Bullish Gold Risks As Safe-Haven Demand Balloons

Weak Dollar Helps Gold

Gold prices have found a decent bid today with the yellow metal trading in the green across the European morning. Weakness in the US Dollar and heightened geopolitical uncertainty on the back of a Ukrainian drone strike on Moscow overnight mean that gold futures are pushing higher. Fed easing expectations have grown meaningfully over the last week or so as softer US data and heightened fears over the US economy have taken hold. Trump’s warning this week that a US recession cannot be ruled out has clearly spooked investors with US stock markets and the broader risk complex cascading lower.

Safe-Haven Demand

The move has turned demand back to gold as safe-haven inflows soar. Alongside fears over the health of the US economy, traders are nervous on the back of a heavy Ukrainian drone strike on Moscow last night which marked the biggest attack inside Russia in three years. With US/Ukraine peace talks due to begin today in Saudi Arabia, markets are fearful that the attack will have hardened Russia’s position, making a peace deal tougher to negotiate.

US Inflation Up Next

Looking ahead this week, traders will be watching the latest US inflation data due tomorrow. If we see CPI readings cool as expected, gold prices are likely to remain supported as USD continues lower. Any undershooting of forecasts should amplify this dynamic while an upside surprise would likely muddy the near-term view, creating some support for USD. Given the broader backdrop, however, it would likely take a strong upside surprise to upset the current narrative.

Technical Views

Gold

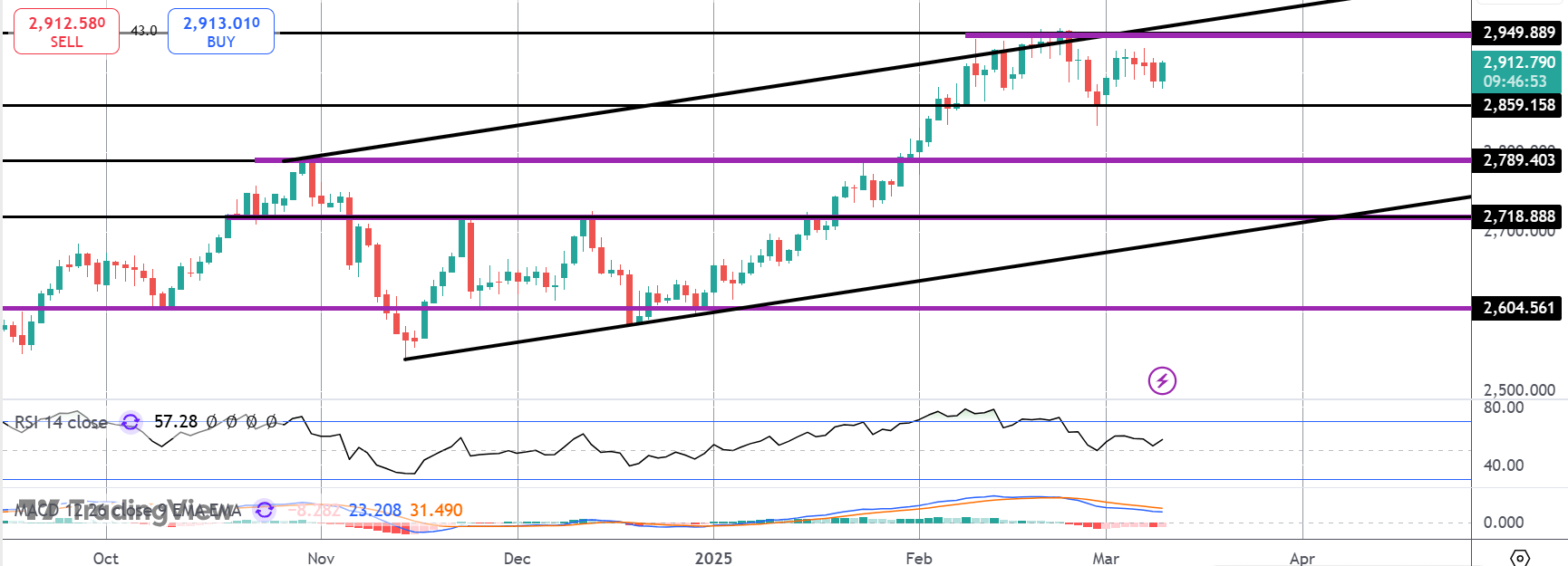

While gold prices remain above the 2,859.15 level, the focus is on a fresh push higher and a breakout above 2,949.88 and the channel highs. Only a downside break of current support will shift that view, turning focus to 2,789.40 as the deeper support to watch. Interestingly, in the Signal Centre today we have a sell limit at 2925.20 suggesting a preference to fade current strength for a reversal lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.