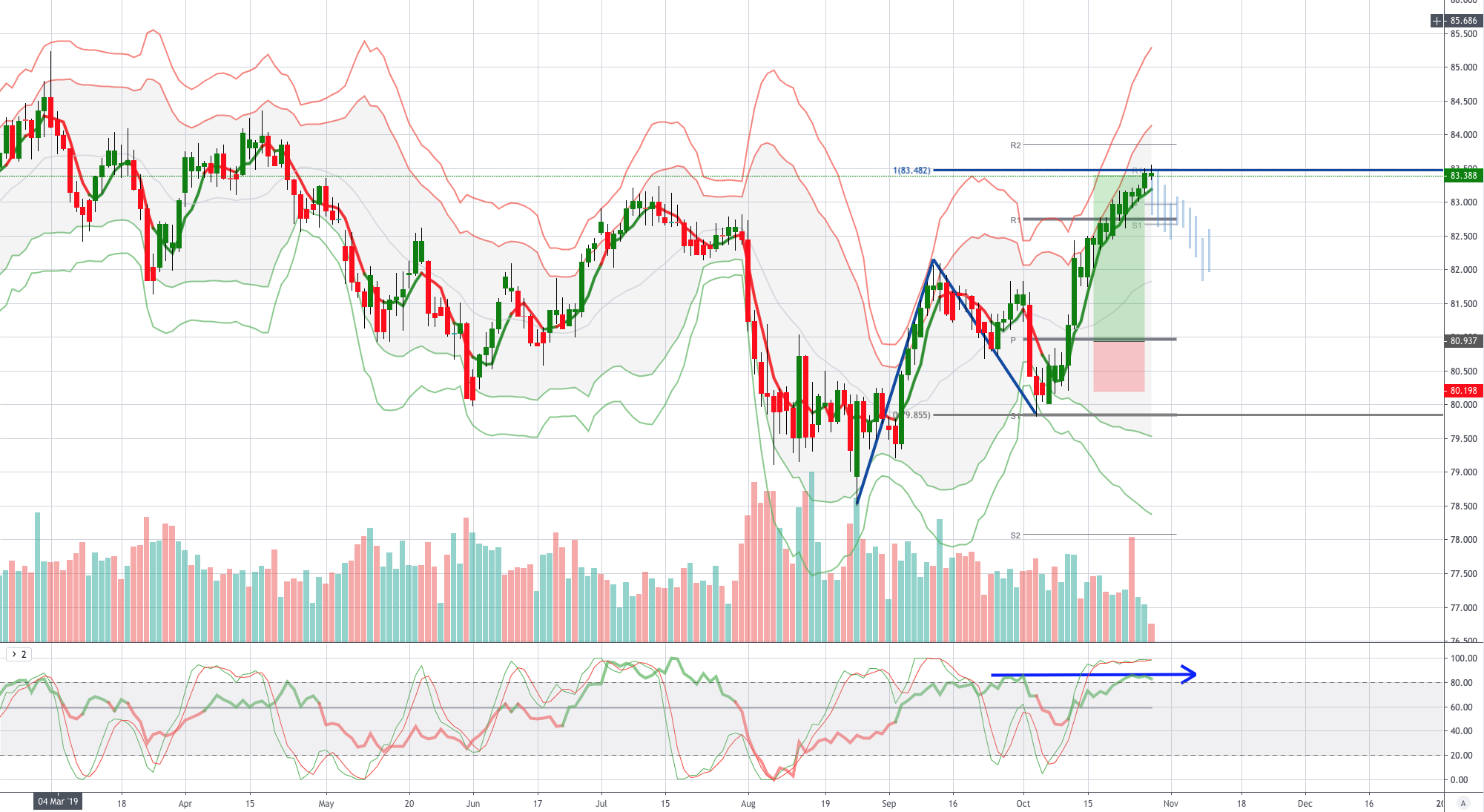

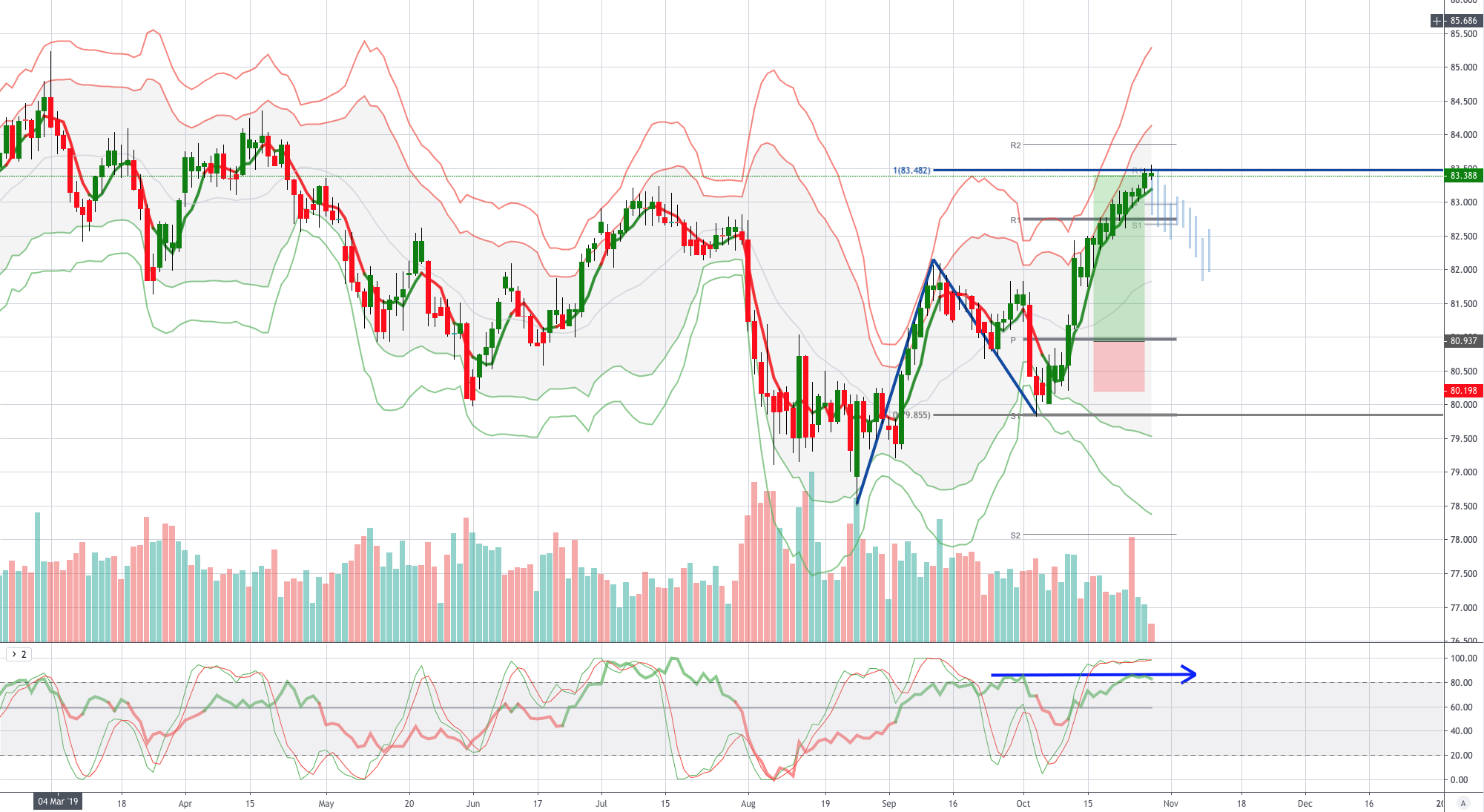

Chart of the Day Bearish CADJPY

Chart of the Day Bearish CADJPY

Bearish CADJPY: CAD: The BoC rate decision Wednesday is the data highlight of the week. Regardless of the outlook for easier Fed policy, strong employment growth, higher wages, on target inflation and above expectations growth, mean that policy makers can sit on their hands and await developments, suggesting a neutral hold statement. Industry level GDP and IPPI data for Aug are out Thursday. The October Markit manufacturing PMI is released Friday.

JPY: The BoJ is expected to remain on hold at the October monetary policy meeting. While Governor Kuroda could be concerned with softer inflation expectations in September, this could be a temporary development. To alleviate the risk of a technical recession due to poor manufacturing data, exports and the consumption tax hike in October, the Cabinet is anticipated to introduce a fiscal stimulus package by the end of this month. Against such background, it seems very unlikely that Governor Kuroda will act before the fiscal stimulus is fully announced. Furthermore, additional monetary stimulus which would only weaken the Yen could reduce consumers’ purchasing power through higher import prices. With banks’ seeing their profit margins increasingly squeezed, an additional cut in interest rates towards an even more negative territory can only make the monetary transmission mechanism less effective.

From a technical and trading perspective the CADJPY has achieved the trading target from my early October analysis. I am now watching how price responds as we test the AB=CD corrective target combined with daily divergence, I will be watching for a close sub 83.18 today top flip the daily charts bearish (closing below the near term VWAP) this would suggest a correction to the October grind higher, initially looking for a test of 82.00/81.70 as interim support, a close above 83.50 would negate this view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!