Dollar Rallying on Hawkish Trump Trade News

Dollar Bouncing Back

The US Dollar has turned sharply higher through the back end of the week as traders respond to Trump’s bullish tariff plans. The president confirmed that he will next week action the currently delayed Mexico and Canada tariffs at 25% with an additional 10% levy on Chinese imports. The news has seen an influx of buying for USD as traders anticipate hawkish implications for US inflation, delaying expected Fed easing over coming months. Indeed, with Trump also floating the potential for a 25% reciprocal tariff on eurozone imports, the President’s more hostile tone on trade this week looks likely to fuel a further push higher in USD as safe-haven flows divert away from other assets such as gold and JPY and back into USD.

Near-Term Risks

Trump’s tariff plans are driving USD buying at a time when the Dollar had previously been weakened by recent US data disappointment. A drop in consumer confidence and higher-than-forecast weekly jobless numbers. The data had seen near-term rate-cut expectations creeping higher again, weighing on USD. However, with tariff news now taking centre stage, USD looks likely to continue higher here unless we see a shock last minute U-turn from Trump, which cannot be ruled out. If such a U-turn were to happen, USD would quickly unwind next week, fuelling a sharp recovery in risk assets.

Technical Views

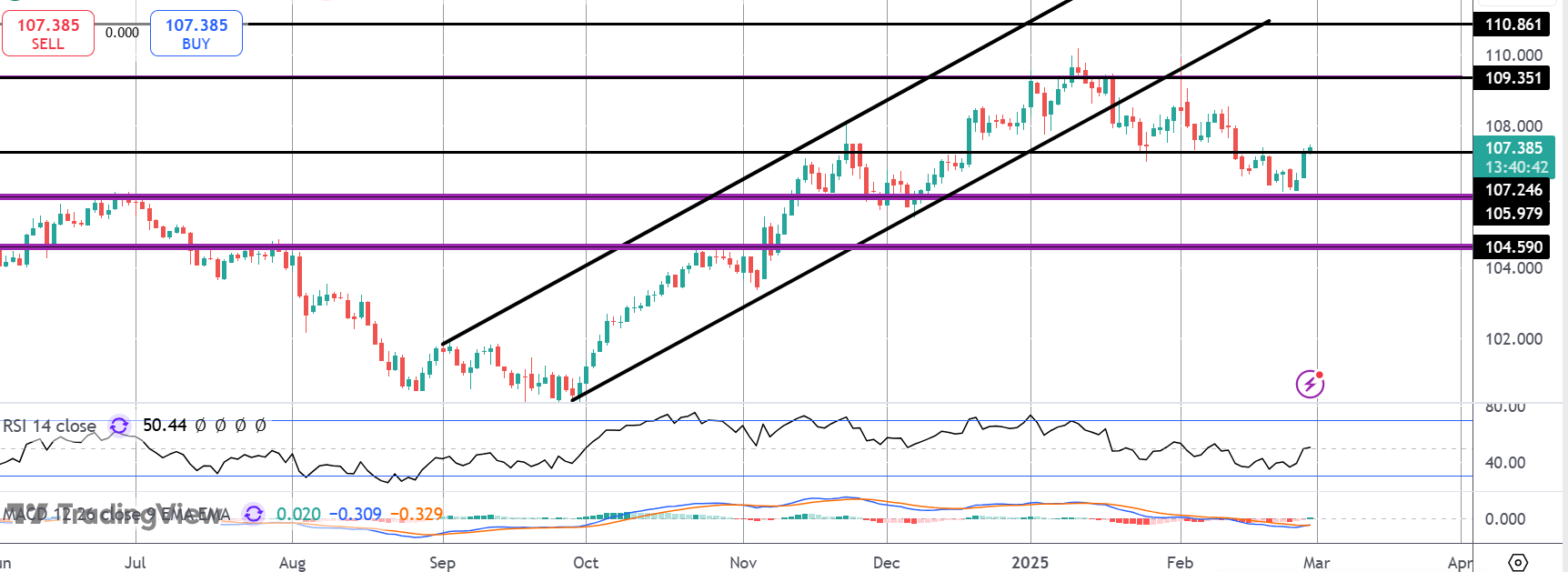

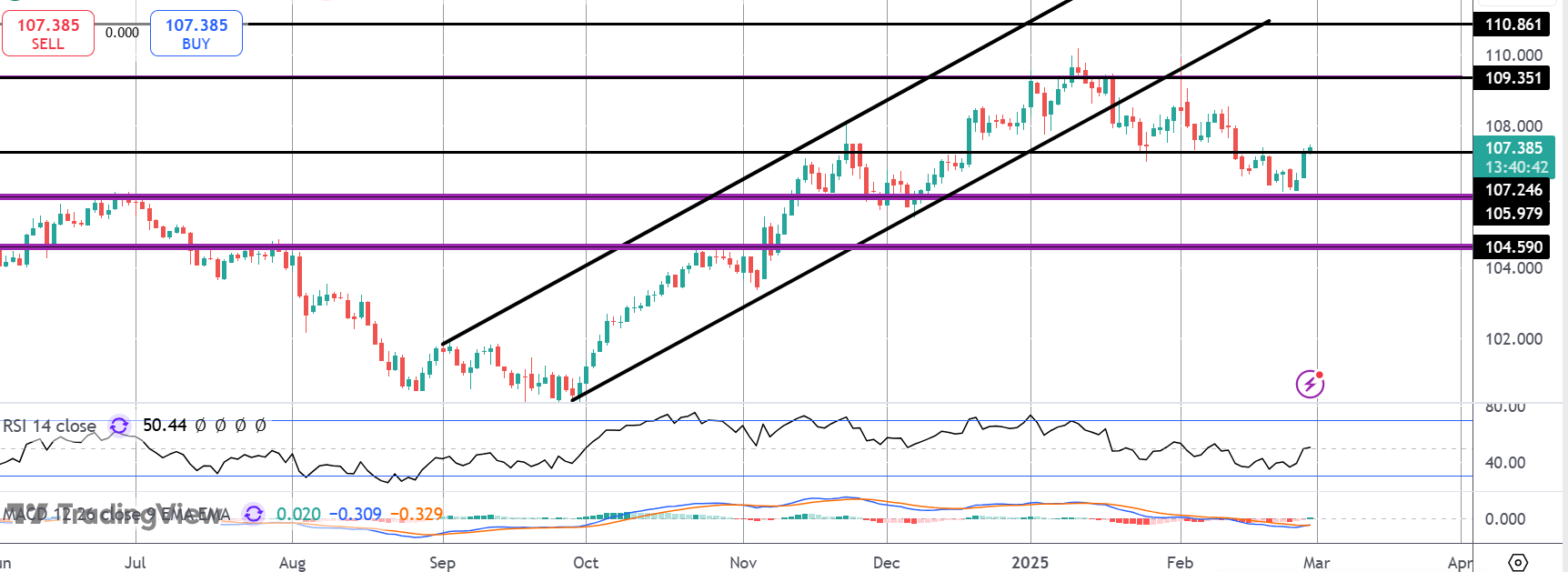

DXY

The sell off in the US Dollar has stalled for now with the index now trading back above 107.24. Whie current lows at 105.97 hold, focus is on a recovery towards thew 109.35 level next, in line with momentum studies which are turning increasingly bullish here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.