SP500 LDN TRADING UPDATE 12/11/25

SP500 LDN TRADING UPDATE 12/11/25

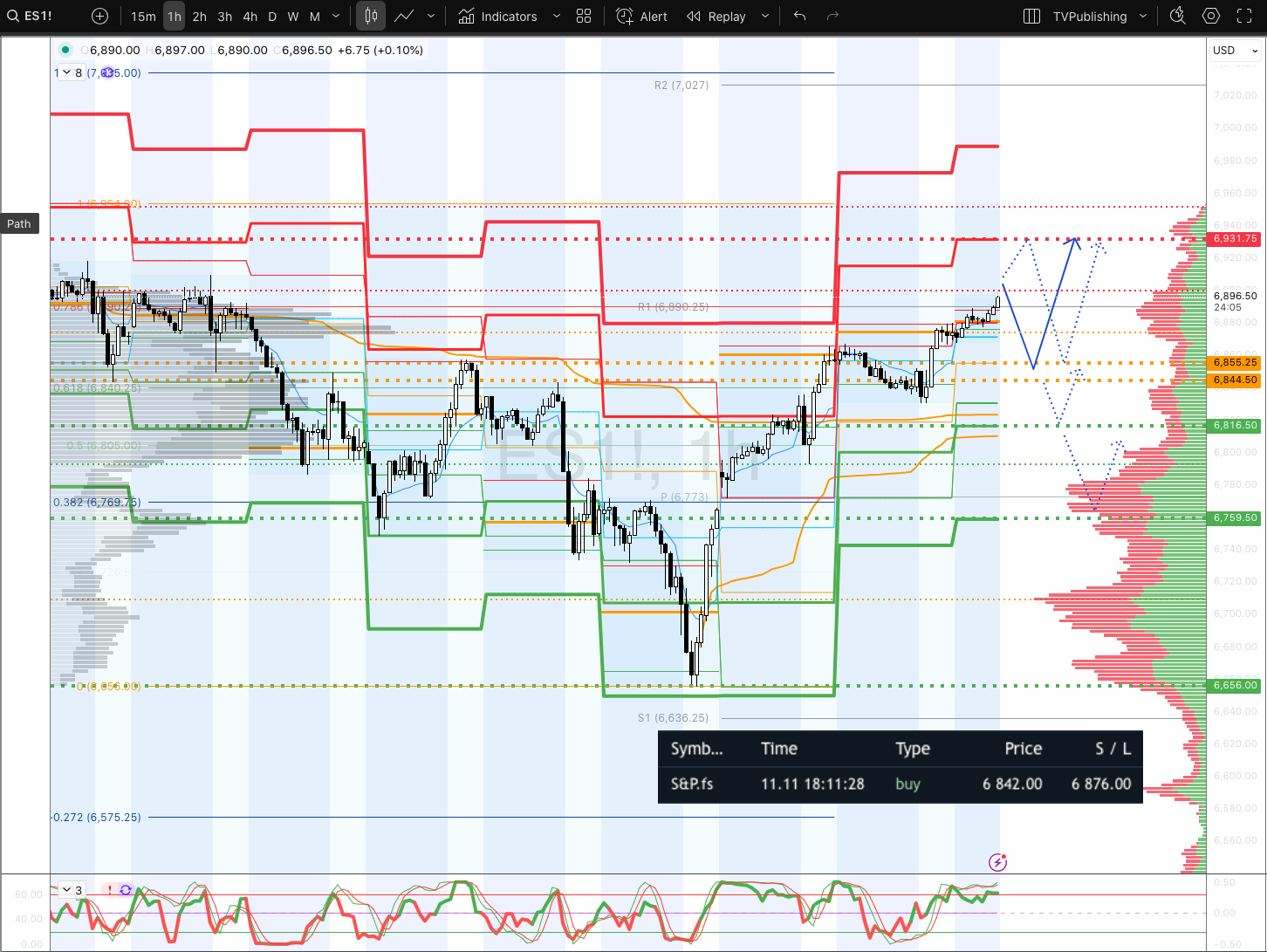

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6877/6629

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6830.5

DAILY BULL BEAR ZONE 6845/55

DAILY RANGE RES 6932 SUP 6815

2 SIGMA RES 6989 SUP 6759

DAILY VWAP BULLISH 6799

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

LONG ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 6929>DAILY RANGE RES

SHORT ON TEST REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: MUTED

S&P closed +12bps at 6,846, with MOC flows of +$700m to buy. NDX fell -31bps to 25,533, R2K gained +17bps to 2,459, and the Dow surged +118bps to 47,927. Trading volumes were light, with 15.3 billion shares exchanged across U.S. equity markets, below the YTD daily average of 17.3 billion. The VIX dipped -1.5% to 17.33. WTI Crude rose +131bps to $60.90, gold increased +33bps to $4,136, the DXY slid -13bps to 99.45, and Bitcoin dropped -2.5% to $102,934.

It was a quiet session, with trading volumes approximately 25% of normal levels due to Veteran’s Day. The S&P edged higher, supported by a defensive tone overall, while the tech/AI sector faced pressure. Key movers included NVDA (-2.5%), CRWV (-15% after cutting guidance due to a delayed customer contract), and AMD (-1.8% on post-investor day profit-taking). Meanwhile, the ADP weekly job report highlighted ongoing labor market concerns. While the ADP MoM signal isn't overly reliable, downside risks remain apparent. Goldman Sachs revised its NFP forecast to -50k, which would mark the weakest print since December 2020, primarily driven by 100k government buyout layoffs. Private payrolls will be a more significant focus, as the government impact is already anticipated.

There’s also speculation about the potential release of both October and November jobs reports within a condensed timeframe in early December, possibly even on December 5th. This could create a critical data window just ahead of the December FOMC meeting.

Activity levels were subdued, rated a 3 on a 1-10 scale. The floor ended -156bps for sale versus the 30-day average of -132bps. Institutional activity was muted. Long-only funds closed flat (macro demand offset tech supply), while hedge funds were net sellers (-$600m), primarily in tech and discretionary sectors. Consumer names saw relative strength, but this appears to be a countertrade against AI trends over the past two days. Sustained rotation out of AI or improvement in the labor market would be needed for this trend to gain traction, neither of which seems imminent.

In derivatives, index flows were quiet due to the bond market closure for Veteran’s Day. Notably, there was a large buyer of December 7050 calls on futures. Term structure steepened significantly, with implied vols increasing despite limited realized moves. This trend is likely to persist during rallies. The desk favors SPX and NDX call spread collars into year-end to position for a low-volatility grind higher. The weekly straddle closed at ~0.95%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!