Chart of the Day Bearish GBPJPY

Chart of the Day Bearish GBPJPY

GBP: EU-27 leaders last night agreed to the UK’s request for an extension to the Brexit deadline, but will reportedly come to a decision on Friday on whether to grant a short one (to provide time for the Brexit bill’s passage through Parliament) or longer one, perhaps of three months, which would give time for a general election. GBP is holding onto its gains pretty well, although the newsflow suggests positive momentum could be waning. The Conservative party don’t want to get caught up in a long 20-day debate on their withdrawal bill ahead of a possible election, while the path to that election is not a clear one either.

JPY: Japan All Industry Activity Index: Japan All Industry Activity Index was unchanged in August (Jul: +0.2%) as the rise in tertiary industry activity was offset by the fall in manufacturing activity. YOY, the index slipped 0.5% (Jul: +1.3%) consistent with expectations of slower growth in Japan. Japanese PMIs were weak, particularly services which fell to 50.3 from 52.8, showing the global slowdown affecting this sector, also witnessed elsewhere recently.

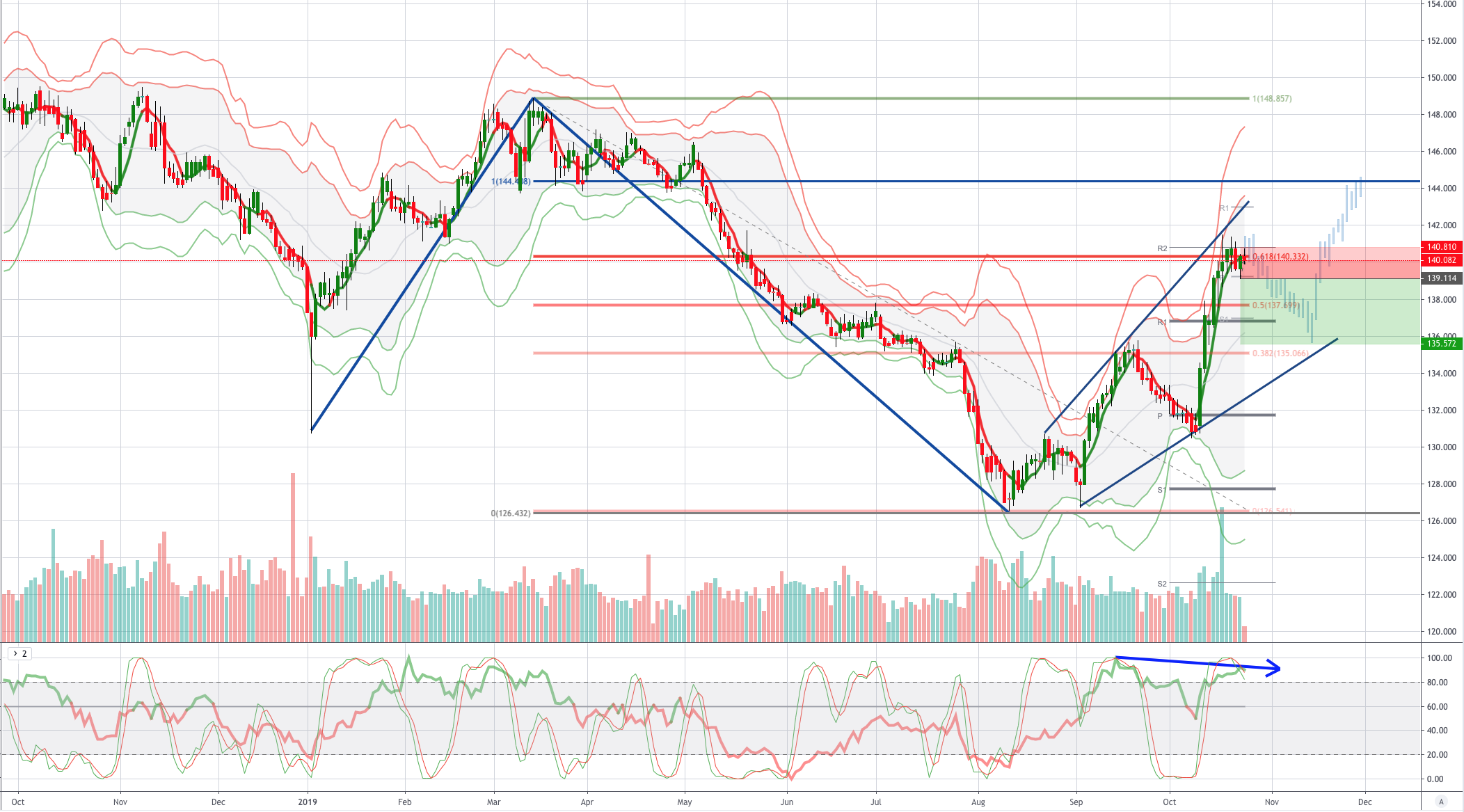

From a technical and trading perspective the GBPJPY has tested a resistance cluster 1.4100/50 fib and trendline significance. Tuesdays bearish key reversal coincided with an exhaustion volume spike on the prior test of resistance, the tails on the daily candles combined with daily divergence suggest near term exhaustion. A breach of 1.2910 today would confirm the reversal pattern and open a move to test prior resistance as support at 1.3560, a breach of 1.4085 would negate the pattern and give cause to reassess.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!