Risk Assets Weaker on Thursday

Global risk sentiment is looking softer into the back end of the week with equities and commodities prices turning lower against last week’s gains. The moves have been seen on the back of a better-than-forecast set of US retail sales for October as well as comments from some Fed members reaffirming commitment to tightening. Fresh geopolitical fears around the violence in Ukraine are also dampening risk sentiment here on the back of the Polish missile strike event earlier in the week.

Retail Sales Beat Forecasts

Headline US retail sales yesterday were seen rising 1.3%, above the 1.1% expected, marking a sharp jump on the prior month’s 0% reading. Similarly, core retail sales were seen rising 1.3% also, well above the 0.5% forecasted, marking a sharp increase on the prior month’s 0.1% reading. Given the importance of retail sales in calculating overall GDP, the data has offered some hope that Q4 growth will show resilience in the face of growing recessionary fears.

Fed’s Daly Reaffirms Tightening Stance

As well as better US data, equities have been weighed on by recent Fed commentary. Fed’s Daly yesterday reaffirmed her support for tightening, citing her view that there is a least another full percentage point of tightening to come before the Fed pauses on rate hikes. Market pricing has now swung fully in favour of a smaller .5% hike from the Fed in December.

Technical Views

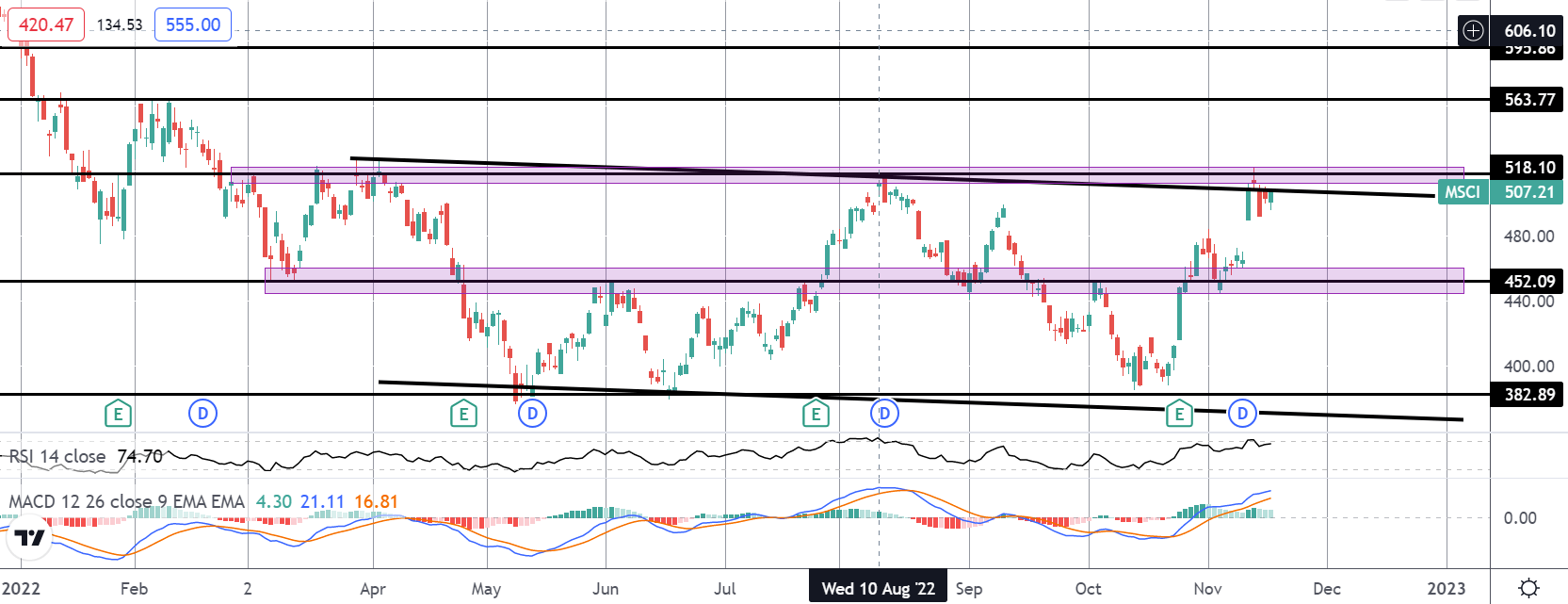

MSCI

The rally off the 400 level and the bear channel lows has seen the index trading back up to test the channel top and structural resistance at the 518.10 level. With momentum studies bullish, the focus is on a continuation higher while the 452.09 level holds as support. If we see a further break higher here the next upside objective for bulls will be the 563.77 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.