Dollar escapes key bearish corridor as Powell speech in Jackson Hole looms

US bond rates retreated from their highs on Wednesday after the BLS revised the annual job growth in the United States downward by 306K, which was lower than some experts had expected, with forecasts anticipating a decrease of 500K. The bond market's reaction, characterized by a roughly 10 basis point drop in yields across all maturities, appeared excessive. However, it once again underscored that job growth in the United States is currently one of the most crucial macroeconomic variables for the Federal Reserve's policy. Even in a scenario where consumer inflation trends have turned, if the labor market remains robust and consumer spending continues to grow at a solid pace, the movement of inflation toward the target level of 2% may be prolonged.

For this reason, the market today proved to be sensitive to unemployment claims data. Initial claims grew at a slower pace than expected (230,000 compared to a forecast of 240,000), and long-term claims also exceeded expectations positively. This allowed the dollar to retest a key medium-term resistance line:

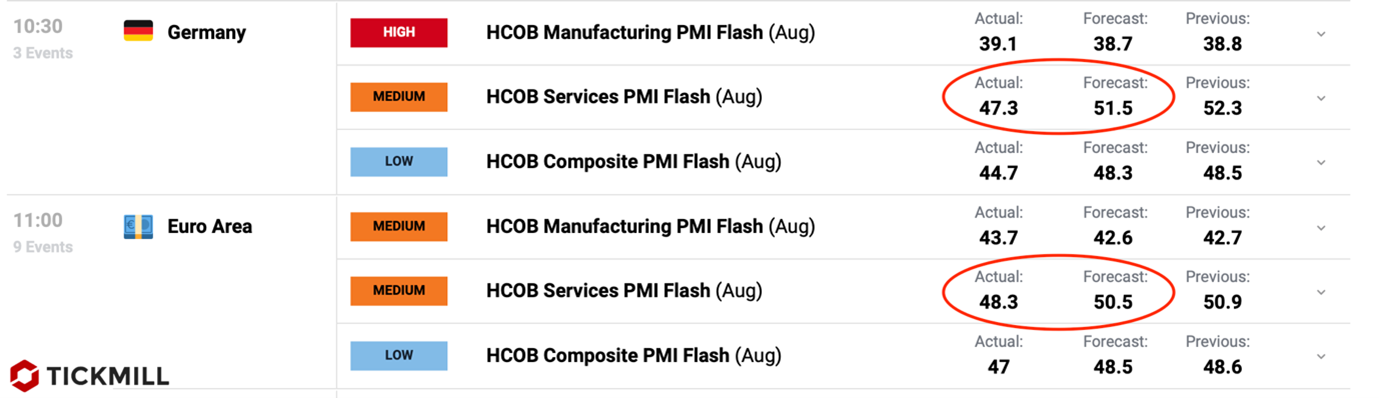

The fundamental backdrop for the euro worsened somewhat after the release of PMI indices for the service sector yesterday. The data showed that activity in the service sector in the key economy of the eurozone and in the EU as a whole contracted compared to the previous month:

The euro's trade-weighted exchange rate fell by 0.5%, and the two-year EURUSD swap rate (which reflects the expected interest rate differential between the US and the EU) increased by 10 basis points to 145 bps. This is the highest level since March and clearly has negative implications for EURUSD. The pair tested the 200-day moving average yesterday, and if it weren't for the negative revision in the pace of US job growth, we would likely have seen a test of the 1.08 level for the pair. It's evident that after the release of leading economic activity data in the Eurozone, market confidence in another rate hike from the European Central Bank has diminished, which cannot be said for the Fed. Therefore, risks for the pair are certainly tilted towards further decline, as indicated by the dollar index breaking out of the bearish channel, signaling strong overall dollar positions.

Tomorrow, the markets await Powell's speech at the Jackson Hole symposium, where it is expected that the head of the central bank will provide insight into whether the recent surge in Treasury yields was justified. It's clear that since long-term yields, which reflect expectations of duration not level of high interest rates, rose faster than short-term yields, the market will be satisfied with statements indicating that rate cuts should not be expected anytime soon. However, if hints are given that the Fed expects inflation to return to the target level by the end of next year and that rate cuts can be expected at that time, the retreat in long-term bond yields could be significant.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.