BTC Reversing From Recent Highs

Bitcoin prices have come off a little from last week’s highs with the market turning lower by 7% across recent days. A slew of weaker-than-forecast tech earnings hurt sentiment last week. However, it was Friday’s post-NFP USD rally that really put BTC under pressure. With the NFP coming in well above market forecasts and unemployment falling to multi-decade lows.

Powell on Watch

Looking ahead this week, traders will be closely watching Fed chairman Powell who speaks tomorrow. On the back of Friday’s better-than-expected data, the risk is that Powell takes a more hawkish stance, helping drive USD further higher and pulling risk assets (including BTC) lower near-term.

US Rates In Focus

Looking ahead, the fate of BTC in coming months will hinge firmly on US rate path projections. While Friday’s jobs data was encouraging, concerns about downside risks to the US economy have been a key feature of the current earnings season. Though many players are now projecting a milder downturn than expected towards the end of last year, focus is likely to drift back towards the Fed ending its tightening operations as we move through Q2 and into summer, creating upside risks for BTC a little further down the line even if we do see some near-term give back.

Technical Views

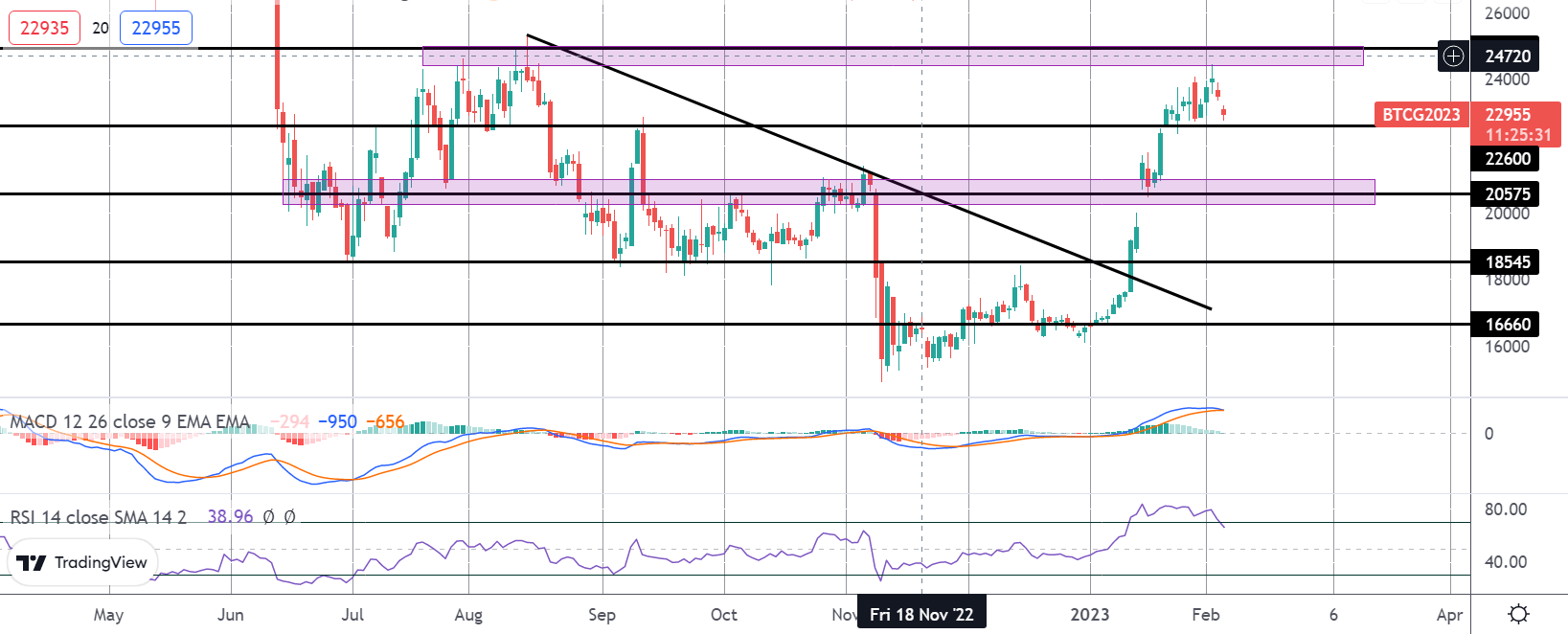

BTC

The failure on approach to the 24930 level has seen the market reversing sharply lower. Price is now testing the 22600 level support and with momentum studies turning lower, the market is at risk of a break lower here. Below this level, 20575 is the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.