Copper Gaps Lower on Fresh Tariff Fears

Tariffs on Watch

Copper prices are down sharply on Monday as traders look ahead to Wednesday’s US tariff announcement. The pause on Trump’s ‘Liberation Day’ tariffs is due to end and tariffs are set to return to higher levels across the board with new rates taking effect from August 1st. Hopes of a US/China trade deal have been left unfulfilled for now and with global trade expected to deteriorate as a result of the return to higher tariff levels, the copper demand outlook is weakening accordingly. In particular, Trump’s threat of an additional 10% tariff on BRICs countries (mix of heavy copper importers and producers) is particularly bearish for the metal.

Copper Down Heavily

The futures market gapped lower at the weekly open and has continued lower through early European trading on Monday with prices now down more than 4% from last week’s highs. Copper prices had been doing well over recent weeks, bolstered by higher demand in the US ahead of expected copper tariffs. Imports to the US has caused a run on global inventories with copper stockpiles on the LME falling far below seasonal averages.

Market Impact

However, with reciprocal tariffs now back in focus, expectations of copper-specific tariffs have been side-lined for now. If fresh tariffs are announced on Wednesday and particularly if Trump does push ahead with higher tariffs on BRICs countries, this should be firmly bearish for copper prices near-term. However, if any last minute deals or extensions are granted, or if the extra BRICs tariffs are avoided, copper should see some relief buying kick in.

Technical Views

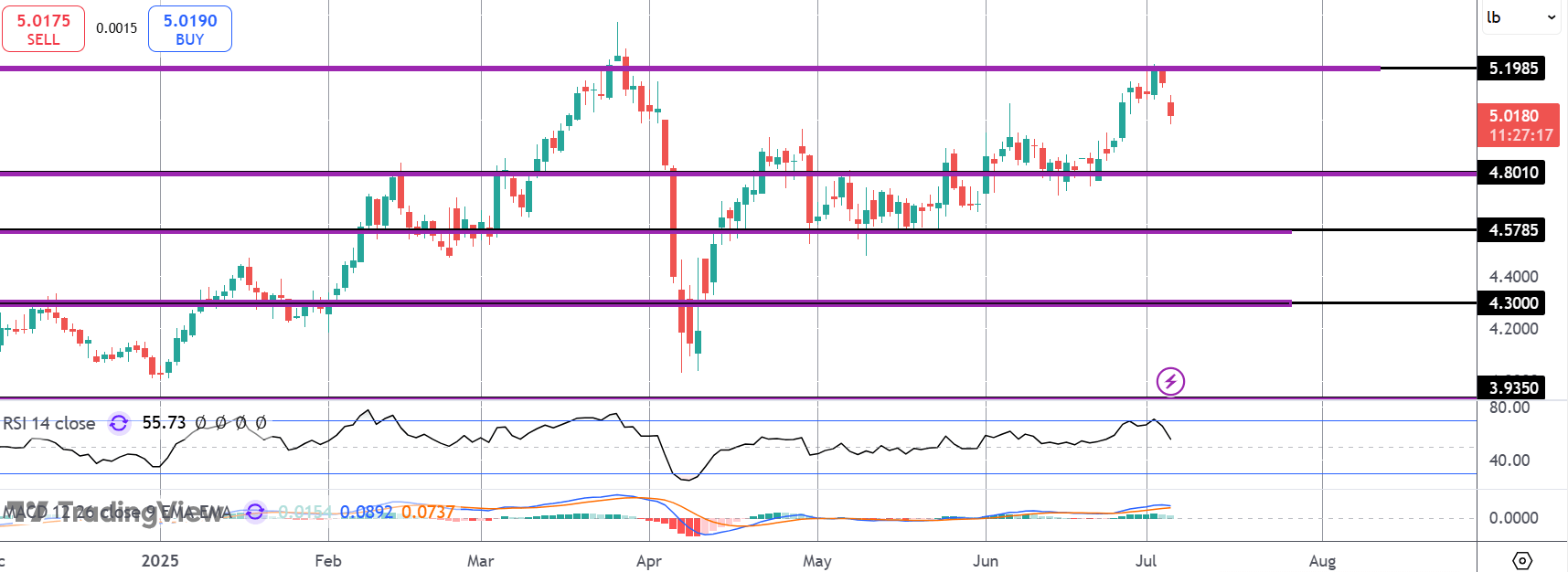

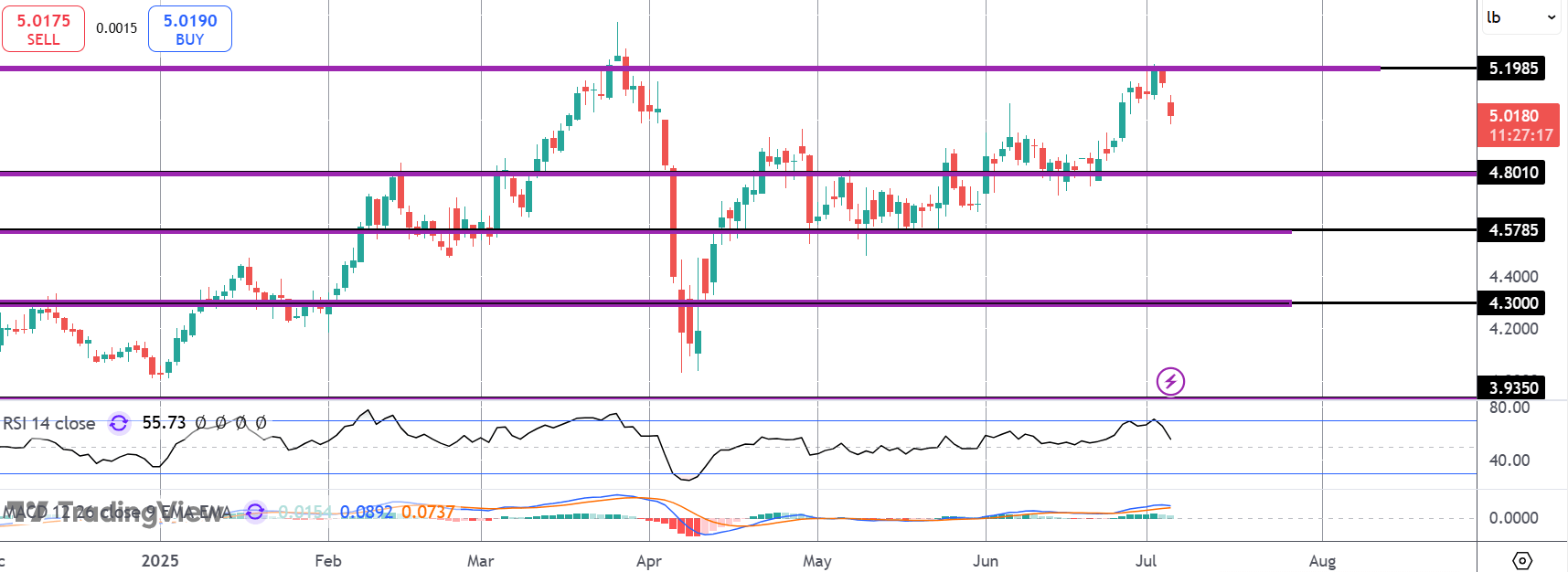

Copper

The rally in copper has stalled for now into the 5.1985 level with price pulling back sharply. Momentum studies are weakening here suggesting room for a deeper pullback. 4.8010 will be the key pivot for bulls to defend in order to keep the upside bias alive and prevent a deeper drop towards 4.5785 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.