Institutional Insights: Deutsche Bank - Investor Flows & Positioning 02/06/25

Stuck In The Middle

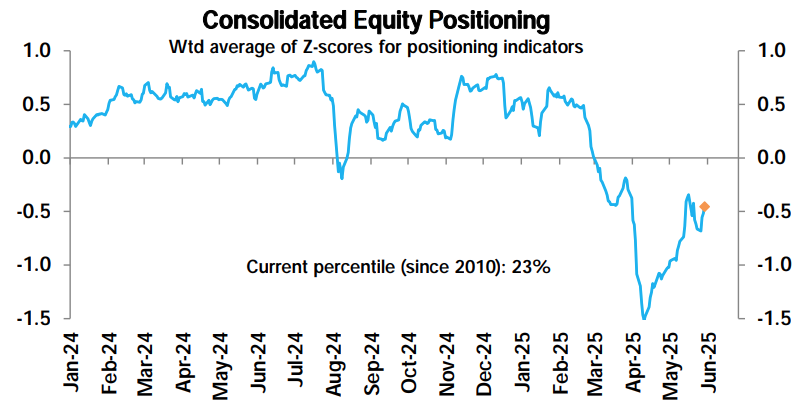

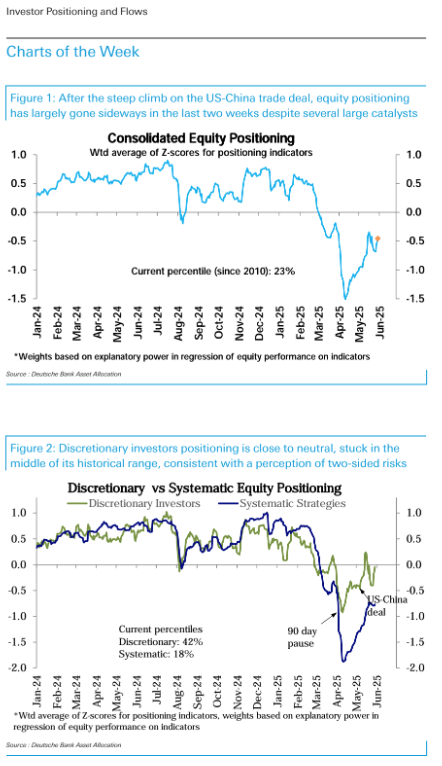

Following a significant climb tied to the US-China trade deal, equity positioning has largely plateaued and remains moderately underweight (z-score: -0.45, 23rd percentile). Discretionary investor positioning is near neutral, sitting in the middle of its historical range, reflecting a balanced view of two-sided risks (z-score: -0.04, 42nd percentile). Systematic strategies, however, continue to show a notable underweight (z-score: -0.77, 18th percentile).

This stagnation is striking, given the numerous market catalysts over the past two weeks: threats of tariffs on Apple, the proposed 50% tariffs on the EU and their subsequent delay, an unexpected court ruling against reciprocal tariffs, and renewed tensions with China. Despite these developments, the market has shown little reaction, with equity volatility and daily trading ranges remaining subdued, while bond market volatility has dropped to a two-month low.

Across sectors, positioning in Technology and cyclicals remains underweight. On the fund flows front, equity funds experienced their largest year-to-date outflows this week, totaling -$9.5 billion. This was driven by record outflows from Japan (-$11.8 billion) and continued outflows from the US (-$5.1 billion), partially offset by inflows into Europe ($1 billion) and Emerging Markets ($2 billion). Meanwhile, bond funds saw robust and broad-based inflows of $19.3 billion.

Positioning and Flows Details:

Our measure of aggregate equity positioning slightly increased after last week’s dip but remains moderately underweight (z score: -0.45, 23rd percentile). Discretionary investor positioning rose modestly to neutral (z score: -0.04, 42nd percentile), while systematic strategies positioning remained unchanged and significantly underweight (z score: -0.77, 18th percentile).

Discretionary Investor Positioning:

Total net call volume (call volume minus put volume) increased this week, driven by broad-based gains across all products, especially in single stocks. Within single stocks, net call volume dropped in defensives, MCG & Tech, and Financials but rose slightly in other sectors. S&P 500 skew (3m, 90%-110%) was volatile throughout the week, ultimately closing lower than the previous week.

Investor sentiment (bull minus bear spread) turned net bearish again this week (20th percentile), reversing the slight bullish sentiment seen last week. Bearish responses increased (85th percentile), while bullish responses declined to a three-week low (33rd percentile). Neutral responses remained largely unchanged (24th percentile).

Systematic Strategies Positioning:

- Volatility-Control Funds: Equity allocation declined this week (21st percentile). Sensitivity to further market selloffs remains low.

- CTAs: Aggregate equity longs increased this week (36th percentile) but remain below long-term median levels. There is a divergence between regions: longs in Europe (59th percentile) and EM (57th percentile) rose above their long-term medians, while US and Japan saw short positions increase. In the US, S&P 500 positions flipped to a net short, while shorts in the Russell 2000 remained flat. Nasdaq 100 longs climbed to their highest level since early March. Shorts in Japanese equities rose slightly (6th percentile). CTA bond positioning, which turned slightly short two weeks ago, declined further this week (36th percentile). In FX, short positions in the US dollar continued to rise (12th percentile). For commodities, oil shorts (8th percentile) and gold longs (65th percentile) remained mostly unchanged.

- Risk Parity Funds: Overall equity allocation has been steadily increasing from April lows (9th percentile) but remains in the bottom decile. Allocations to the US (7th percentile) and other developed markets (7th percentile) were unchanged, while EM allocations edged higher (28th percentile). Bond allocations rose (39th percentile), along with commodities (37th percentile) and inflation-linked notes (33rd percentile).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!