Market turbulence and central bank credibility: the costs of fluctuating policy stances for the Fed

This week was marked by extraordinary turbulence on the financial markets, but by the end of the week, the prevailing opinion was that politicians had offered convincing "guarantees" for troubled sectors/institutions. The Fed announced a mechanism for providing liquidity to banks with fragile balances (the BTFP program), which, judging by the explosive growth in the Fed's balance sheet over the past few days, is nothing other than hidden QE. And the Swiss National Bank promised to intervene if things go really wrong for Credit Suisse. All in all, it seems that this was enough. Yesterday, the SPX continued to rebound from its lows and seems seriously intent on breaking through the 4000 mark soon, with the NQ and Dow also making decent gains.

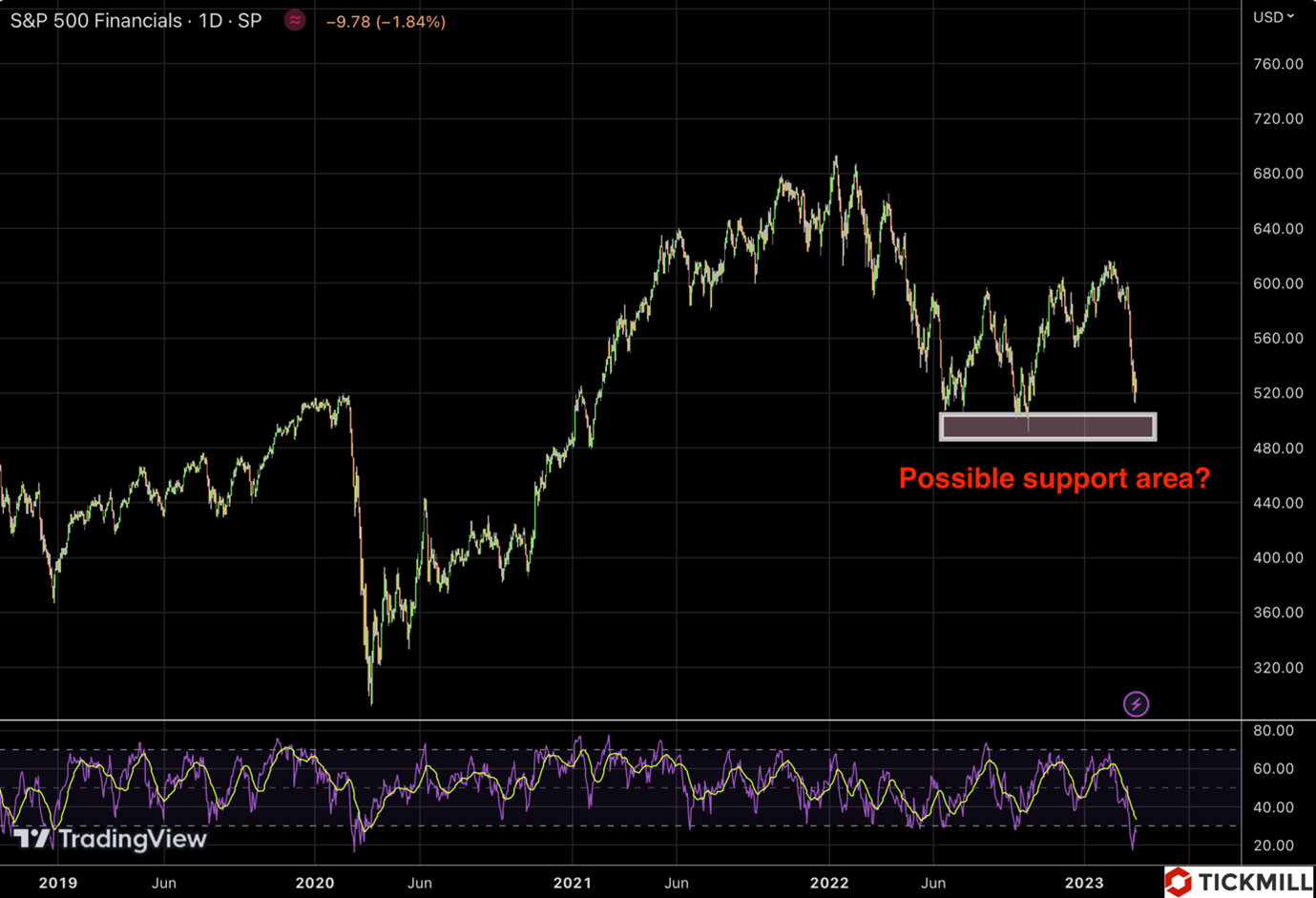

The S&P 500 financial sector, which is viewed currently as a proxy of a broad risk-off, trades near the lows of 2022, when the price formed a double bottom, which may now reinforce the market's perception that the 500-point area will act as a support zone:

The European Central Bank continued to raise interest rates, with a 50 basis point increase this week, as expected. Given that central banks are trying to synchronize policies, it can be expected that the Fed will also try to maintain its previous stance on fighting inflation, continue to raise rates, and resist pressure from market participants who sharply reduced their expectations after the recent shocks in the banking sector. Before the events with SVB, the market was expecting three rate hikes and a terminal rate in the range of 5.25% to 5.5%. Subsequently, the forecast changed dramatically: one rate hike of 25 basis points at the upcoming meeting, followed by a series of rate cuts to the range of 4.00-4.25% by the end of 2023. In my opinion, these expectations are unrealistic: in January, Powell spoke of an imminent pause, then, against the backdrop of hawkish surprises in the data in February, he acknowledged that the Fed would need to tighten somewhat more, and now it turns out that he will have to abruptly change his rhetoric towards a more dovish one. Moreover, there was no significant easing of inflation in February. Such fluctuations in stance can easily lead to a loss of confidence in the central bank's policy, as well as a loss of reputation as the main forecaster of inflation. In turn, this can sharply reduce the effectiveness of policy, making it less predictable: officials expect one effect on macroeconomic and financial variables, but since market participants doubt the Fed's forecasts, they start using their own, and the effect is completely different. The Federal Reserve is well aware of these costs (see Lucas Critique), so market participants betting on a dovish outcome are likely to be disappointed at the upcoming meeting.

These considerations lead us to the following idea: the room for rally in risk assets ahead of the Fed meeting is sharply limited. In my view, closer to the meeting, markets participants will start to price in a hawkish outcome, which will lead to selling pressure. Looking at the SP500 benchmark, we can expect the following scenario: a range of 3900-3950 before the Fed meeting, followed by a wave of selling after the regulator's meeting. The dollar index, in turn, will enter the range of 103.50-104.5 and then rise on the backdrop of hawkish statements from the Fed.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.