Dollar Dips Again Following PPI Spike

US Data Impact

The US Dollar is on watch today as traders brace for more US data with retail sales and UoM data due. Yesterday an unexpected jump in US PPI fuelled an uptick in USD as traders scaled back their Fed easing expectations slightly. While a cut next month is still virtually priced in (95%), expectations for further cut ahead of year end have cooled a touch If we see any further data strength, this is likely to further dampen those forecasts creating support for USD. On the other hand, any fresh data weakness should reinforce dovish expectations, putting pressure on USD.

Trump-Putin Meeting in Focus

Away from US data, traders will today also be watching for updates from the first meeting between Trump and Putin, taking place in Alaska. While expectations for any sort of agreement today aren’t particularly higher, traders will be looking for signs of progress. If talks go well and the road to a Russia-Ukraine peace deal looks clearer, this should lift global risk sentiment with USD likely to weaken in this scenario. However, if talks stumble and fail and traders sense that a peace deal is unlikely near-term, this could cause a squeeze higher in USD as traders scale back their riskier positions and return to safety. As such, there is plenty of volatility risk into today’s meeting.

Technical Views

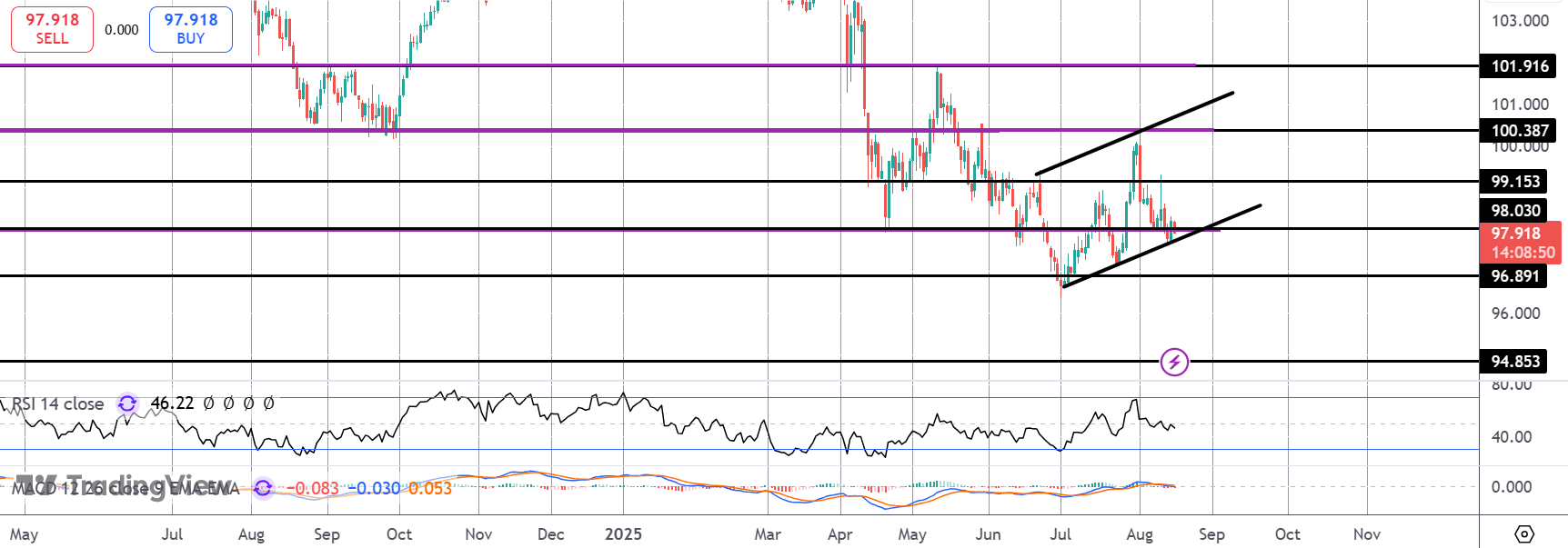

DXY

For now, DXY remains within the corrective bull channel off YTD lows, sitting atop the 98 level support. With momentum studies weak, however, risks of a downside break are seen with 96.89 the next support to watch around the YTD lows. The bear view only change son a break back above the 99.15 level which capped the rally last week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.