Crude Breaks Support Following OPEC+ Meeting

Crude Breaks Lower

Crude oil prices remain under pressure on Tuesday with the futures market now trading below the 72.61 level. Tit-for-tat trade tariffs between the US and China have rocked sentiment across risk markets this week with crude in particular coming under pressure following news that China will now add additional taxes to US crude imports. While the overall level of China’s US crude imports isn’t substantial enough to have a significant impact on price, the retaliatory move has been viewed as evidence of the risk of a further escalation in the trade standoff.

China Demand Concerns

With China’s economy only recently showing signs of improvement following a wave of fiscal and monetary stimulus measures, the concern is that a trade war with the US will undermine the recovery, diluting the oil demand outlook there. Any further escalation in the trade war between the two is likely to see oil prices continue lower near-term.

OPEC+ in Focus

Alongside news of the burgeoning US/China trade war, oil prices remain pressured this week following the OPEC+ meeting yesterday which saw producers agreeing to continue with gradually raising output levels. The decision comes on the back of Trump calling for the cartel and its allies to help bring down oil prices, despite clashes between the two during Trump’s last spell in the White House. However, OPEC+ did note that it will no longer be using EIA data in its monitoring and analysis of crude production levels though said the decision was not political.

Technical Views

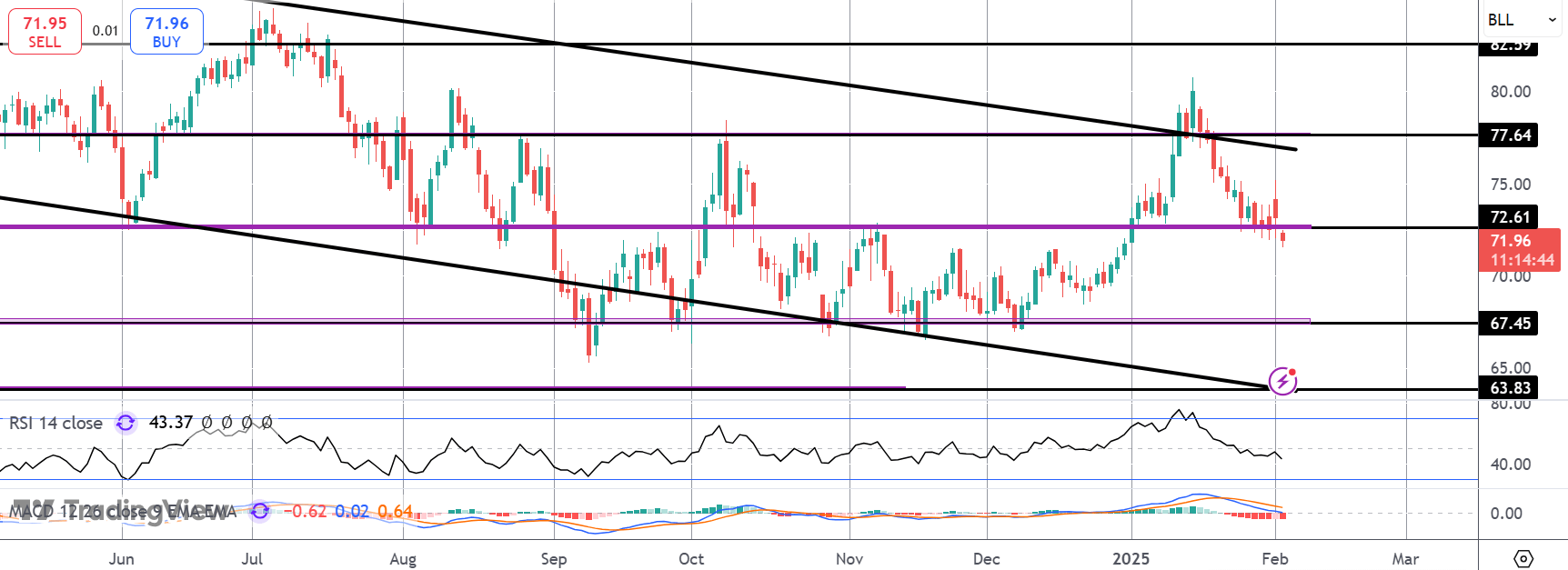

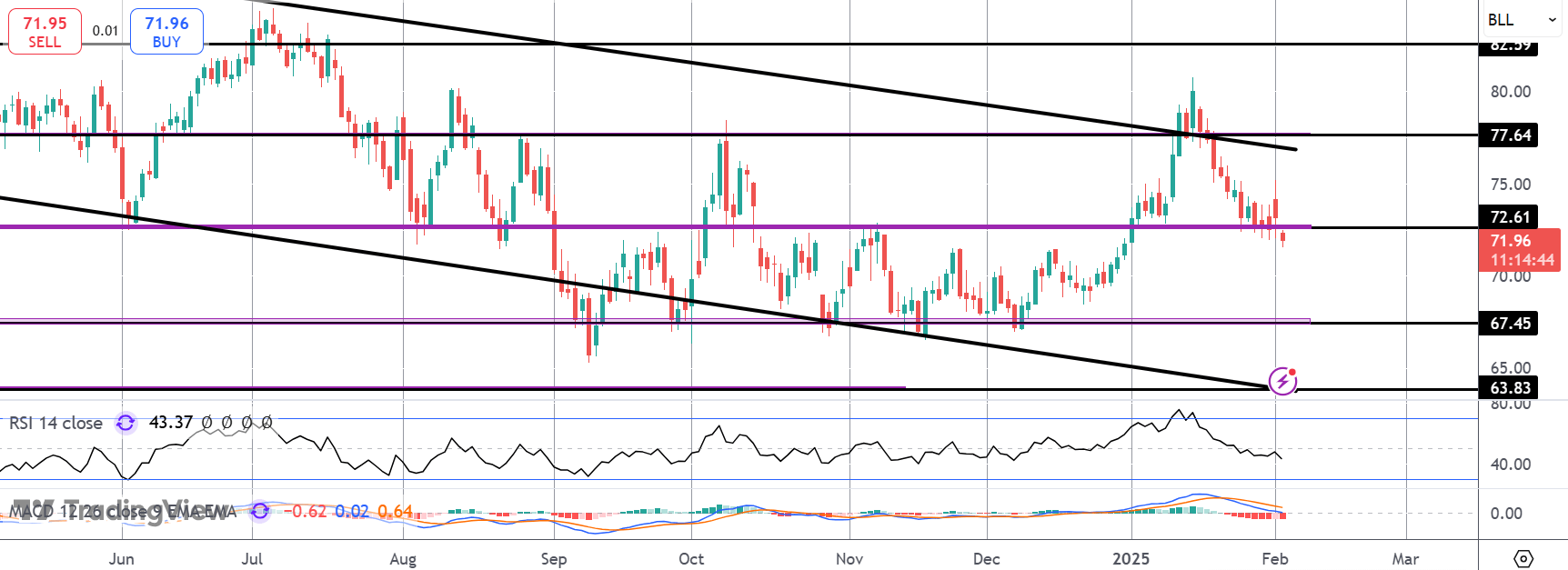

Crude

The sell off in crude has now seen the market breaking below the 71.61 level, having previously stalled there over the last week. While below, focus is on a continuation lower in line with bearish momentum studies readings, with 67.45 the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.