Institutional Insights: Goldman Sachs Trading Desk Views 04/09/24

Institutional Insights: Goldman Sachs Trading Desk Views 04/09/24

GS DESK UPDATE...Wobbly start to the month as seasonality, tepid data, and positioning weighed on equities. Much ink has been poured about the S&P's historical September, and on top of that, subsector performance does not fair much better: XLI:-0.55% / XLU:-1.7% / XLB:-1.75%. Moving to the data, GSEcon characterized this morning's slate as ~mixed~, but it clearly was not enough to quell growth fears. Of note, new orders fell 2.8pts to 44.6 after 47.4, its fourth monthly decline in the past five months to leave it at its lowest since May2023. The uninspiring data put the pressure on growth proxies...* Cyclicals (GSXCYCL):-2.35%* Soft Landing (GSXUSOFL):-1.89%* Home Builders (XHB):-3.40%* Small Caps (IWM):-3%* Oil/Gas Levered (GSIDLARO):-4%* Global Copper (GSXGCOPP): 6.3% ... 3SD move, worst since March 2023Despite a lack of headlines, tech, particularly semis, traded poorly. To point, NVDA registered its worst 1day performance since mid-April. Color from our TMT Trader Pete Bartlett: Residual earnings-related supply in NVDA as investors get back into their seats following the holiday week. Primary pieces of pushback from last week’s beat & raise print were: skinnier EPS beat in qtr & guide, with lower “wow” factor vs. previous quarters / GMs normalizing / some high-end upside #s actually came down following print/positioning & technicalWHY THE SELLOFF???

There wasn’t a specific smoking gun for today’s move (outside of NVDA/Semi’s continued weakness) to cause today’s risk off move. However, there a few negative forces (in no particular order) working against the bullish narrative that combined could explain today’s pain (h/t Flood and BG).

1. DATA WASN’T GREAT....

from GS ECON: "All 3 key components remain in

contractionary territory". Construction spending came in negative. Bad is bad

and growth fears were renewed.

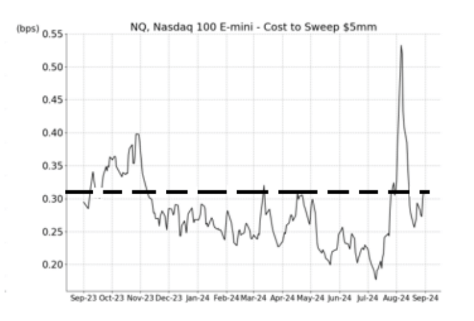

2.LIQUIDITY ISN’T GREAT...

Liquidity in NDX futures essentially at ytd lows

3. REVERSION?...

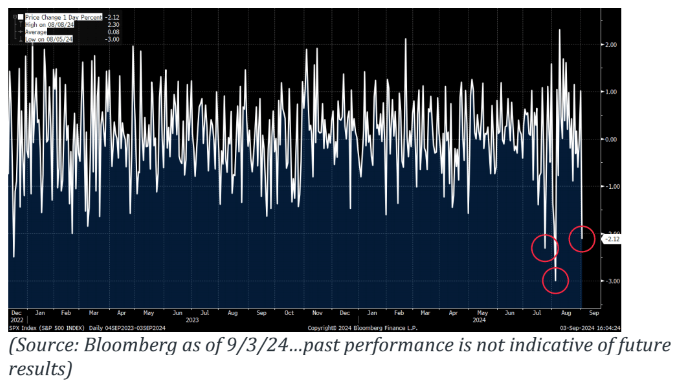

We ripped 75bps into month end close Friday (remember $10.5B MOC to buy?)...giving that back and then some today. SPX had the 3rd worst day of the year...they’ve all come since July.

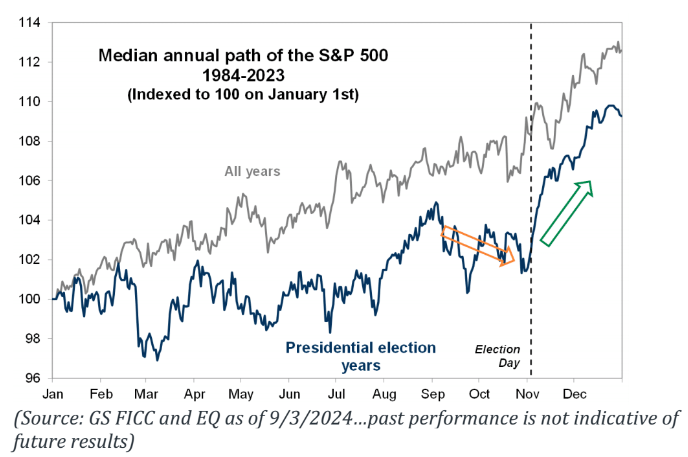

4. SEASONALS NOT HELPING...

Everyone pointing to this historical barometer (didn’t matter last week?)...it gets particularly challenging in an election year.

5. PAPER PARANOIA?... We expect ~$5B of paper to hit in the upcoming week. We counted $3.2B after the close.

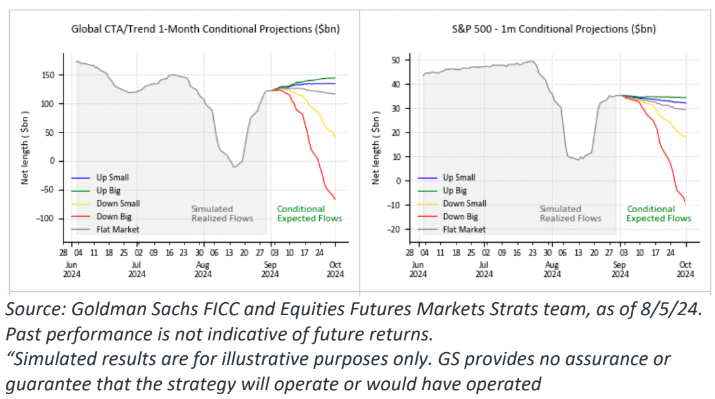

6.CTA’s...

Expect this will start getting airtime again as they flip back to the sell side. Short term thresholds triggered today: SPX Short term threshold: 5515. Medium term is 5328 (important trigger level). Asymmetry is to the downside.

7.YEN CARRY TRADE NOT DONE?...

”Arif Husain says he was early in sounding the alarm on Japan’s rising interest rates last year, which he described as the “San Andreas fault of finance.” The head of fixed income at T. Rowe Price is now warning that investors have “just seen the first shift in that fault, and there is more” market volatility ahead after the nation’s rate hike in July helped trigger a sharp reversal of the yen carry trade.”

8. BUYBACKS GO BYE BYE?...

We estimate the next blackout window will begin 9/13 when ~50% of corporates have entered blackout ahead of Q3 earnings releases. This biggest buyer slows down.

9. TAKE THE (NVDA) MONEY AND RUN?...

Lots of question on Semis weakness, with our Semis Basket (GSTMTSEM Index) having its worst move since Aug 1: we chalk up to: 1. Residual earnings related supply in NVDA as investors get back into their seats following the holiday week; 2. Negative seasonality or the group with Semis lower every Sept since 2020; 3. Reports out that OpenAI is developing new In Hou se AI chips; 4. Reshuffling of books ahead of a busier stretch of micro datapoints, with AVGO earnings Thurs / Citi’s TMT conf kicking off today / GS Tech & Communacopia conf next week (Jensen speaks next Wed). This isn’t going to help: *NVIDIA GETS DOJ SUBPOENA IN ESCALATING ANTITRUST INVESTIGATION.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!