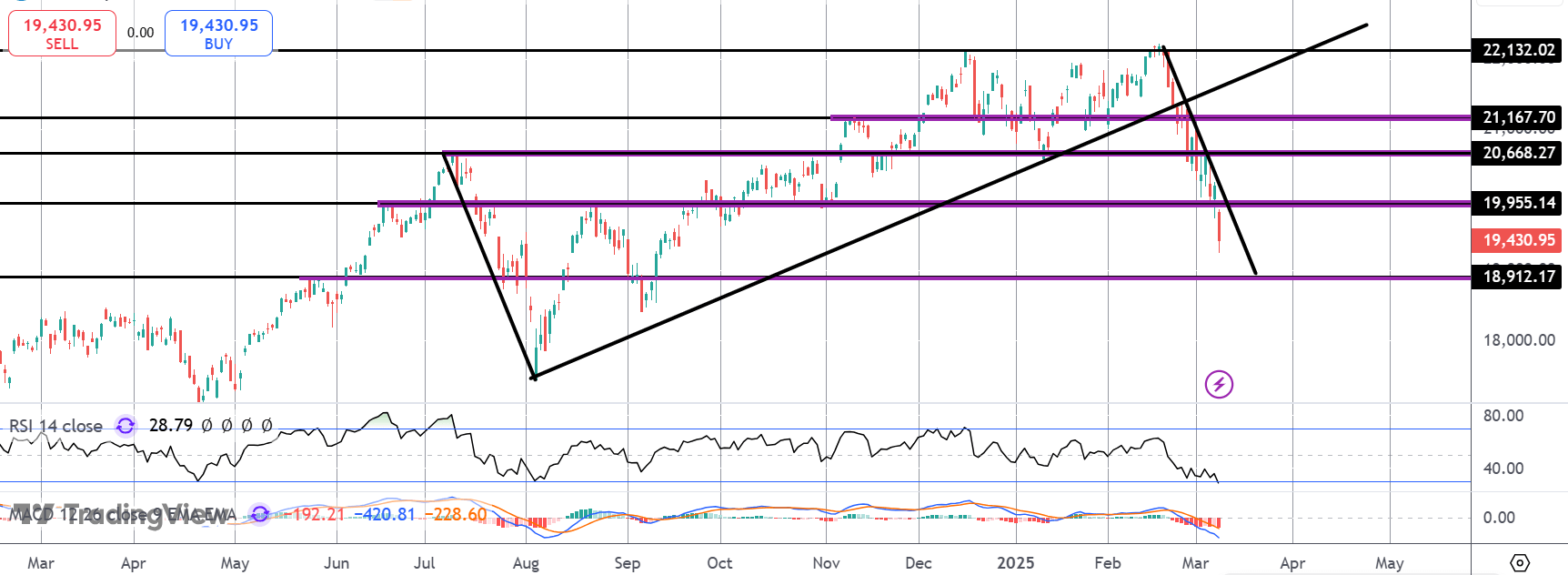

Nasdaq

The sell off in the index has seen price breaking below the 19,955.14 level. Price is now fast approaching a test of the 18,912.17 support, which also marks the point at which the current correction will be equal to the correction over July last year. This will be a key zone for bulls with the prospect of a recovery diminished greatly if we break below that level. Topside, 19,55.14 is the first level bulls need to recover.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.