Gold Bulls Hope For FOMC Fireworks

Gold Near Highs

Gold prices are on watch this week as traders look ahead to the all-important September FOMC meeting on Wednesday. Recent labour market weakness has fuelled a heavy dovish shift in market expectations with traders now looking for three cuts this year, beginning on Wednesday. Last week’s inflation data failed to derail this view, while confirming a fresh uptick in inflation last month.

Fed Expectations

As such, traders will now be looking for the Fed to endorse this dovishness with a cut on Wednesday and a clear signal that further easing is coming. If Powell delivers on this expectation, USD should move lower allowing room for gold to continue higher near-term. However, if the Fed is seen taking a more neutral tone, perhaps focusing on lingering inflation risks, this will likely dilute easing expectations over the remainder of the year and could see gold correcting lower as USD squeezes higher.

Safe-Haven Demand

Alongside the Fed and USD rate expectations, gold prices are also being underpinned by continued safe-haven support linked to elevated global geopolitical tensions. Ongoing conflict between Russia and Ukraine as well as recent events where Russia threatened ANTO airspace in Poland mean that safe-haven demand for gold remains strong. Additionally, Israel’s continued war against Gaza and recent attacks against Hamas in Qatar are also adding to a sense of global unease. While this backdrop remains, gold prices look likely to continue higher while safe-haven demand remains firm.

Technical Views

Gold

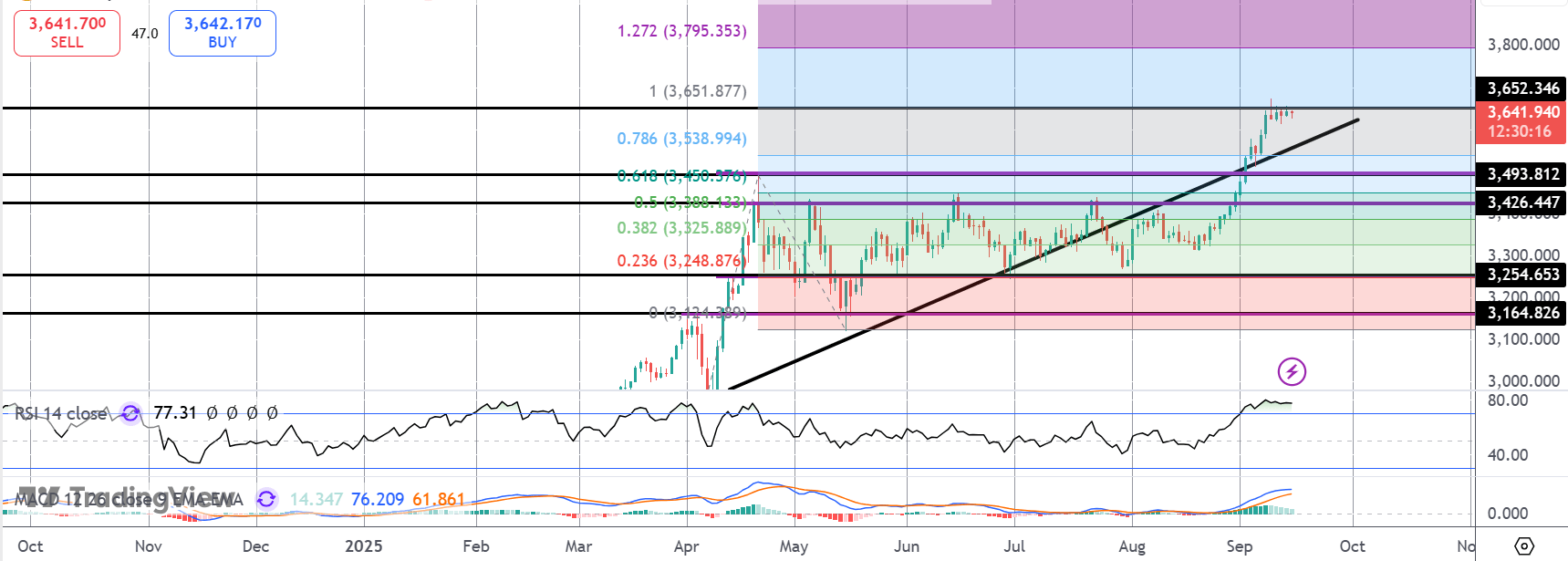

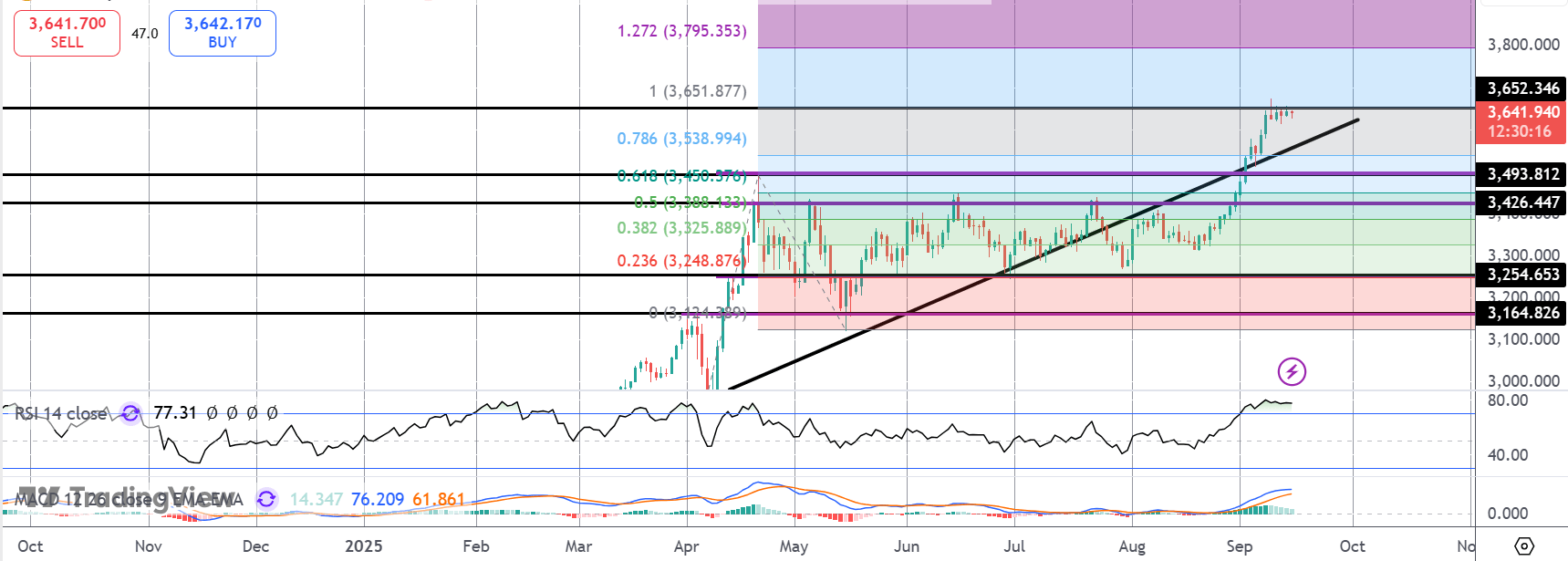

For now, gold prices remain hemmed in by the 1:1 Fib extension level at 3,652.34. Momentum studies are cooling here reflecting the pause. However, while price holds above the 3,493.81 level, focus is on a fresh push higher with the 3,800 level the next bull objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.