EURUSD Breakdown Risks Ahead of ECB

EUR Under Pressure

EURUSD is heading lower ahead of the April ECB meeting this afternoon. The bank is widely expected to give a strong signal that rate cuts are coming, starting in June. Pricing for a cut in June is currently sitting above 80% so if the bank fails to give a strong easing signal, this could see some weakening in that price, leading EUR higher.

June Easing Signal Expected

The base case scenario today, however, is for firmly dovish forward guidance from the ECB which should keep EUR pressured through into next week. Inflation has been falling steadily in the eurozone and ECB commentary at the last meeting and since has remained on the dovish side.

ECB & Fed

Indeed, the case for EURUSD shorts is particularly strong on the back of yesterday’s US inflation data. With inflation seen rising above forecasts for a third consecutive month, traders have quickly scaled back their easing expectations for June with a Fed rate cut now priced in by September. Against this backdrop, if the ECB does succeed in signalling a June cut today this should see EURUSD heading sharply lower. The only caveat here is that if the ECB senses some delay in Fed easing coming, they might look to delay their own easing timeline. If we see any commentary on this issue this could keep EUR underpinned for now.

Technical Views

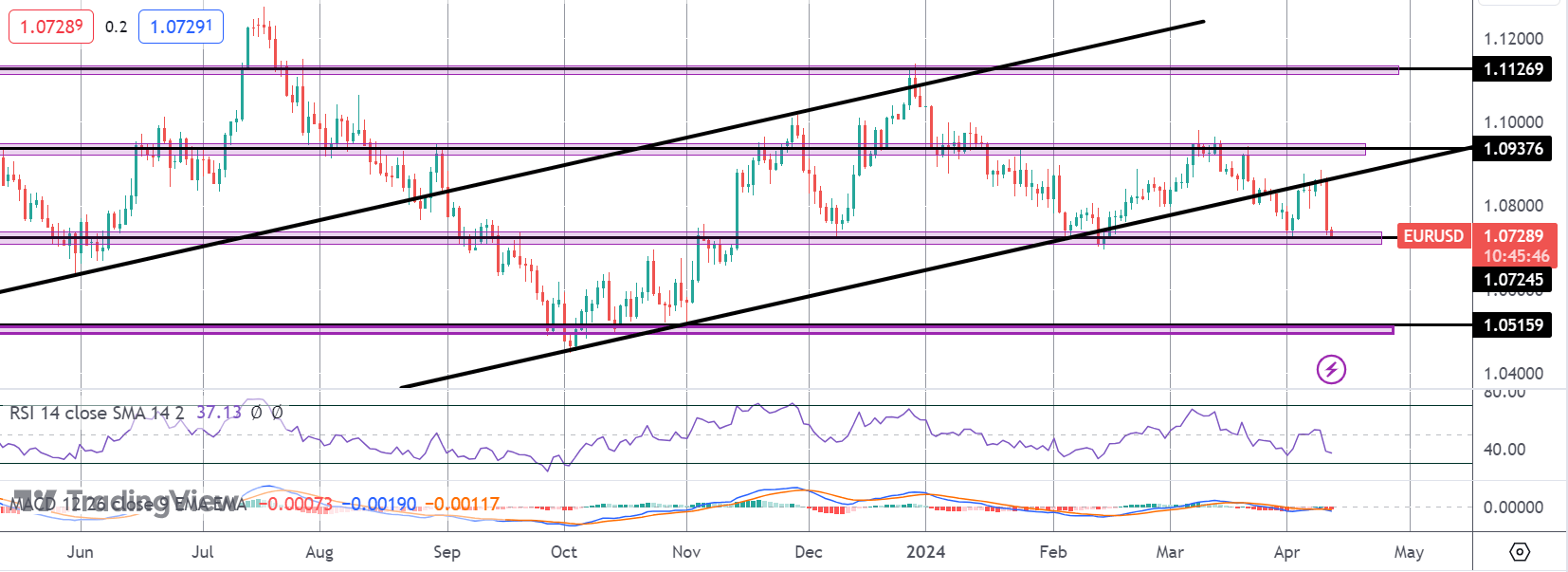

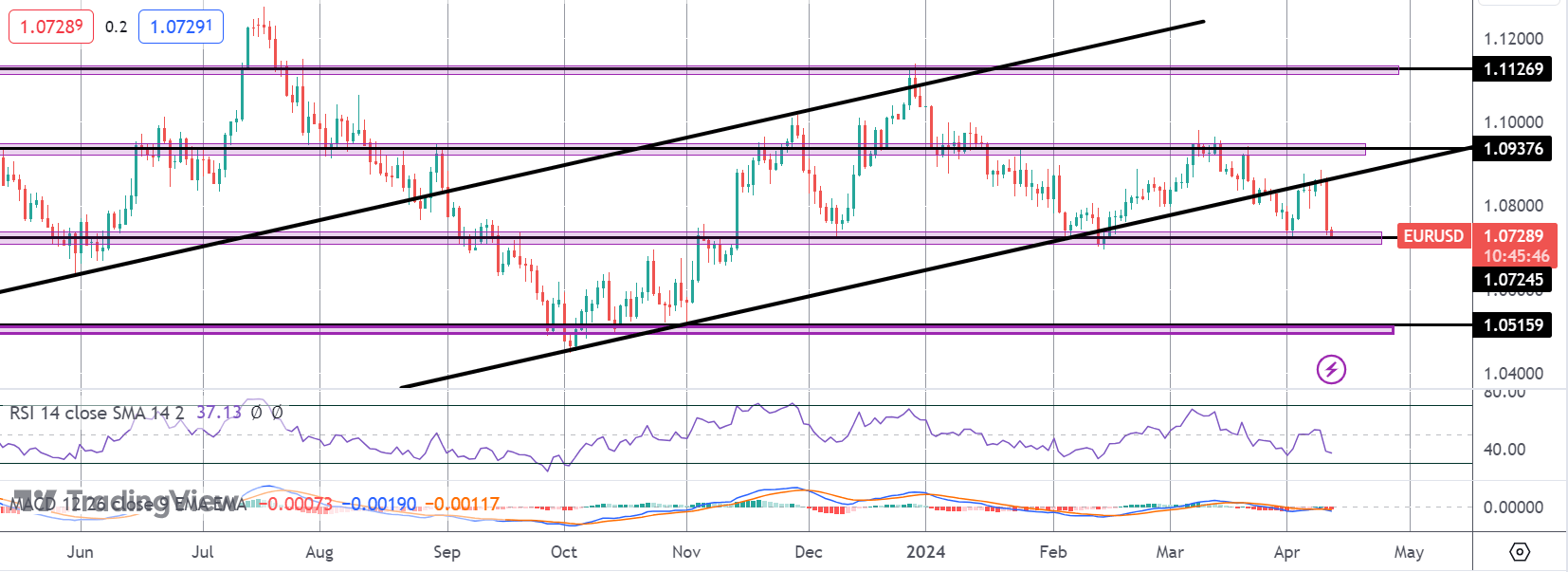

EURUSD

The failure at the retest of the broken bull channel lows has seen the market turning back down towards the 1.0724 level. This is a major support area for the pair and a break here will be firmly bearish, turning focus to a test of 1.0515 next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.