Daily Market Outlook, January 24, 2023

.png)

Daily Market Outlook, January 24, 2023

Tech Rally on Wall Street Sees Nikkei Back Above 27K

The Nikkei (the only major Asian market open during the lunar holiday week) managed to shake off a third successive monthly decline in manufacturing data to reclaim the pivotal 27k level, as markets were buoyed by another impressive led Tech rally, Tesla gaining nearly 8% on the day, as the Tech heavy Nasdaq100 was up over 2% trading above 11800. European bourses are set to follow suit with futures suggesting a positive open.

In the UK data out this morning confirmed a year over year doubling in the public purse borrowing rising to £26.6Bln in December, however, it is thought that the 12 month deficit may still come in below forecasts, January;s data will be a key input to the final outcome as the January figure will contain HMRC tax revenues for the year. Datawise focus is on PMI releases, with both the manufacturing services data expected to remain in contractionary territory, printing below the pivotal 50 level, there is a chance that the services data may offer some modest growth driven by seasonal and world cup spending. The FTSE is currently the only European market currently trading in the red, driven by AstraZeneca and Glencore declines.

In the Eurozone PMI data is also expected to see meagre gains on the services side of the ledger vehicle manufacturing is thought to lag remaining sub 50 suggesting contraction in the sector continues, however, regional data just released by France saw a surprise gain in the manufacturing sector, printing 50.6. ECB Chief Lagarde is due to speak again today. With the BoE and FOMC moving into their respective black out periods, given the proximity of their policy announcements) Lagarde is expected to once again reiterate her hawkish stance.

The US data slate is also dominated by PMI data due later today, with both readings believed to remain in contractionary territory, key for US investors will be whether next weeks ISM data confirms the PMI prints as the ISM releases tend to be tracked more closely by US investors

Markets-wise, in the UK BHP have signed a partnership deal with Munduro Capital to assess the feasibility of copper mining in Serbia. The National Grid are offering discounts to customers who agree to use less electricity during peak consumption hours as a means to avoid black out periods during excessive consumption periods. After the close of US trading today tech stalwart Microsoft is set to announce earnings, given the recent rise in MSFT share price and the broader gains in the tech sector, investors will be looking for decent forward guidance to maintain the rally, any meaningful downgrades on outlook would see investors paring risk appetite ahead of Tesla earnings due tomorrow.

Overnight News of Note

Asian Shares Climb In The Wake Of Tech-Stock Fuelled Gains

Bank Of Japan Eases Bond Market Strains With Loans To Banks

Japan's Factory Activity Extends Declines For Third Straight Month

Australian Business Conditions Fall For A Third Straight Month

President Biden Set To Hammer GOP National Sales Tax

ECB Policymakers Spar On Rate Outlook Beyond Feb Hike

Dollar In Doldrums As Euro Near 9-Month Peak, Yen Bounces

Oil Steadies As Traders Look To China To Deliver Demand Boost

US Weighs Cancellation Of Next SPR Sale – Energy Intel

Asian Shares Climb In The Wake Of Tech-Stock Fuelled Gains

DOJ Poised To Sue Google Over Digital Ad Market Dominance

EU Lawmakers To Vote On Tighter Crypto, ESG Rules For Banks

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Options Expiration For the New York Cut 10am EST

(BOLD expiries with a value of a Billion+more magnetic if price is within the daily trading range)

USDJPY 131.00

AUDUSD 0.7000

USDCAD 1.3450

Technical & Trade Views

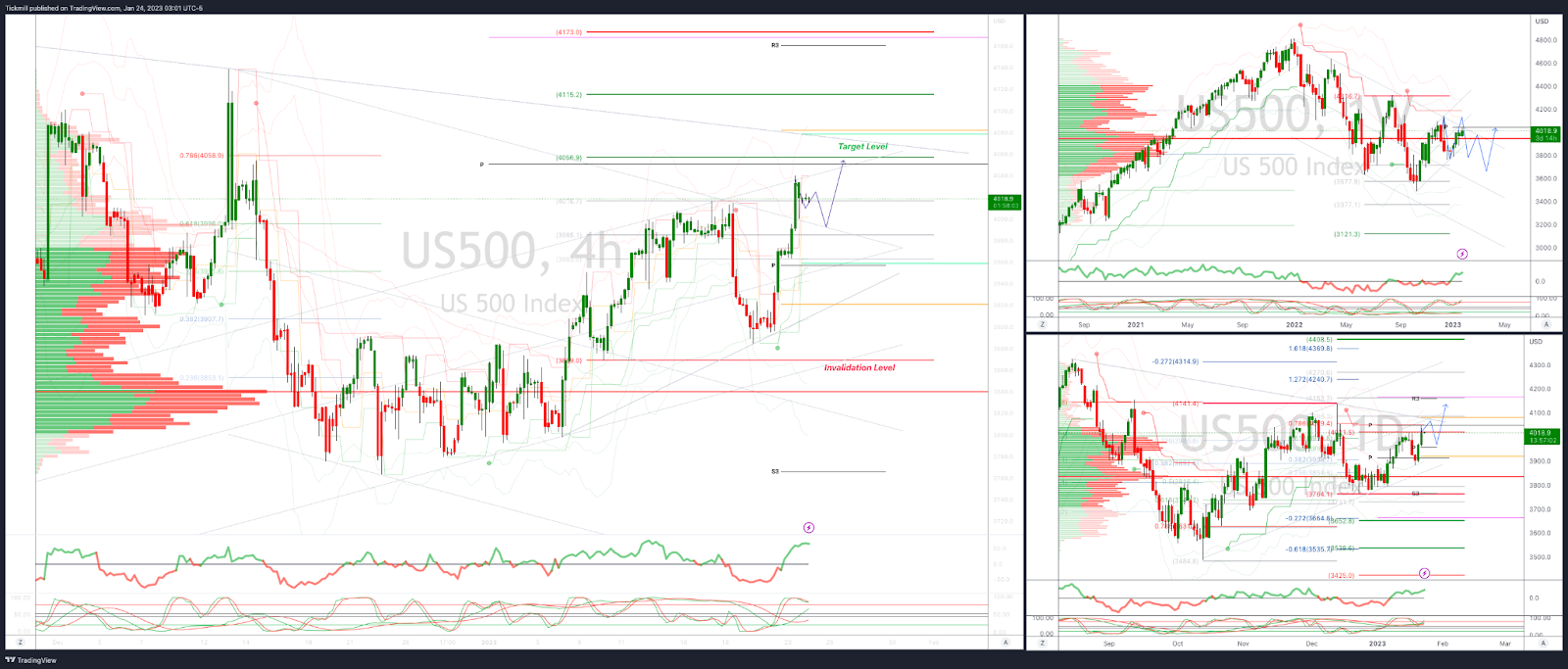

SP500 Bias: Intraday Bullish Above Bearish Below 3995

Primary support is 3869

Primary objective is 4055

Below 3840 opens 3800

20 Day VWAP bullish, 5 Day VWAP bullish

EURUSD Bias: Intraday Bullish Above Bearish below 1.0835

Primary support is 1.0750

Primary objective is 1.10

Below 1.0730 opens 1.0610

20 Day VWAP bullish, 5 Day VWAP bullish

-1674551661.png)

GBPUSD Bias: Intraday Bullish Above Bearish below 1.2320

Primary support is 1.2250

Primary objective 1.2460

Below 1.2240 opens 1.2185

20 Day VWAP bullish, 5 Day VWAP bullish

.png)

USDJPY Bias: Intraday Bullish above Bearish Below 131.50

Primary resistance is 132.30

Primary objective is 125.00

Above 133.00 opens 135.00

20 Day VWAP bearish, 5 Day VWAP bullish

.png)

AUDUSD Bias: Intraday Bullish Above Bearish below .7060

Primary resistance is .7060

Primary objective is .6939

Above .7060 opens .7110

20 Day VWAP bullish, 5 Day VWAP bullish

.png)

BTCUSD Bias: Bullish Above Bearish below 22300

Primary support 21600

Primary objective is 23700

Below 21500 opens 20700

20 Day VWAP bullish, 5 Day VWAP bullish

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!