Dollar Rises on Hawkish Fed Comments

Waller Backs Pause in Easing

The US Dollar is trading in the green so far today with the DXY bid on the back of hawkish comments from some Fed policymakers yesterday. Fed’s Waller voiced his support for pausing rate cuts on the back of disappointing inflation data last week, though said the Fed could likely resume cutting later this year if the current inflationary spike fades.

Data Accuracy Concerns

Notably, however, Waller did express some concern around the accuracy of the data pointing to a trend over recent years for higher readings at the start of the year which could be a result of ‘residual seasonality’ in the data not being fully adjusted for. Fed’s Harker also shared this concern speaking yesterday, pointing to an upside surprise in 9 of the last 10 January CPI readings.

FOMC Minutes

Looking ahead this week, traders will be watching tomorrow’s FOMC minutes for further insight into the Fed’s current view. Given the hot inflation reading we’ve had since that meeting, there is a chance that some of the comments might have lost relevancy. However, any discussions related to pausing easing given the return of inflation risks are likely to have a bigger impact on the market in light of that data meaning that USD risks appear skewed to the upside tomorrow.

Technical Views

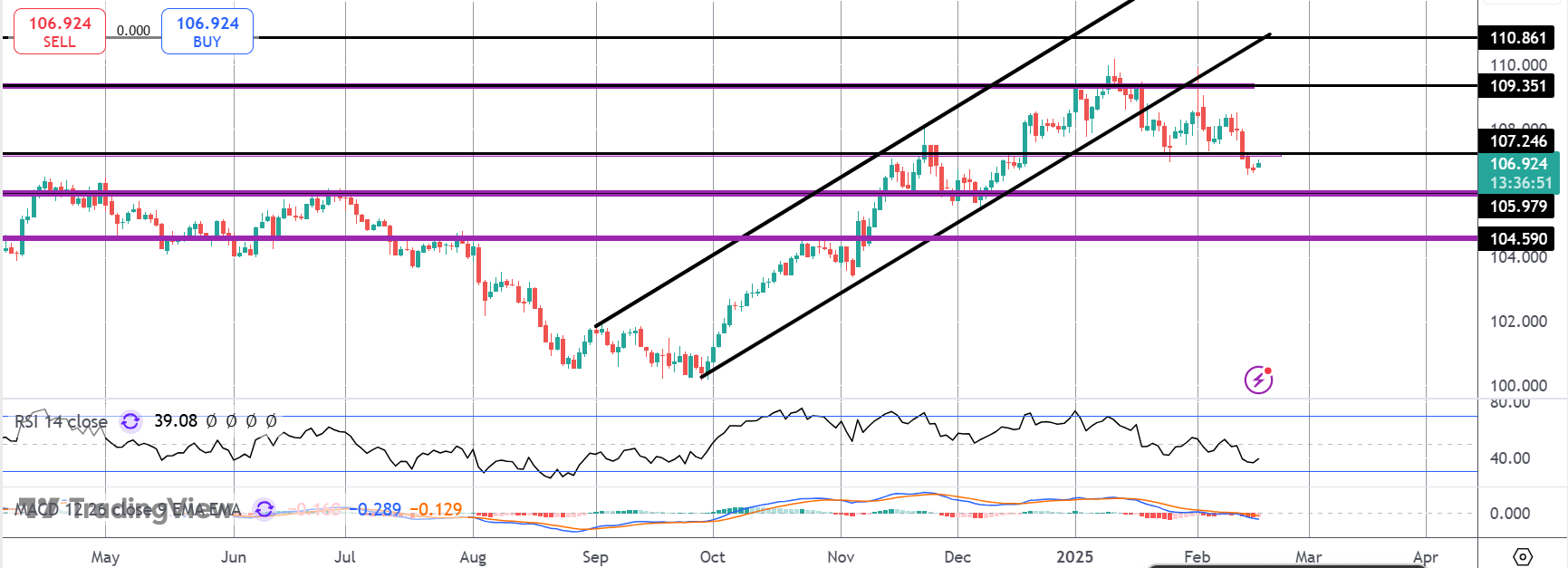

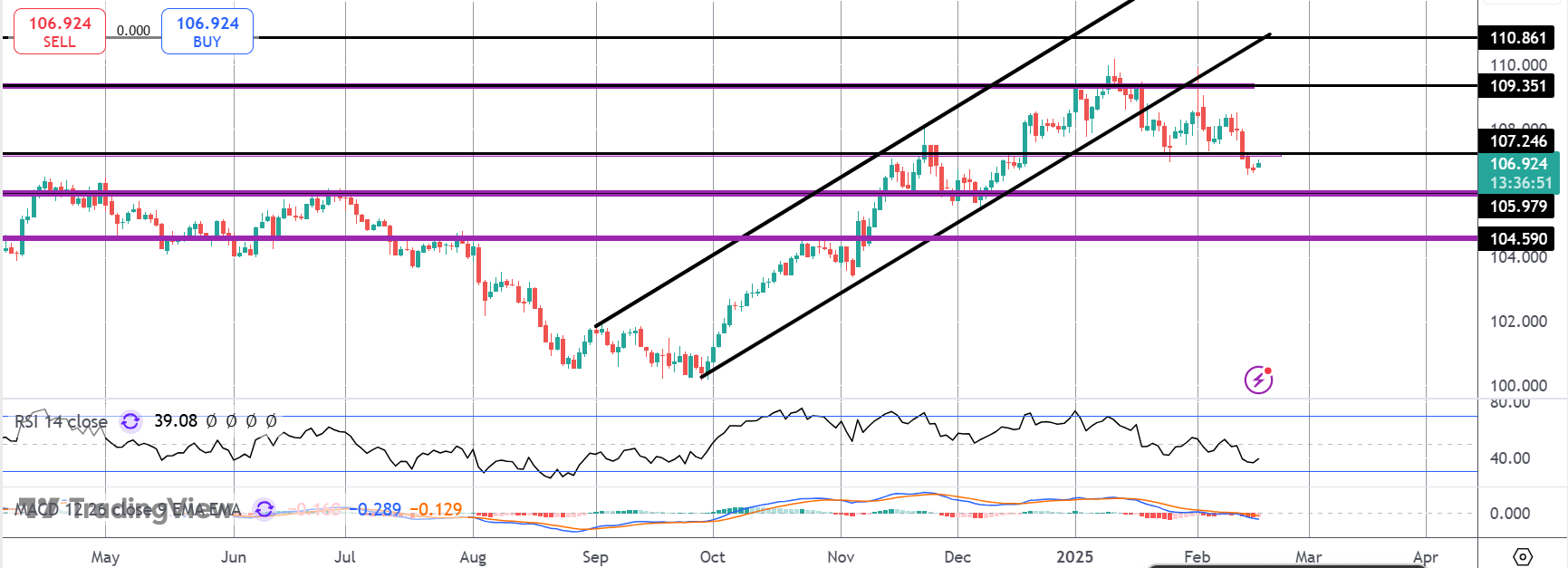

DXY

For now, the Dollar remains below the 107.24 level and with momentum studies bearish, focus is on a continued push lower while the level holds as resistance. 105.97 and 104.59 will be the next supports to watch. Back above 107.24, focus turns to 109.35 as the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.