Crude Rallies on US/China Trade Optimism

Crude Rallying on Friday

Crude prices are rallying ahead of the weekend with the futures market now up around 10% on the week. The move comes amidst an improved risk atmosphere on the back of the US/UK trade deal announced yesterday and with US/China trade talks due this weekend. The prospect of a scaling back of US/China tariffs is a major bullish catalyst for risk assets. If talks go well this weekend and it looks as though the two sides are on course to make a deal, crude prices look poised to rally further next week.

OPEC+ & Demand Forecasts

The rally in crude comes despite OPEC+ recently hiking oil output for a second consecutive month. Indeed, news that Kazakstan confirmed it has no plans to reduce oil output this month suggests that OPEC+ could well hike output again. These output increases come at a time when demand forecasts are being called into question. Goldman Sachs and other major names recently cut their 2025 demand forecasts as a result of the ongoing US trade war.

US/China Trade Talks

Despite these factors, however, the reaction in crude prices this week shows that the US/China trade story remains the key factor. If we see positive headlines on the back of these upcoming talks, risk sentiment will continue to improve and crude prices will move higher. However, if talks falter, crude prices are vulnerable to a sharp reversal lower, particularly in light of these other bearish elements the market is currently ignoring.

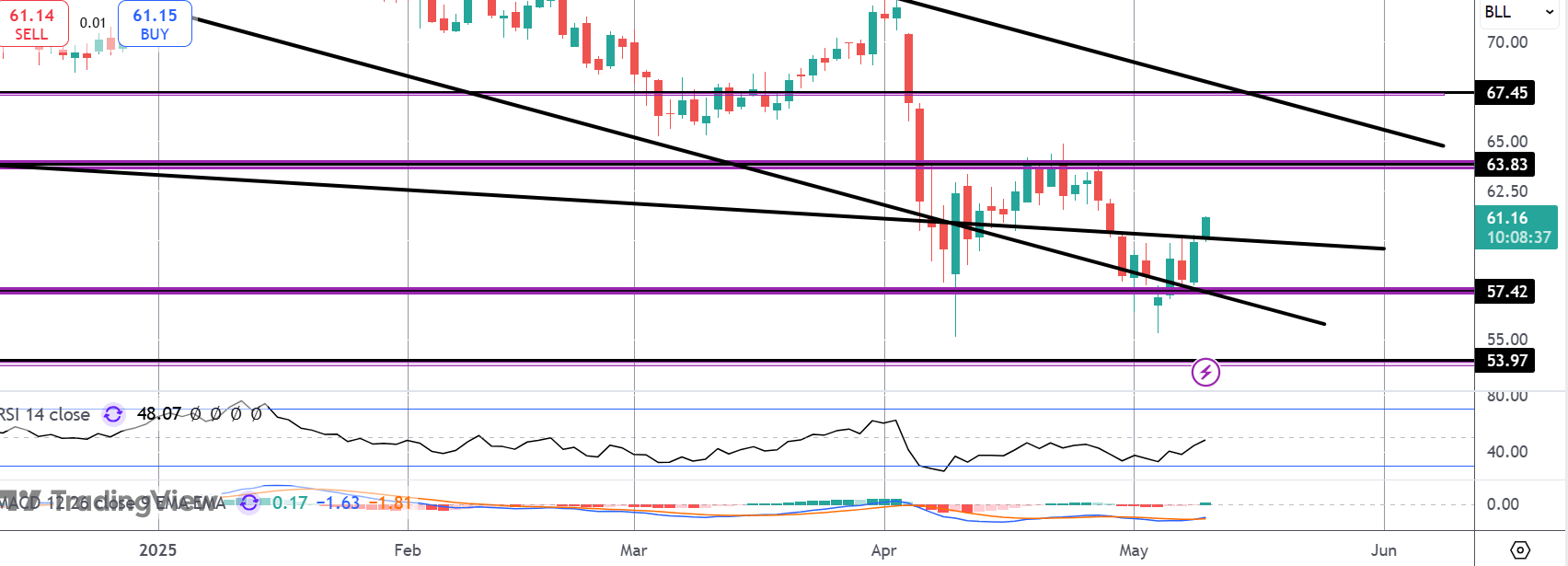

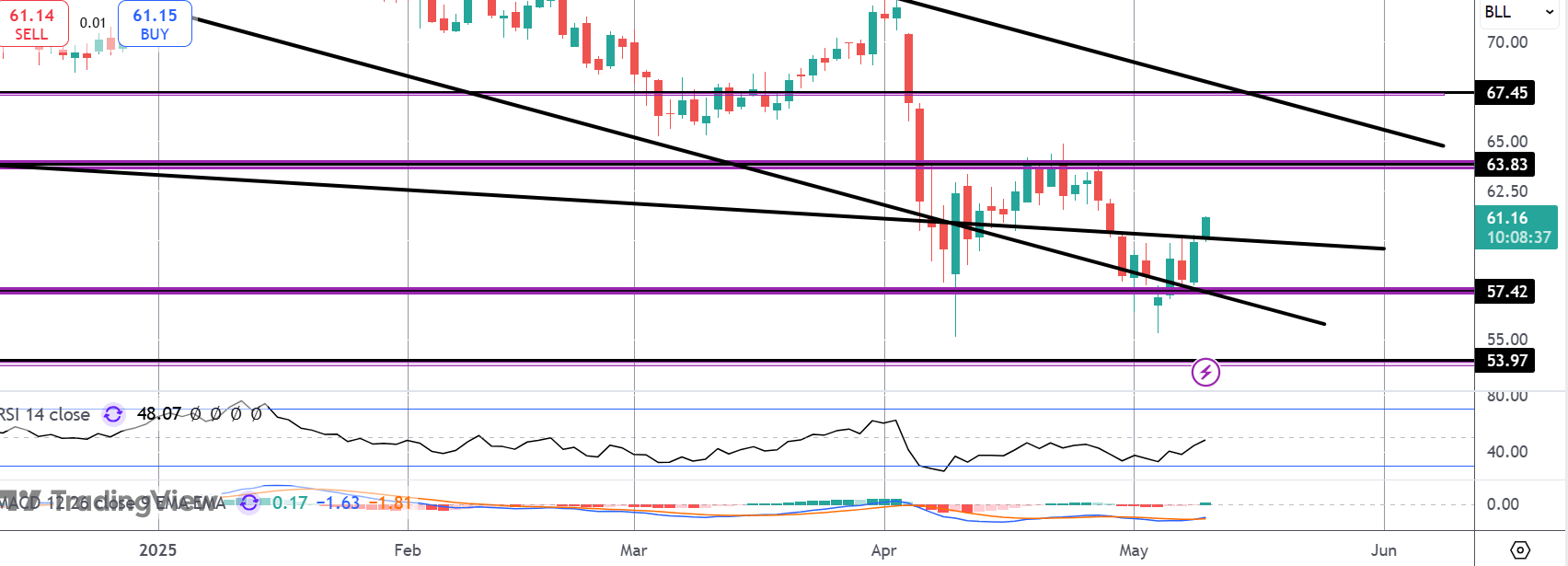

Technical Views

Crude

The rally in crude has seen the market breaking back above the bear channel lows with price now fast approaching a test of the 63.83 level. With the bear channel highs siting just above there, this will be a key challenge for bulls and a break above signals the room for a much fuller correction. While price holds below 63.83, however, risks of a fresh move lower are seen.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.