Can Bitcoin Recovery Continue?

Fed Expectations & Risk Appetite

Following heavy losses over the prior fortnight, crypto sentiment has recovered this week with BTC futures ending the week firmly higher. A better tone to risk markets ahead of next week’s FOMC meeting has helped drive demand back into BTC. Despite a mixed reaction to recent labour market and inflation data, the US Dollar trailed off through the end of the week as traders perceived a higher likelihood of a deeper rate-cut next week in response to comments from former FOMC member Dudley, as well as reports in the FT and WSJ. Traders have ramped up their bets on a larger Fed cut next week with pricing now evenly split, creating plenty of volatility risk for markets next week.

US Elections Uncertainty

Away from the focus on the Fed, uncertainty ahead of the US elections is also impacting BTC. A downturn in expectations for a Trump win have hindered BTC recently. Given that Trump is seen as the more pro-crypto candidate, weaker polling results have fuelled disappointment among crypto traders who, over early summer, had been buying into crypto, optimistic of a Trump win. Still, given the broader pick up in risk appetite this week, many players point to the fact that either candidate winning is likely to fuel a fresh rally in crypto simply through adding clarity and putting an end to pre-election uncertainty. As such, the near-term outlook looks favourable again for BTC with Fed easing and the US elections expected to add support for crypto over the remainder of the year.

Technical Views

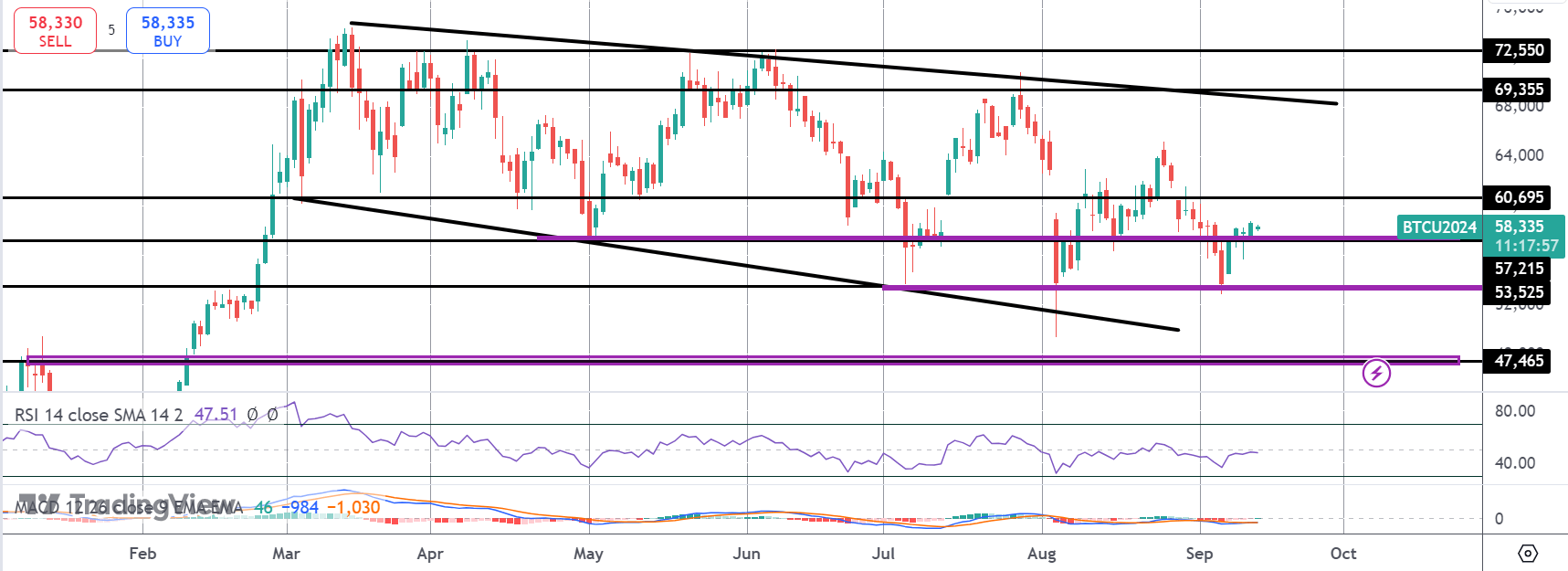

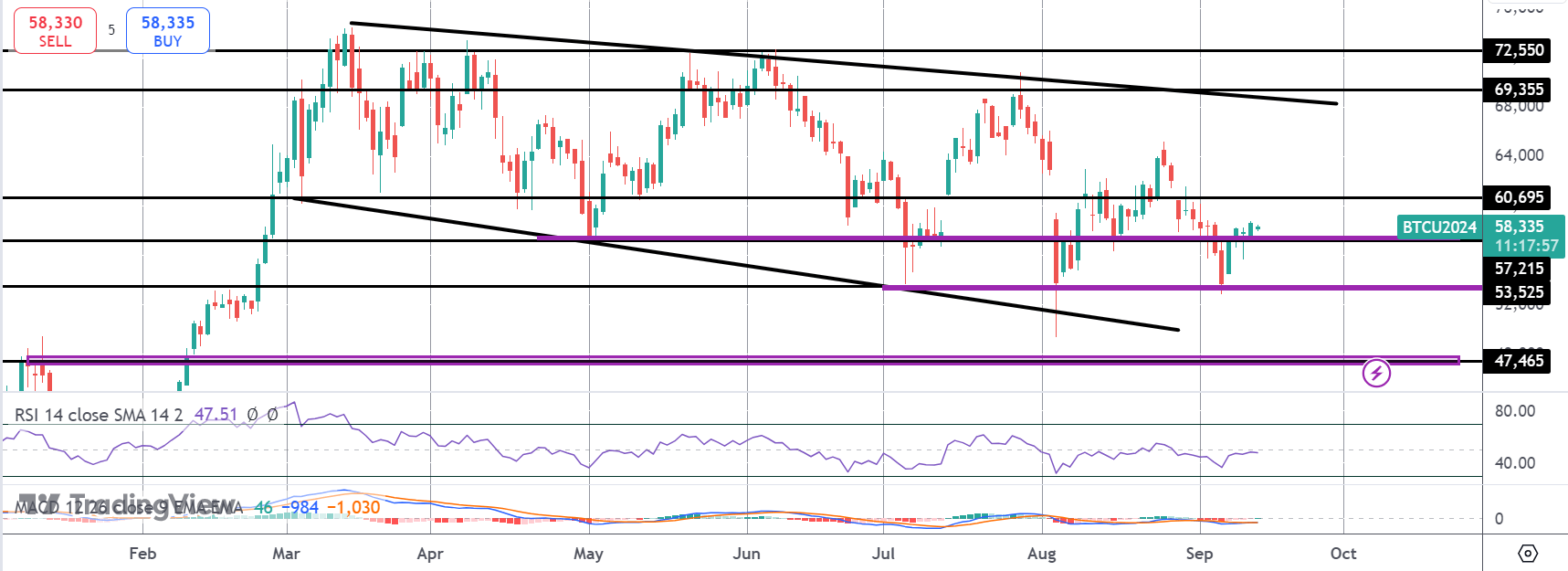

BTC

The sell off in BTC has stalled for now into a test of the 53,525 level with price since bouncing and breaking back above 57,215. This is a key pivot for the market (monthly open) and while above here, the focus is on a further push higher towards the channel highs. 60,695 offers initial resistance for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.