Exxon in Focus

All eyes are firmly on US earnings today with the world’s largest public energy firm, ExxonMobil, due to report Q4 results. On the back of a bumper +80% year for the stock, investors are looking for fresh reasons to hold Exxon through 2023. With that in mind, the focus for today’s earnings call will be much more on the group’s outlook and guidance and less on its actual recent performance. Still, those are the numbers which will grab the headlines and, on that front, the market is looking for EPS of $3.289 on revenues of $97.34 billion.

Dim Outlook For Energy Prices

With oil and gas prices having collapsed over the back end of 2022, revenues are understandably expected to be reduced in Q4. However, the market will be more focused on where Exxon sees oil prices heading in 2023. With the group having steered away from the move towards green energy seen from the likes of BP and Shell, its profits are very much tied to the fate of fossil fuel price direction.

Poor Results For Rival Chevron

Exxon’s main rival, Chevron, was seen posting disappointing results on Friday leading the stock to fall more than 5%, now down more than 7% from recent highs. On the back of this, its feasible that we see a similar move from Exxon shares should today’s numbers disappoint. With the EIA forecasting the price of a barrel of oil to fall to $83, down almost 20% from last year, the near-term outlook for Exxon looks skewed to the downside, particularly on the back of the big run up we saw last year.

Technical Views

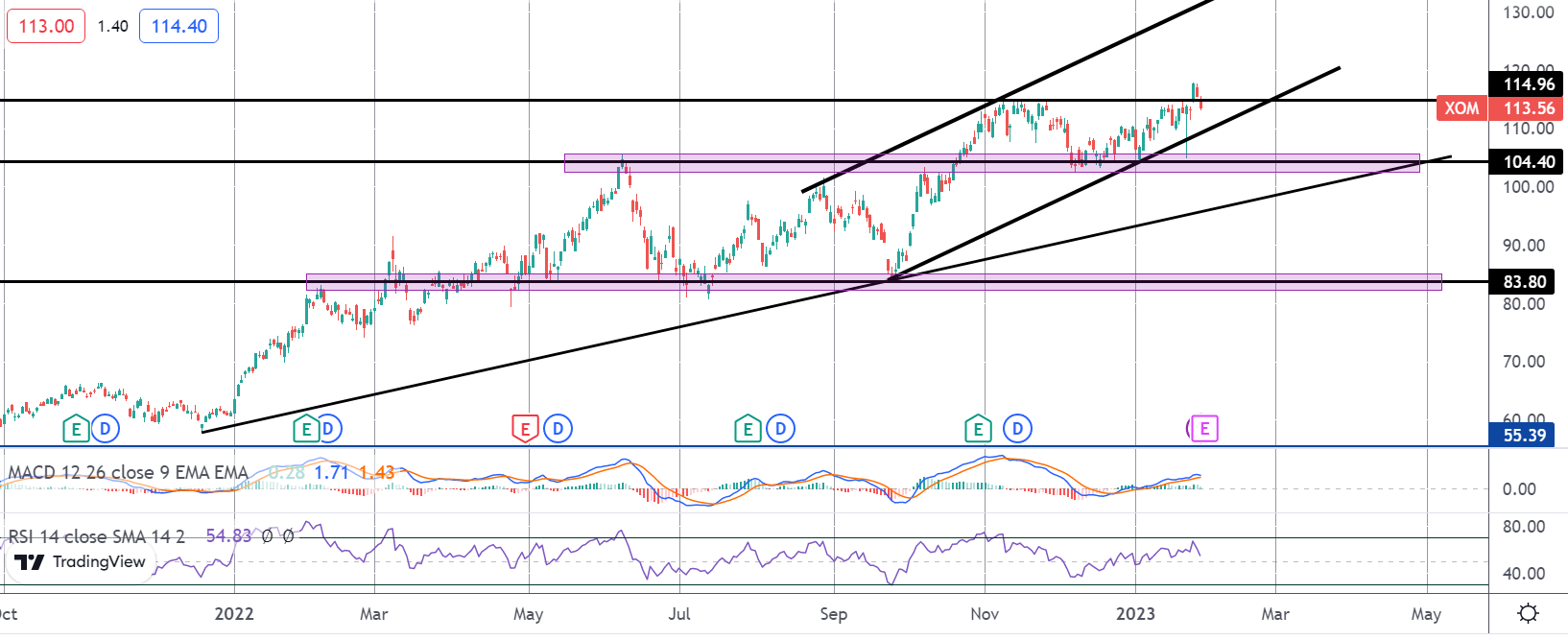

ExxonMobil

The rally in Exxon shares has run into selling pressure above the 114.96 2022 highs, with the stock now trading back below the level. While still within the bull channel for now, bearish divergence on momentum studies highlights bearish reversal risks and the key level to watch is the 104.40 level, a break of which opens the way for a test of the longer term bull trend line ahead of deeper support at 83.80.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.