Copper Poised for FOMC Breakout?

Copper at Highs Ahead of Fed

Copper prices are holding around their highest levels in two months ahead of the keenly awaited September FOMC meeting later today. Expectations that the Fed will begin easing this month have helped support copper prices in recent weeks with the futures market gaining more than 6% off the September lows. More recently, the growing expectation of a deeper cut from the Fed has been particularly bullish for copper prices. Last week, market pricing for a deeper .5% cut soared from around 10% to over 60% as traders reacted to dovish headlines in the WSJ and FT. The two publications ran reports citing sources who said that the Fed was considering a larger cut and that it was a very close call.

Market Scenarios for Copper

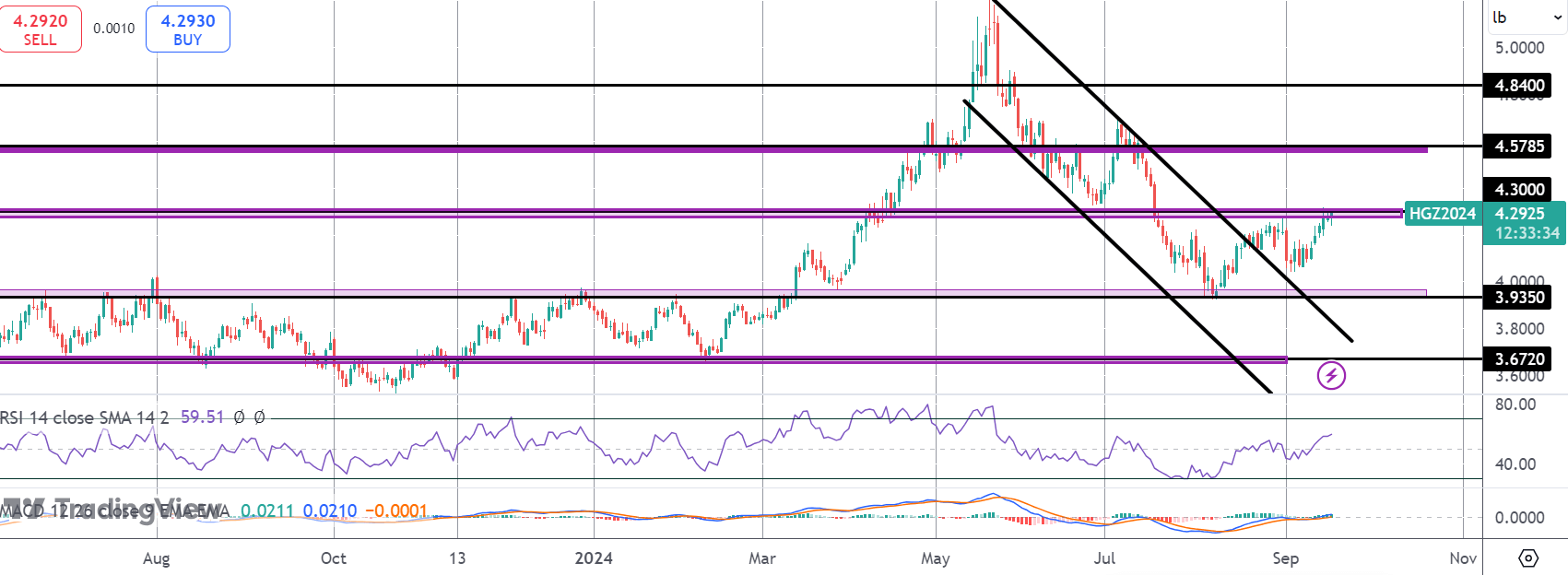

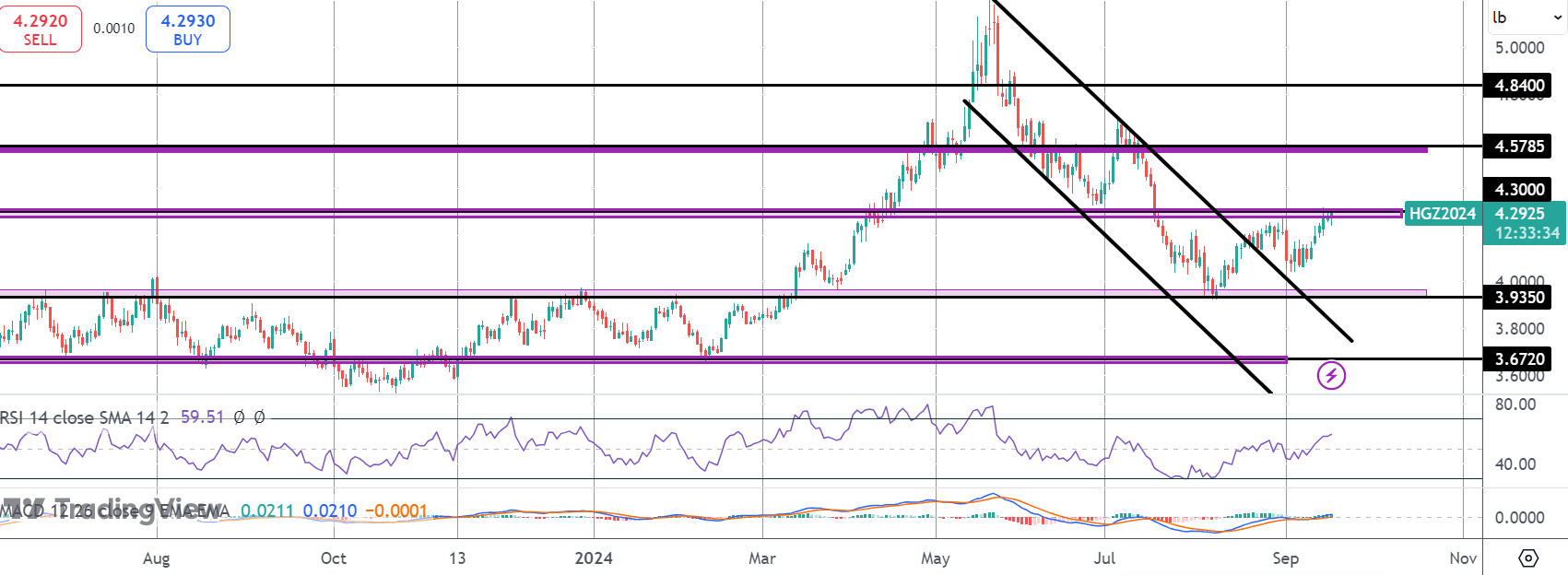

Looking ahead to today’s meeting, the implications for the Dollar and commodities markets are clear. If the Fed opts for a larger cut and signals that further easing will be forthcoming, this should send USD firmly lower and allow copper prices to breakout. In this scenario we could easily see copper doubling its September gains, heading up towards the 4.5785 level. However, if the Fed opts for a smaller cut this month, given the level of dovish expectation in the market USD could see a wave of short-covering. In this scenario, copper prices will lilkey soften near-term, depending on the scale of any USD rally. Firmly dovish forward guidance might be able to curtail the upside in USD but near-term copper would likely struggle to move higher.

Technical Views

Copper

Copper prices continue to push against the 4.3000 level here suggesting appetite for a break higher towards 4.5785, in line with bullish momentum studies readings. If copper reverses from current levels, however, 3.9350 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.