Market Spotlight: UK Recession Fears Grow As Real Wages Fall Further

Real Wages Falling

The latest economic data out of the UK today has further heightened fears of a recession there. in the three months through August 2022, the unemployment rate was seen ticking back up to 3.6% from 3.5% prior. At the same time, wages were seen rising just 6%, down from the prior 3-months’ 6.1%. With inflation currently sitting at 10.1%, real wages have dropped even lower over the most recent period. Additionally, with UK CPI projected to increase to 10.7% tomorrow, real wages are being squeezed even harder.

Weaker UK Economic Outlook

UK consumers have been under immense pressure this year amidst soaring energy prices, rising inflation and higher interest rates. With real wages continuing to drop and the likelihood of the BOE hiking rates again next month, the near-term outlook is very precarious for the UK economy. The upcoming UK budget on Thursday looks set to add further strain for households and businesses with widespread spending cuts and tax hikes forecast.

Tomorrow’s Inflation Reading in Focus

For GBP, which is currently being boosted by a weaker USD and better equities prices, the outlook remains skewed towards downside. However, given the expectations already baked into the market here, a weaker inflation reading tomorrow might help alleviate some of this pressure, allowing GBP room to move higher near-term as traders price in a smaller BOE hike. However, if forecasts are hit or surpassed, chances of a further, large hike from the BOE should remain.

Technical Views

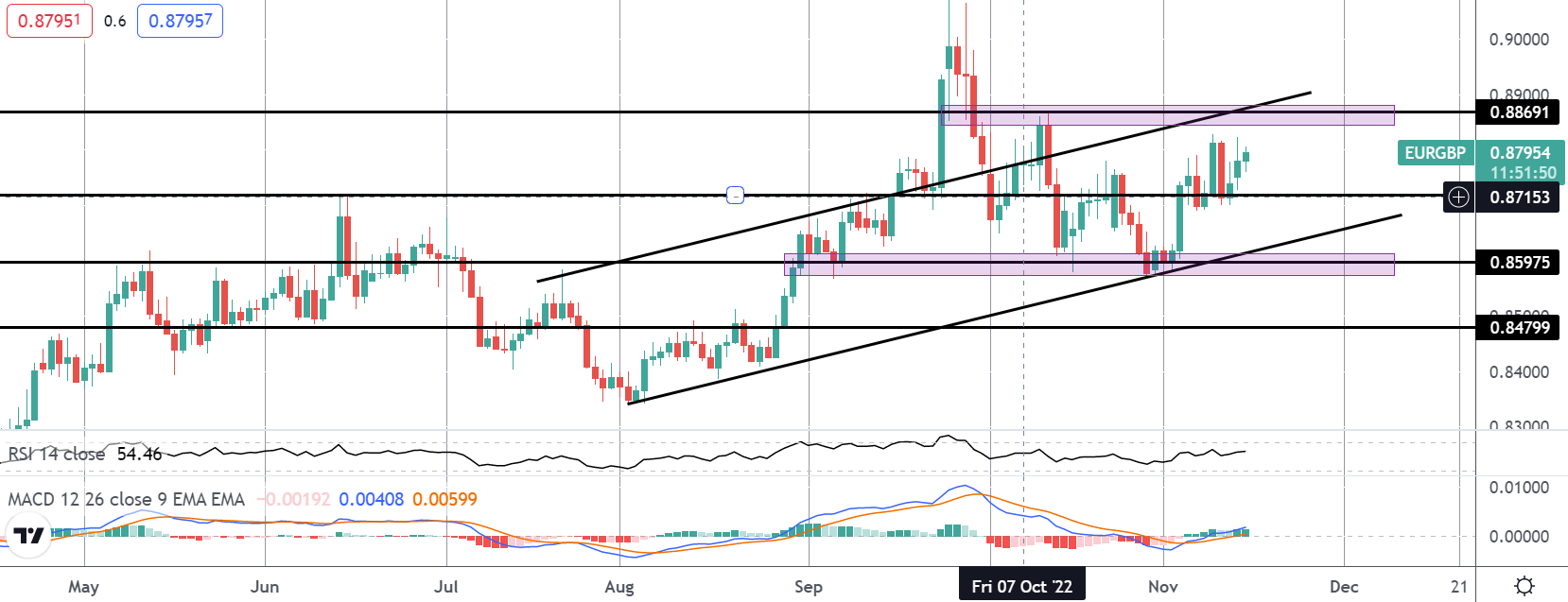

EURGBP

Following the failed topside break earlier in the year, EURGBP is now trading back within the bull channel. Currently, price is hemmed in between support at .8595 and resistance at .8869. With momentum studies bullish focus remains on further upside for now, targeting a move back up to YTD highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.