Crude Still Caught In Between

Oil prices continue to hover around the 72.61 level as we cross over into the back end of the week. The market has been fairly congested recently as traders grapple with opposing market forces, struggling to establish a solid directional view. A stronger US Dollar is curtailing upside for now with the Fed pushing back against near-term rate-cut expectations. Concerns over the economy in China are also having a dampening impact on prices. The latest GDP data out of China this week undershot forecasts, along with a much weaker set of retail sales, highlighting the issues there.

OPEC Raises Demand Forecasts

In terms of supporting factors for the market, supply disruptions linked to ongoing conflict in the Middle East are helping to offset some of this downward pressure. Continued disruptions to shipping routes in the Red Sea along with protests in Libya are still a major issue. Indeed, OPEC+ this week upgraded its demand outlook for the year ahead as a result of the conflict in the Middle East and the various disruption being caused as a result.

Bullish Risks for Crude

Looking ahead, OPEC forecasts global oil demand to rise to 106.21 bpd in 2025, up from prior forecasts. This is linked to Middle East tensions as well as the disrupted US oil production as a result of extreme weather. Given the situation in the Middle East, prices look vulnerable to further upside near-term as a result of any incoming news linked to an escalation of violence there.

Technical Views

Crude

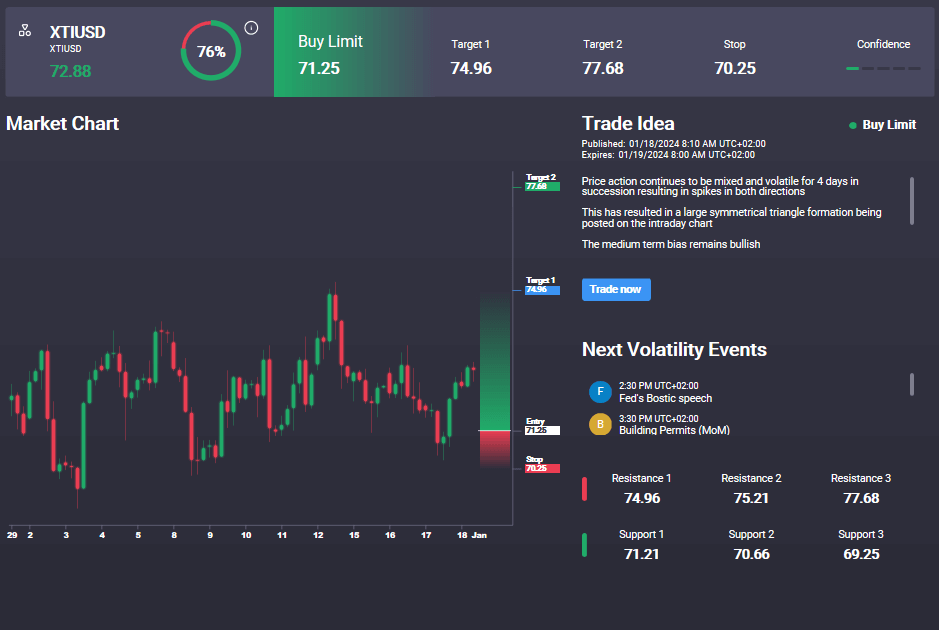

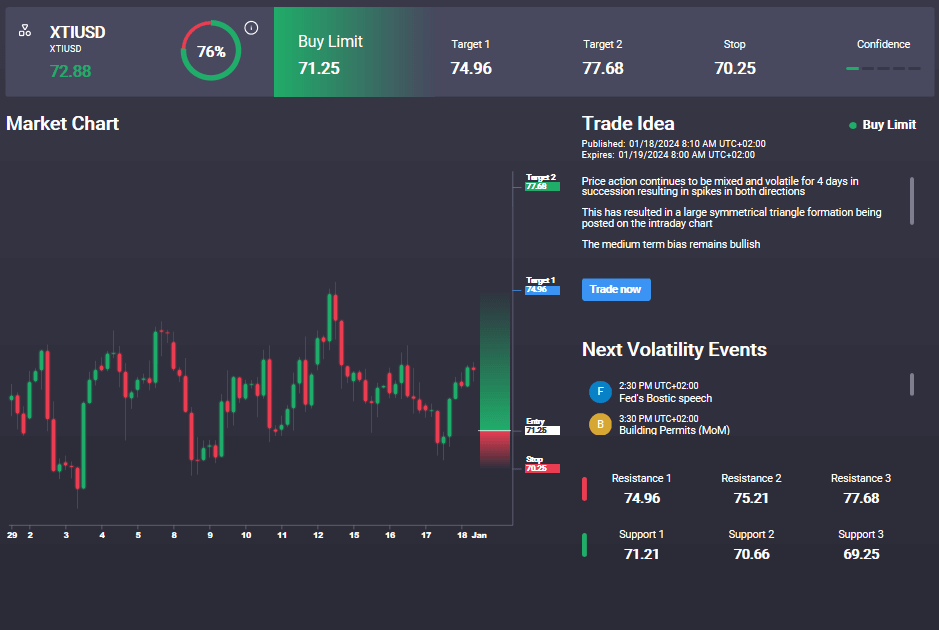

The sell off in crude has stalled for now into a test of the 66.79 area support. Price is now testing the top of the bull channel and the 72.61 level resistance. With momentum studies moving higher, focus is on a further push to the topside above here with 77.64 the next resistance to note. Notably, we have an active buy signal in crude set below market at 71.25 suggesting a preference to buy any dip from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.