Institutional Insights: Bank of America EUR FX Views

Bank of America - EUR in a USD world

Key takeaways

• Trade uncertainty and monetary policy keep us cautious on EUR in the near term. We favour EUR-JPY and EUR-CAD downside.

• But we are also getting concerned EA bearishness is getting "stretched" and some positions vulnerable.

• Bearish outcomes can force bullish action. We see downside EUR risks from France but upside from German and EU-wide reforms.

Bearish EUR near term, but upside risks beyond it

Potentially higher trade uncertainty and relative monetary policy keep us cautious on EUR in the near term. But we are also getting concerned Euro area bearishness per se is getting “stretched”, and some positions could get squeezed. EUR-JPY lower remains our preferred bearish EUR expression. We also favour EUR-CAD downside, partly on our quant signals. France continues posing downside EUR risks, but we see mostly upside risks from a German fiscal policy rethink and EU-wide reforms. Too bearish Euro area outcomes could force much-needed, and potentially game-changing, action, we think. So, while we stay cautious for now, we think there is a limit to how far Euro area bearishness can go.

Bearish EUR near term on trade uncertainty and relative monetary policy

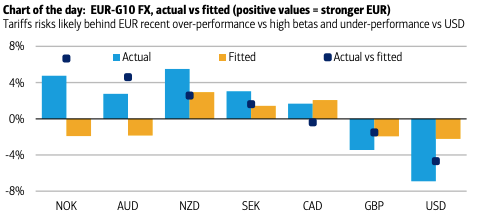

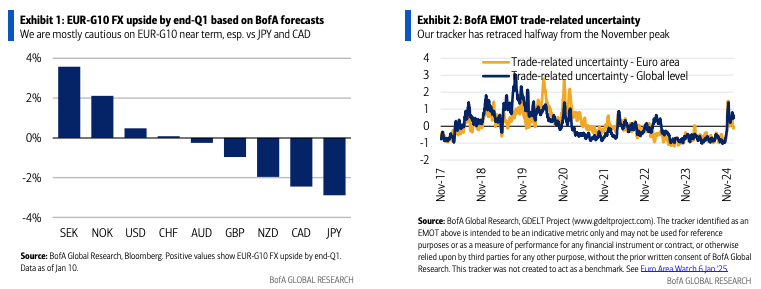

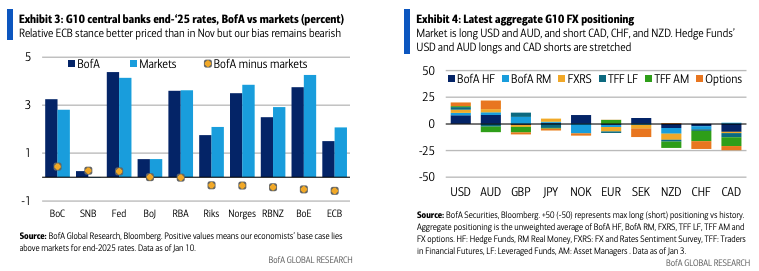

We stay cautious on EUR-G10 FX near term (Exhibit 1) on: (1) potentially higher trade uncertainty and worsened risk sentiment; and (2) relative monetary policy, especially after the solid December jobs report (see Federal Reserve Watch 10 Jan '25). We think trade uncertainty already explains a good part of the EUR-USD underperformance and EUR-“high beta G10” overperformance (see Chart of the day), at least based on typical macro drivers (monetary policy, risk sentiment, commodity prices). But our tracker suggests trade uncertainty has retraced from its November peak (Exhibit 2). Our economists did find the ECB pricing fair ahead of US Dec payrolls (see Euro Area Watch 6 Jan '25), but their bias remains bearish (Exhibit 3), more so in risk-adjusted terms and vs. the Fed.

EUR-JPY remains our preferred bearish EUR expression

• EUR-JPY remains our preferred bearish EUR expression. We remain short EUR-JPY via a ERKO put (strike: 158.75, down/out European barrier: 150, expiry May 23 2025, entry spot: 160.65, entry cost: 0.7425% EUR; current spot ref: 161.74, current cost: 0.67% EUR; risks to the trade are German fiscal stimulus and/or EA reforms, more hawkish ECB, or dovish BoJ – for our open and recently closed trades please see Global FX Weekly 10 Jan '25). On JPY, markets could start pricing in policy response should its weakness extend: 160 seems a key USD-JPY level to us (see Japan Watch 9 Jan '25).

• EUR-USD is slightly below our end-Q1 1.03 forecast. We see risks for more USD strength in the short term, on the Fed being done and on US tariffs after the inauguration (see also Global FX Weekly 10 Jan '25). But with the market short EURUSD (Exhibit 4) and Hedge Funds very short, we also see vulnerabilities unless/until Real Money clients step in (see USD Watch 6 Jan '25 and LCBF 7 Jan '25). We find USD’s relatively restrained reaction post-December payrolls suggestive (see US Watch 10 Jan '25).

• EUR-GBP: Our bias remains bearish. We are inclined to fade its recent move but prefer to wait for the market to turn short GBP from neutral (again Exhibit 4 and see also UK Viewpoint: The Great British Sell Off, 9 Jan '25).

•Antipodeans: EUR-AUD is around our end-Q1 forecast, but the long AUD positioning, esp. for Hedge Funds (Exhibit 4), and AUD’s greater reliance on CNY and China (see Global FX weekly 30 Aug '24) pose upside risks. By contrast, we see limited EUR-NZD upside, also given positioning (see World at a Glance 7 Jan '25).

• EUR-CAD: Our quant signals suggest downside near term risks (see FX Vol Insight 10 Jan '25), and so do positioning (Exhibit 4) and relative monetary policy (Exhibit 3), also given the strong Canadian labour market data (Canada Watch 10 Jan '25). • EUR-CHF: We maintain a bearish CHF bias incl. vs EUR, but for now we prefer to express it vs USD (see FX Vol Insight 10 Jan '25 and CHF Watch 7 Jan '25).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!