Crude Boosted By Chinese Stimulus Hopes

Crude Pushing Higher Off Support

Crude prices are rising through the middle of the week, despite the current resurgence in USD strength. The move higher appears linked to optimism around expected Chinese stimulus, talk of stronger US sanctions against Russian oil, and rising geopolitical uncertainty linked to ongoing situations in the Middle East.

Chinese Stimulus Optimism

China this week loosened its monetary policy stance for the first time in 14 years as a response to the economic challenges it is facing. Traders are now bracing for anticipated rate cuts and stimulus packages designed to help propel activity higher. This optimism is spilling over into oil prices here traders are speculating on an uptick in demand into next year as activity picks up.

Recent attempts by the Chinese government and central bank to help stimulate the economy have proven fruitless with only short-lived reactions. This time, traders are expecting a more consistent and substantial response from the government to help drive demand higher.

Demand Forecasts on Watch

Traders will today turn their attention to the monthly reports due from OPEC and the IEA. This week, the Chinese National Petroleum Corporation released a report signalling that it expects Chinese demand to peak next year, five years earlier than previously forecast. Further weak demand forecasts might cap the recovery in oil. However, bigger focus is likely to stay on Chinese stimulus expectations near-term which should keep crude supported.

Technical Views

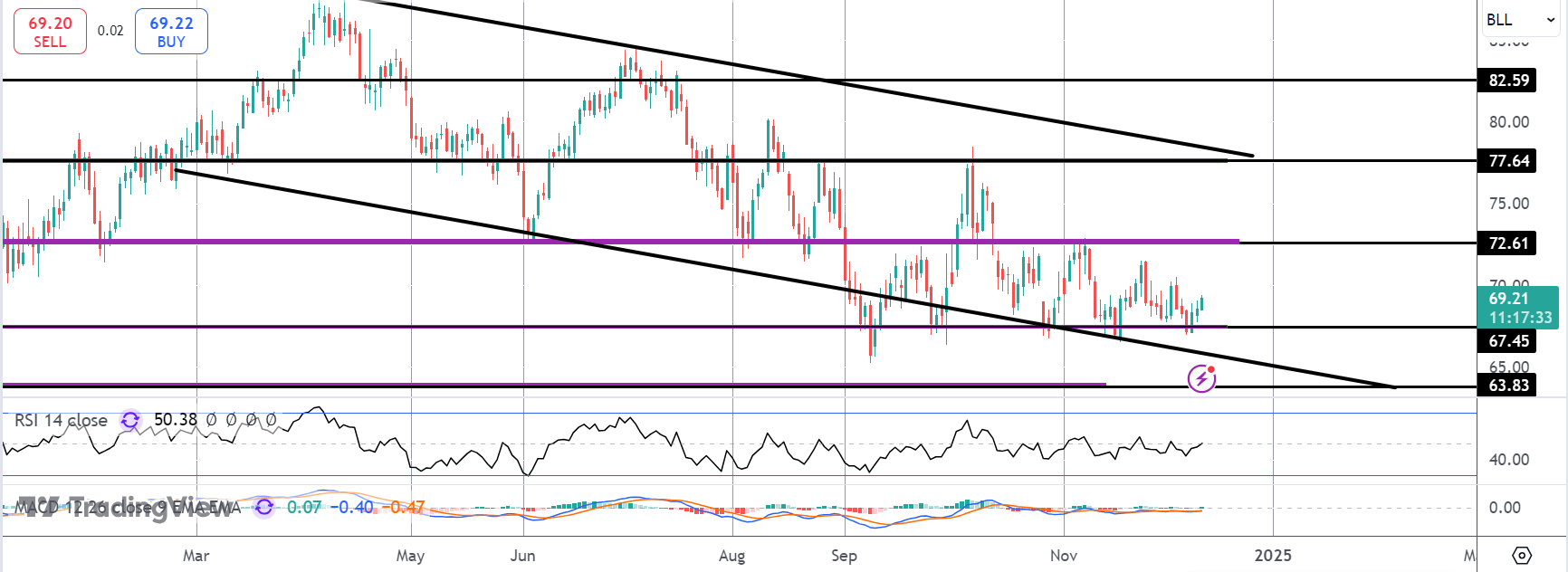

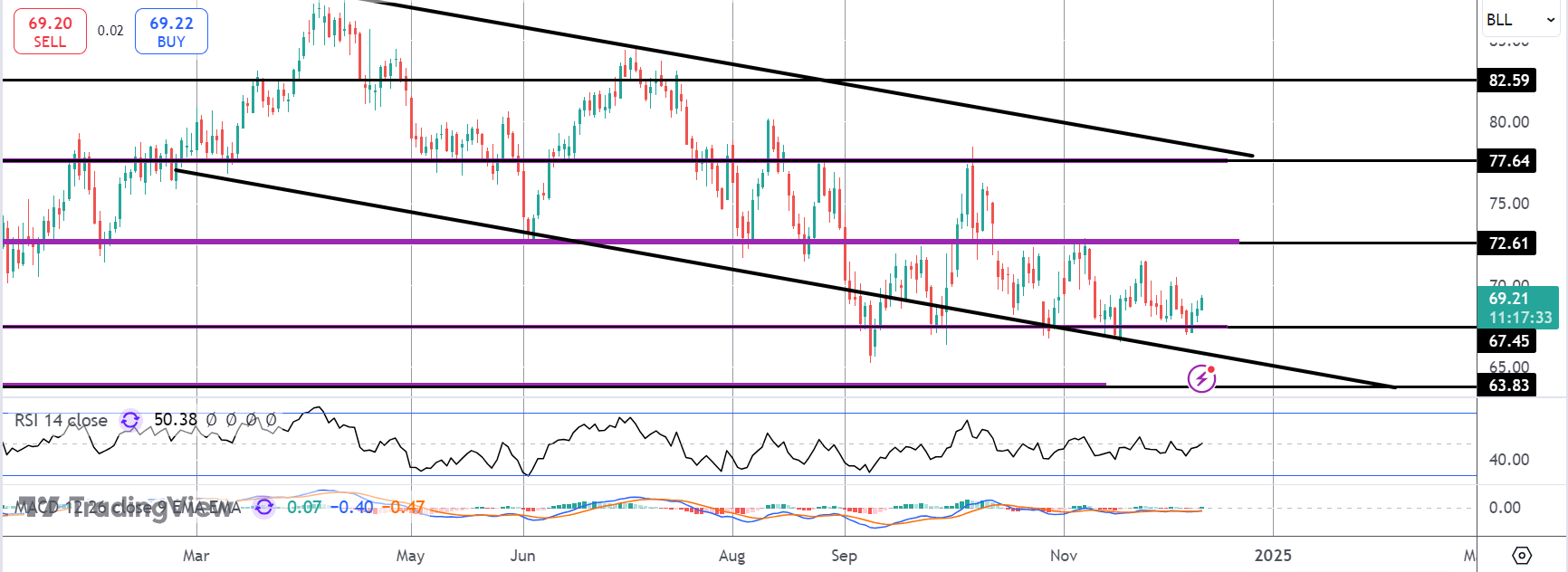

Crude

Crude prices continue to hover around the 67.45 level this week, with price having languished around that price since September, supported too by the bear channel lows. While the level holds, focus is on a break of the 72.61 resistance and a fresh push higher. Below there, however, 63.83 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.