Dollar Gains Ground Amid Surprising Nonfarm Payrolls Spike

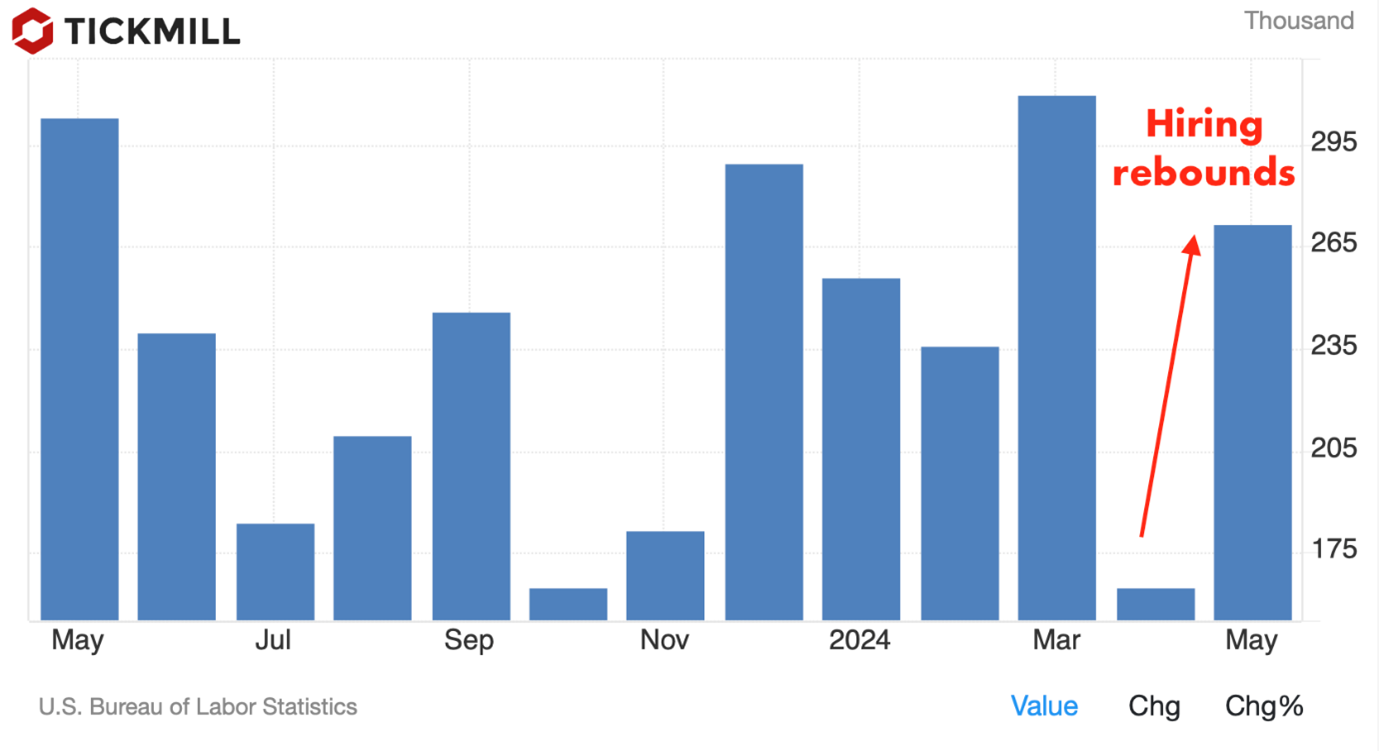

In a surprising turn of events, the US Dollar surged today, fueled by an unexpected leap in the Nonfarm Payrolls report. Employers added 272K jobs in May, significantly outpacing the highest forecast of 258K and shattering the consensus estimate of 185K. This development throws a wrench into the growing speculation of a September rate cut by the US Federal Reserve.

Following the robust Nonfarm Payrolls report, EUR/USD experienced significant bearish pressure, threatening key short-term support. The pair is currently hovering near the 1.0800 mark, a crucial level bolstered by both the lower trendline of the descending channel and the 200-day moving average. A sustained break below this support could pave the way for further declines, with the next target around 1.0723. The increased wage growth and rising unemployment rate create a dilemma for the Fed, but the strong job data diminishes prospects for near-term rate cuts, providing additional support for the USD:

Not all metrics paint a rosy picture, though. The Unemployment Rate edged up to 4.0%, contrary to expectations of it remaining steady at 3.9%. Moreover, wage growth accelerated, with Average Hourly Earnings climbing to 4.0% year-over-year, up from a revised 3.9%. On a monthly basis, wages grew by 0.4%, surpassing the anticipated 0.3%. This uptick in wages underscores persistent inflationary pressures, complicating the Fed's decision-making process.

Recent labor market indicators had hinted at cooling conditions, bolstering hopes for a rate cut. The JOLTS Job Openings data for April and ADP Employment Change for May both fell short of expectations, and Initial Jobless Claims rose more than anticipated for the week ending May 31. These signs of a weakening labor market had initially spurred bets on a September rate cut, as reflected by the CME FedWatch tool, which showed a 68% probability of a cut prior to the Nonfarm Payrolls release. Post-report, this probability has dropped to 54%.

Across the pond, the British Pound's trajectory will hinge on the upcoming Employment data for the February-April period, set to be released on Tuesday. The UK's employment figures have declined for three consecutive months, and further layoffs could amplify calls for an early rate cut by the Bank of England (BoE).

Investors are also keenly watching the UK Average Earnings data, a critical indicator of wage growth. Strong wage growth in the UK has been a key driver of high service inflation, thwarting efforts to bring price pressures back towards the BoE's 2% target.

A similar story unfolds in the near-term technical picture of GBPUSD: the buy side of the market apparently cancelled plans to push through a major medium-term resistance level, and the dip following NFP data now challenges the lower bound of the medium-term ascending channel with a break lower potentially shifting the narrative to a bearish one:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.